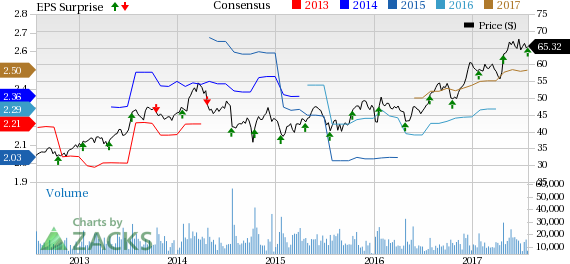

Xilinx Inc. (NASDAQ:XLNX) reported first-quarter fiscal 2018 earnings of 63 cents per share, which beat the Zacks Consensus Estimate by three cents. The figure increased 2.7% from the year-ago quarter and 9.6% from the previous quarter.

The year-over-year growth was primarily driven by higher revenues, while the sequential increase benefited from lower operating expenses despite modest top-line growth.

Xilinx reported revenues of approximately $615.4 million, up 7% year over year and 1% quarter over quarter. Revenues were in line with the mid point of the company’s guided revenue range of $600–$630 million. However, the figure lagged the Zacks Consensus Estimate of $616 million.

Advanced Products Drives Top line

Management noted that Xilinx’s revenues have grown for the seventh consecutive quarter reflecting product strength. The growth was primarily driven by robust performance of the company’s 16nm, 20nm, and 28nm products. Management also noted that the expanded partnership with Avnet (NYSE:AVT) is benefiting top-line growth.

On the basis of End Market, Communications & Data Center segment revenues (41% of total revenue) declined 1% year over year, but increased 1% sequentially. Industrial, Aerospace & Defense segment revenues (42% of total revenue) increased 17% on a year-over-year basis but remained flat on a sequential basis. Broadcast, Consumer & Automotive revenues (17% of total revenue) increased 6% year over year and 3% sequentially.

Product wise, Advanced products revenues increased a whopping 33% year over year and 8% sequentially. We note that the segment’s contribution to total revenue was 52%, a significant increase from 42% in the year-ago quarter and 49% in the previous quarter.

The 28-nm portfolio increased sequentially due to strong demand from ISM, TME, broadcast and consumer market. The 20-nm sales also significantly increased in the quarter, driven by robust demand in wireless, primarily for pre-5G deployments.

However, Xilinx noted that the 16-nm was the topmost performer in the quarter. The company shipped 22 unique products to more than 530 discrete customers across all end markets.

As expected, revenues from core products declined 12% from the year-ago quarter and 6% sequentially.

Geographically, on a year-over-year basis, revenues from Asia Pacific, Japan and Europe increased 16%, 9% and 9%, respectively. On the other hand, revenues from North America declined 6%.

Sequentially, North America was weak, declining 7%. This was fully offset by robust growth from Asia Pacific, Japan and Europe, which increased 5%, 12% and 1%, respectively.

Product Strength: Key Catalyst

Xilinx’s ongoing transition from a FPGA provider to an all programmable devices producer is helping it to gain market share. The company’s expanding product portfolio, which includes the Zynq RFSoC platform, is aiding it against intense competition from the likes of Intel (NASDAQ:INTC) . Zynq portfolio, which is implemented in both the 28-nm and 16-nm node, delivered strong top-line growth in the quarter.

Xilinx stated that it has started sampling of the 16-nm RFSoC Silicon In-house family of product, which offers a superior architectural solution to 5G wireless with integrated RF-class analog technology. The product helps in reducing power consumption (50% to 75%) and footprint reduction for future 5G deployments, cable and wireless backhaul applications.

Management is also optimistic over the demand of Amazon’s (NASDAQ:AMZN) FPGA-as-a-Service (the cloud service is supported by Xilinx’s Ultrascale+ FPGAs) that targets the traditional hardware FPGA designers. Xilinx believes that Amazon’s deployment of SDAccel and SDSoC products will boost its competitive position against other SoC providers.

Operational Details

Gross margin contracted 190 basis points (bps) year over year to 68.8% and was within the company’s guided range of 68–70%. Sequentially, gross margin contracted 70 bps.

Operating expenses increased 10.5% year over year but declined 2.7% to $242.3 million. The figure was almost $3 million higher than the company’s guidance. This was because Xilinx accelerated some 16-nm tape-out expenses to extend its technology leadership and add some increased litigation expense.

Moreover, as a percentage of revenues, operating expenses amounted to 39.4%, reflecting a 130 bps year-over-year increase. But sequentially, operating expenses, as a percentage of revenues, fell 150 bps.

As a result, operating income declined 3.5% year over year but increased 3.7% quarter over quarter to $181 million. Additionally, operating margin contracted 320 bps due to lower gross margin base as well as higher operating expenses, as a percentage of revenues. Sequentially, operating margin expanded 80 bps.

Balance Sheet, Cash Flow & Shareholders’ Return

Xilinx exited the quarter with cash and cash equivalents, and short-term investments of approximately $3.65 billion compared with $3.32 billion in the previous quarter. The company has total long-term debt (excluding current portion) of about $1.74 billion up from $995.2 million at the end of the previous quarter.

During the quarter, Xilinx raised $750 million of fixed rate debt at a rate of 2.95% with a seven-year term.

Xilinx generated cash of $191 million from operations and incurred $10 million as capital expenditure. The company paid $82 million in dividends and repurchased approximately 1 million shares for $67 million.

Guidance

For second-quarter fiscal 2018, Xilinx expects revenues in a range $605–$635 million. (mid-point $620 million). The mid-point of the company’s guidance range of $620 million is currently higher than the Zacks Consensus Estimate of $617.7 million.

Management continues to expect growth in Advanced Products segment. Xilings expects the communications end-market to decline primarily due to weakness in wireless. Industrial, Aerospace & Defense and Broadcast, Consumer & Automotive are expected to increase.

Gross margin is anticipated to be between 69% and 71%. Operating expenses are likely to be around $253 million, higher than expected due to increasing research & development (R&D) expenses related to tape-outs. Tax rate is projected between 10% and 14%.

The company remains focused on achieving the fiscal 2018 revenue target of approximately $2.5 billion. Xilinx also expects to deliver more than 30% of operating margin exiting this fiscal year.

Our Take

We believe that rising demand for 28-nm, 20-nm and 16-nm nodes is positive for the company. Moreover, favorable product mix (higher Industrial, lower wireless) will help in gross margin expansion in the current quarter.

Xilinx’s expanding software defined programming portfolio along with hardware solutions to accelerate machine learning is expected to drive user base. The company has significant growth opportunities in Data center, 5G deployment, Artificial Intelligence (AI), Industrial IoT and Advanced Driver Assisted Systems (ADAS) applications over the long haul.

However, growth from wireless is expected to remain volatile until 2020, which is a concern. Increasing operating expenses related to tape-outs will weigh on profitability in the near term.

Moreover, management’s pessimistic view over business conditions in India and China, two of its fastest growing markets, poses strong headwinds.

Currently, Xilinx has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Avnet, Inc. (AVT): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Xilinx, Inc. (XLNX): Free Stock Analysis Report

Original post

Zacks Investment Research