- Xi Jinping-Donald Trump meeting to be crucial for the next stage of the trade war.

- Weak US data likely to put pressure on Trump soon.

- China opens up for more infrastructure stimulus, data for May was mixed.

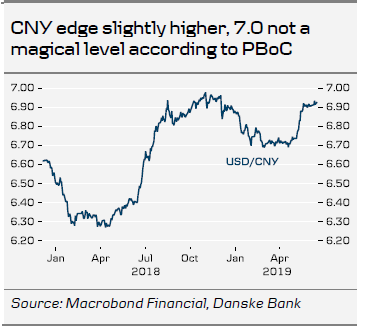

- The People's Bank of China (PBoC) indicates that 7.0 for USD/CNY is not a 'red line'.

Can Xi and Trump bridge the significant gap that has opened up?

The past week did not provide any encouraging news on the trade front. The meeting between US President Donald Trump and China's President Xi Jinping at the G20 summit in two weeks will be crucial for the next stage of the trade war. When the Chinese delegation left Washington on 10 May, the two sides agreed that talks would continue in Beijing but no meetings are scheduled and we hear no stories of preparations for the Xi-Trump meeting. Actually, China has not even confirmed that Xi will meet with Trump.

Trump showed no signs of softening his stance this week. On Monday, he stated that if Xi would not meet at the G20 summit, he would move on with tariffs on another USD300bn of goods. Then, on Friday, he said 'it doesn't matter' if Xi Jinping shows up. Trump continues to signal confidence that China will go back to the 'old' deal: 'I can tell you China would like to make a deal very badly. They're getting hurt by the tariffs because companies can't pay the tariffs, so they're leaving China .' In another interview, he said 'we had a deal with China. Unless they go back to that deal, I have no interest '.

However, the Chinese side shows no sign of a change in its stance. Xinhua yesterday posted yet another story reiterating 'China will not give ground on issues of principle ' and 'China's attitude is very clear. The United States must change its attitude, show sincerity and correct its wrong practices if it wants the talks to continue '. The change of wrong practices might refer to the export ban on Huawei. However, China has not elaborated on what 'wrong practices' means. The message, that China does not want a trade war but is ready to fight to the end if necessary was also repeated many times during the week.

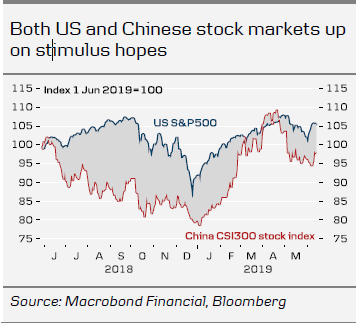

In a letter to Trump, more than 600 companies urged him to resolve the trade dispute. Intel (NASDAQ:INTC) and Google (NASDAQ:GOOGL) have also been lobbying for exemptions from the export ban on Huawei. An indicator from Morgan Stanley (NYSE:MS) measuring US business conditions collapsed in June to the lowest level since the financial crisis 10 years ago. This follows other recent data, which point to a business slowdown and challenges the view of Trump's economic adviser Larry Kudlow, who, on Tuesday, argued that US growth will continue at 3% for the rest of the year, even without a trade deal. Chinese data remain weak but there are no signs of a hard landing (see more below).

Comment: A big gap in the trade talks between the US and China opened up in early May and there are no signs either side will back down. The concessions Trump wants from China are called ‘core principles’ on the China side, which makes it close to impossible for Xi to move on this. This article explains well why Xi is unable to offer much to Trump, as it describes how the resistance to the US demands is broad based in the Politbureau and that ‘despite being positioned as the ‘core’ of the party leadership, even Xi cannot overturn a collective decision without securing the consent of the party leaders.

If China makes further talks conditional on removal of the export ban on Huawei, it would complicate things further. Trump would look weak if he left Osaka with a ceasefire and removed the export ban. We are increasingly concerned that Xi and Trump are unable to compromise enough for Trump to abstain from adding more tariffs on China.

Going into an election campaign, Trump has to weigh the benefit of being tough on China and the damage it would do to the US economy. If he listens to Larry Kudlow and believes growth will be 3% rest for the year, he may overplay his hand in the short term, as Chinese retaliation to more tariffs is likely to hurt the US economy. We look for a trade deal at some point in H2, when the economic pain in the US becomes clear and Trump takes the deal he can get. He is normally good at selling any deal as a success. In our view, polls currently indicate that he needs a strong economy to win the 2020 election.

More infrastructure stimulus, 7.0 not red line for USD/CNY

This week China opened up for more infrastructure spending by loosening restrictions on so-called special-purpose bonds. PBoC officials have also stated on several occasions that the 7.0 level for USD/CNY is not a ‘red line’ but that markets decide the level of CNY.

Comment: China aims to keep growth in the 6.0-6.5% range and if we see a further escalation of the trade war, we expect China to ease further. It is slightly concerning for the long term, though, that debt-fuelled infrastructure spending seems to be increasing. Monetary policy easing would put depreciation pressure on the CNY. However, that the Federal Reserve is expected to ease policy as well should keep some sort of a lid on USD/CNY. We expect the cross to rise to 7.10 in 3M (NYSE:MMM).

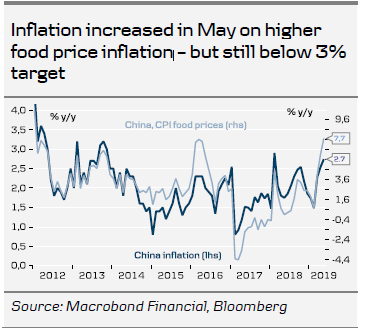

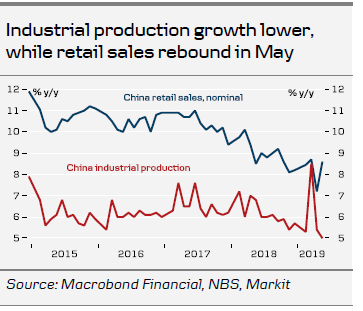

Mixed data for June but no hard landing

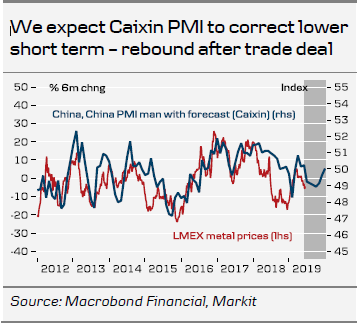

Chinese data this week was a mixed bag (see charts). Industrial production fell to the lowest level in 17 years, while retail sales rebounded in May. Imports and exports are still soft. CPI inflation increased from 2.5% to 2.7% y/y due to a rise in food prices. Credit and money growth was broadly as expected. Metal prices are falling but at a moderate pace.

Comment: The data did not add much new to the economic picture, in our view. However, it is too early to see the real effects of the trade war escalation. We look for a still-soft picture in the short term until we get a trade deal.

Other China news over the past week:

Demonstrations have roiled Hong Kong this week, as big crowds have taken to the streets to protest against a proposed extradition bill.

The US called Taiwan a country in paper on the Indo-Pacific strategy. This is a clear violation of the One China policy and adds to US-China tensions.

China has officially launched a new technology innovation board, China’s version of the US Nasdaq. The board is intended to facilitate financing of domestic tech innovators and is a pet project of Xi Jinping, who has called for more support for China’s innovation.