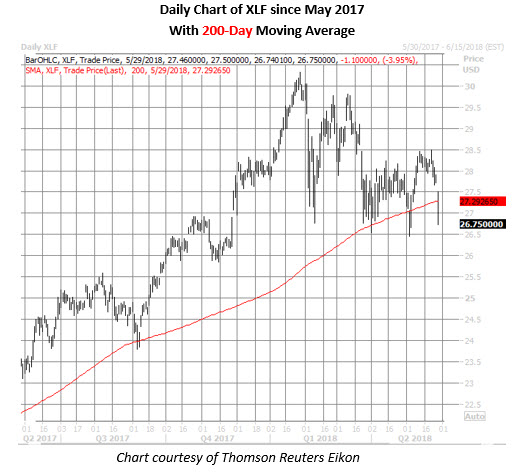

Bank stocks are crumbling today as geopolitical uncertainty boosts bond prices. Most recently, the 10-year Treasury yield was down 4.2% at 2.81%, while the Financial Select Sector SPDR (NYSE:XLF) has plunged 3.7% to trade at $26.80. The drop has sparked a rush of activity in XLF's options pits, with most of the action occurring on the put side of the aisle.

Specifically, 180,589 puts and 148,366 calls have changed hands on XLF so far today -- nearly three times what's typically seen at this point, and total options volume pacing in the 95th annual percentile. Most active are the July 26 put and 28 call, where data from Trade-Alert suggest one speculator may be closing out of a risk-reversal, or synthetic long, strategy.

Elsewhere, the weekly 6/1 27-strike put has garnered notable interest, with more than 14,000 contracts traded. New positions are being initiated here, and it looks like some of that activity could be of the sell-to-open kind. If this is the case, the put writers expect XLF to hold near $27 through expiration at this Friday's close.

They could also be betting on a volatility crush -- which would make it cheaper to buy back the options they sold. The implied volatility term structure on these weekly 6/1 options is currently at 28.06%, versus 20.39% for standard June options.

Whatever the reason, XLF has tended to reward premium sellers over the past year, per its Schaeffer's Volatility Scorecard (SVS) reading of 25. In other words, the fund has underperformed over the last 12 months, relative to what the options market has priced in.

Looking closer at the charts, today's slide has XLF shares on track to close below their 200-day moving average for just the third time in the past 12 months. The fund has been in a channel of lower highs since topping out at a 10-year peak north of $30 in late January. What's more, XLF is on track for a fourth straight monthly loss -- the longest such losing streak since 2011.