Trying to chart a Falling Wedge on a reversing uptrend is as dangerous as trying to catch a falling knife chart with the two activities being somewhat the same and this is where the Financial Select Sector SPDR ETF (XLF) was yesterday as shown by its weakening uptrend below.

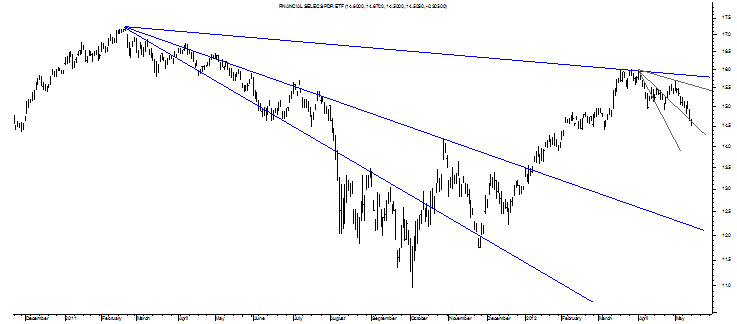

It is weakening considering the XLF never truly reversed its long-term downtrend per the blue Bull Fan Lines as drawn above with the last wave down resulting in a near-term set of Bull Fan Lines that suggest the XLF is struggling mightily to reverse that downtrend and struggling so much it may just fail as has proven the case with copper.

Such a potential failure to reverse its intermediate-term downtrend is showing up in a new set of Bear Fan Lines that are showing us the XLF’s attempt to reverse its intermediate-term uptrend.

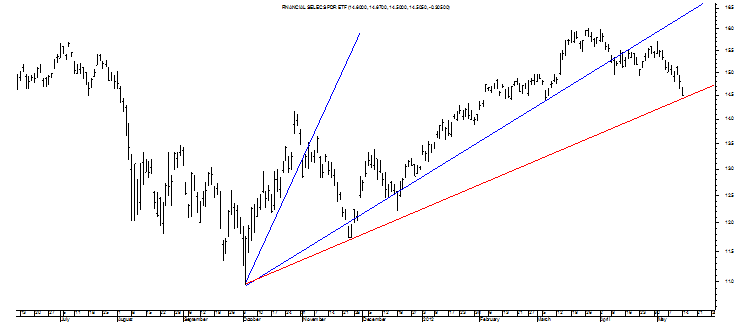

Once the XLF closes convincingly below the bottom Bear Fan Line in red as seems inevitable with its inability to begin to reverse its long-term downtrend, its chart will turn officially bearish and a transformation that has been showing itself to us for nearly three months now on a sideways trend.

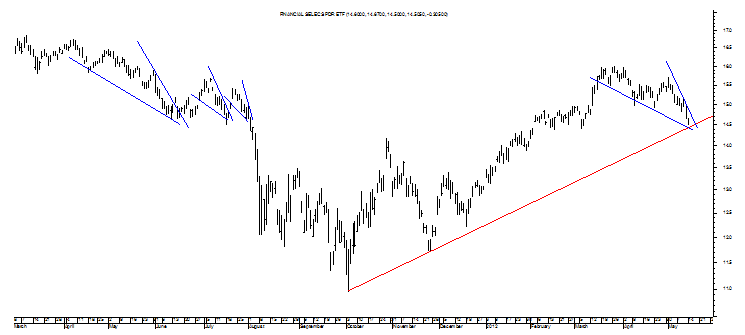

However, ahead of the XLF making that closing reversal, there is a chance the XLF will try to trade between the two bottom trendlines briefly and perhaps on a weak-looking Bull Wedge as shown below.

What is also shown above is just how dangerous this pattern is in a reversing uptrend as was the case last year with two of those Bull Wedges working out fair at best with one simply failing into a painful bottom.

This current Bull Wedge is more likely to go in the camp of the first one shown – a Falling Wedge really as is the case now when extended prior to May – and this means a brief move up to maybe $15.31 at best before some more sideways trading or a big decline.

Whether it is worth it to play such a poor risk-to-reward ratio is up to the risk profile of the trader for there is nothing in the chart above that speaks to investing unless on the short side with an unmarked and starting-to-confirm Rising Wedge waiting patiently on the sidelines to take the XLF down to its target of $10.95. It is the bearish ramifications of that pattern that suggest it’s better to step aside from any possible kickback rallies with the likely 25%+ decline-to-come far outweighing some 5%+ move up in the near-term.

It seems, then, that the XLF confirms a correction in risk is coming and it makes sense to get out of the way.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

XLF: Correction Is Coming, Get Out Of The Way

Published 05/14/2012, 11:43 PM

Updated 07/09/2023, 06:31 AM

XLF: Correction Is Coming, Get Out Of The Way

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.