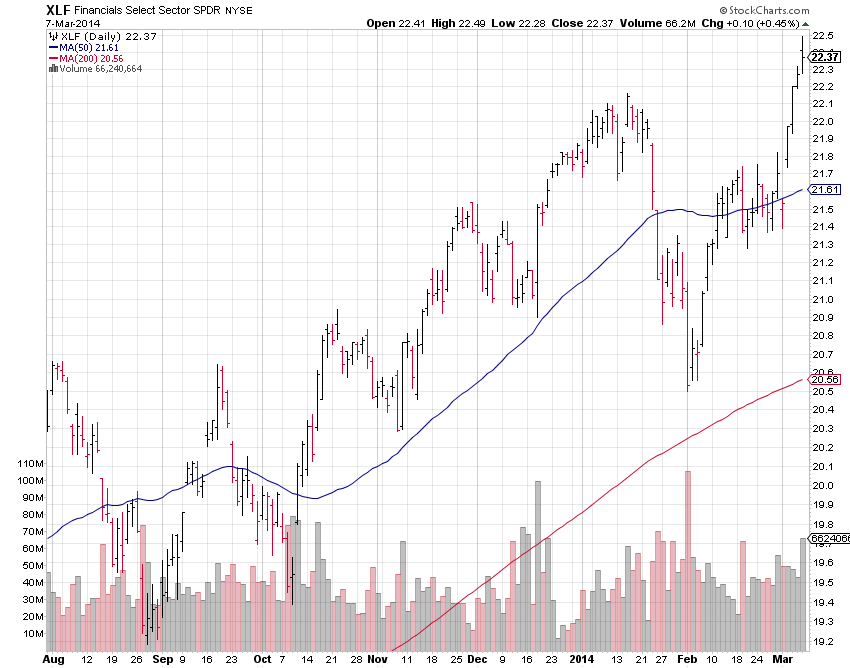

In last weeks summary we noted the under performance of the financial sector. And seeing as the financial sector accounts for over 16% of the S+P 500 and the second largest sector, it was something worth keeping an eye on.

This week we got some encouraging performance from the financials as a whole as the chart above shows. The XLF broke well above it's 2013 highs on a closing basis.

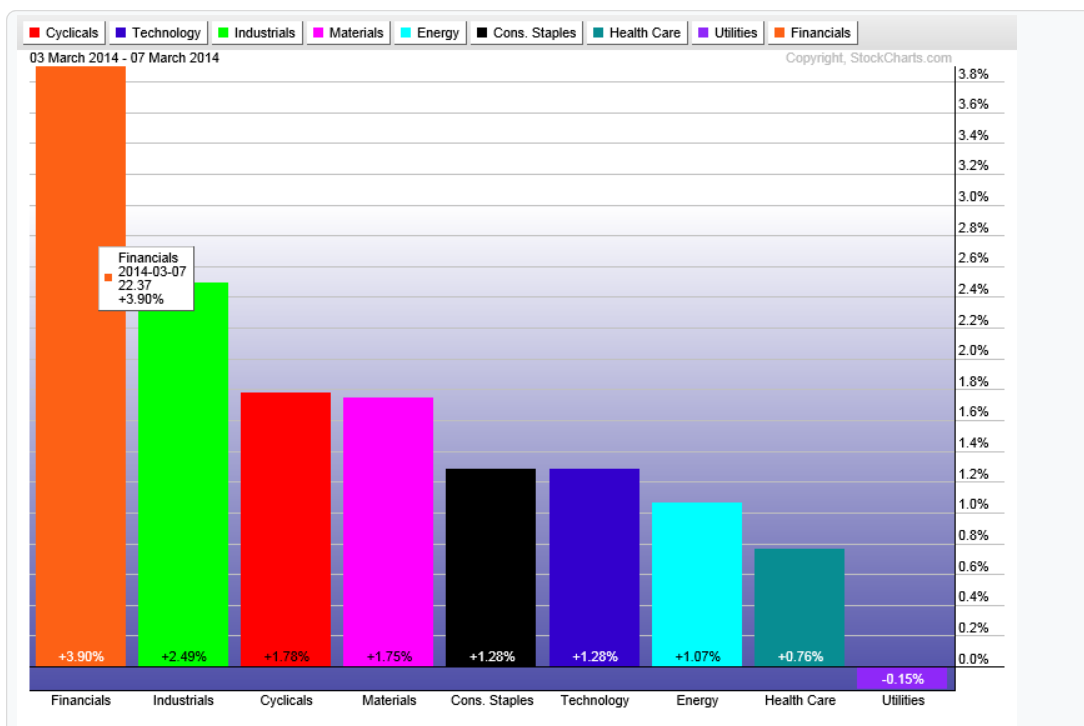

The sector performance this week shows many of the "risk on" sectors performed well during this weeks rally. As the financial, industrial and consumer discretionary sectors lead the way. Couple this with the strong readings from the advance - decline indicators and the major averages themselves, this does bode well for short term future stock market prices as a whole.

I still remain rather unenthusiastic about the risk to reward at current stock market prices, as how much higher can we go without a meaningful correction? However I still advocate a balanced approach for investors where one doesn't need to sit in cash and listen to the doom and gloom, but also doesn't go all in with all the leverage and beta one can find, either. There are plenty of different methods described in detail from some stellar bloggers like the ones I have listed on my favorite sites list.

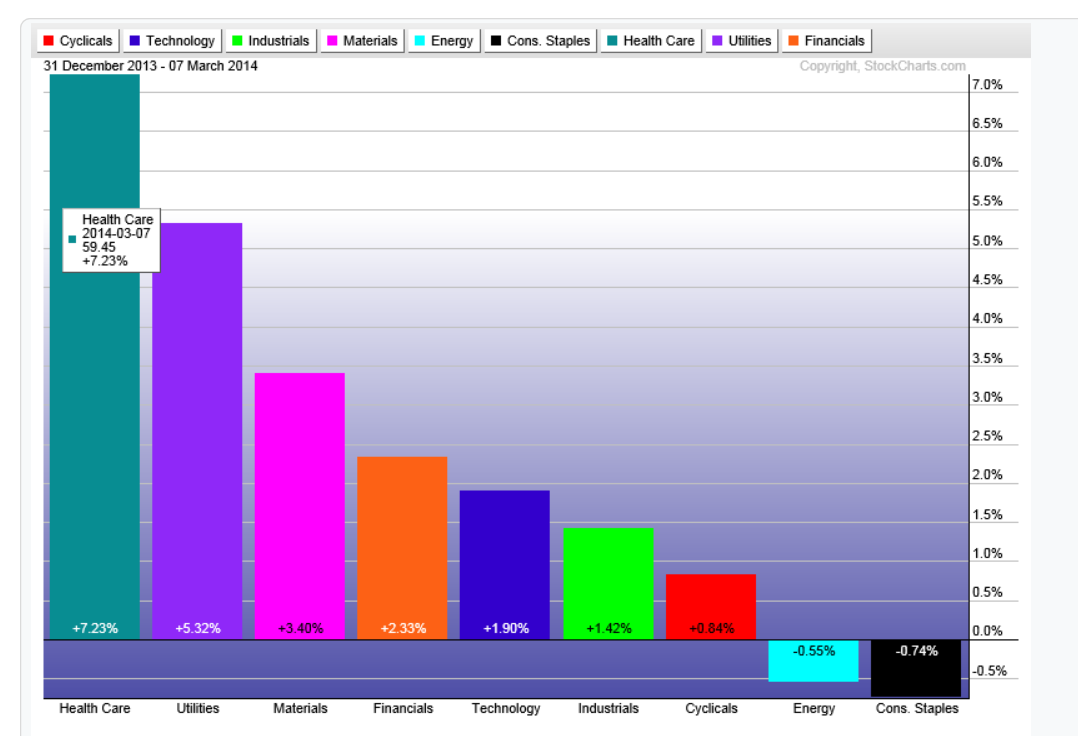

The sector performance year to date continues to show relative strength in the Health Care and Utilities sectors but this week the cyclical sectors have closed the gap as the S+P 500 moves into positive territory for the year 2014.