Summary

Revenue and operating income were flat; net income rose thanks to a lower tax bill.

All of their base rate increases requests are in a holding pattern until the company recomputes their revenue needs by taking the TCJA into consideration.

The second quarter doesn't look much brighter.

This idea was discussed in more depth with members of my private investing community, Turning Points.

Investment thesis: While Xcel energy is attractive due to its size and large geographic footprint, investors should consider other utilities that have better revenue growth with a higher dividend.

Of 53 electric companies, Xcel Energy (NASDAQ:XEL):

- is the 7th largest (market capitalization $23.92 billion);

- is the 11th most expensive (PE 20.77);

- is the 14th most expensive on a forward PE basis (FPE of 18.06)

- has the 30th highest dividend (current yield of 3.25%).

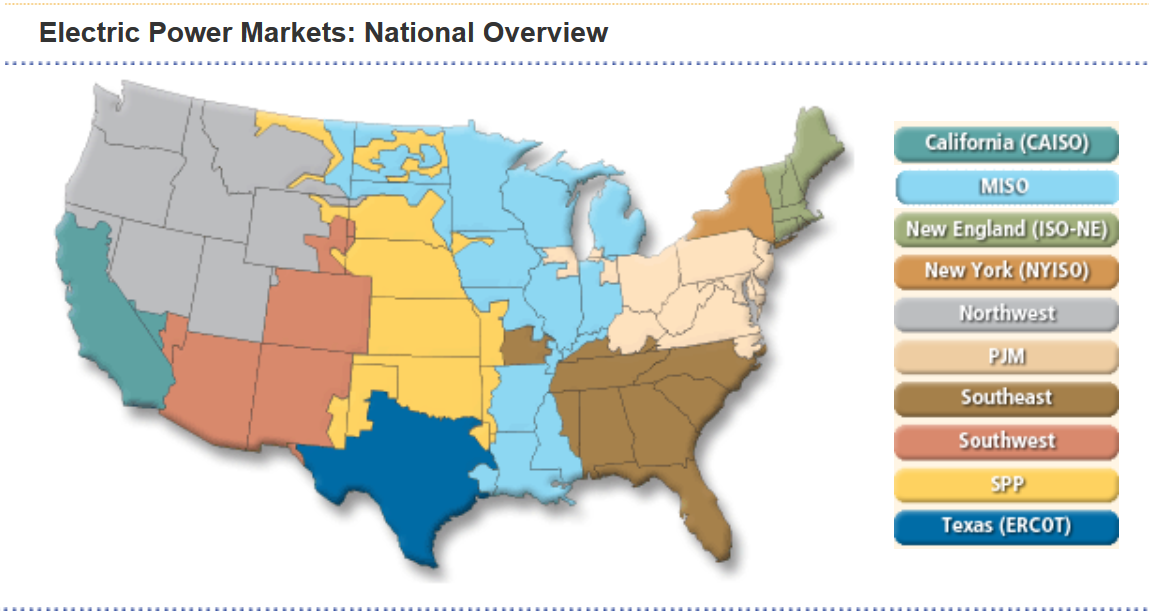

Xcel provides electricity and gas service in Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas, and Wisconsin. A broad geographic footprint is good because it broadens its exposure to various markets. However, it does mean it has to deal with a larger number of energy markets:

This potentially increases the company's compliance costs.

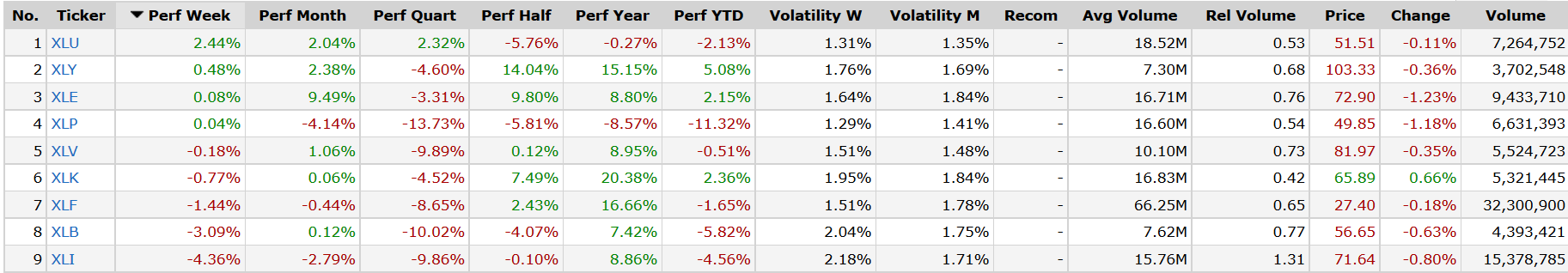

The electric utility sector is down for the year:

The industry sold off in mid-December as Treasury yields started to rise. The industry continued to sell off in February with the broader market. Since then, the industry has been moving higher.

As of this writing, the Utilities Select Sector SPDR (NYSE:XLU) is the best-performing ETF of the week:

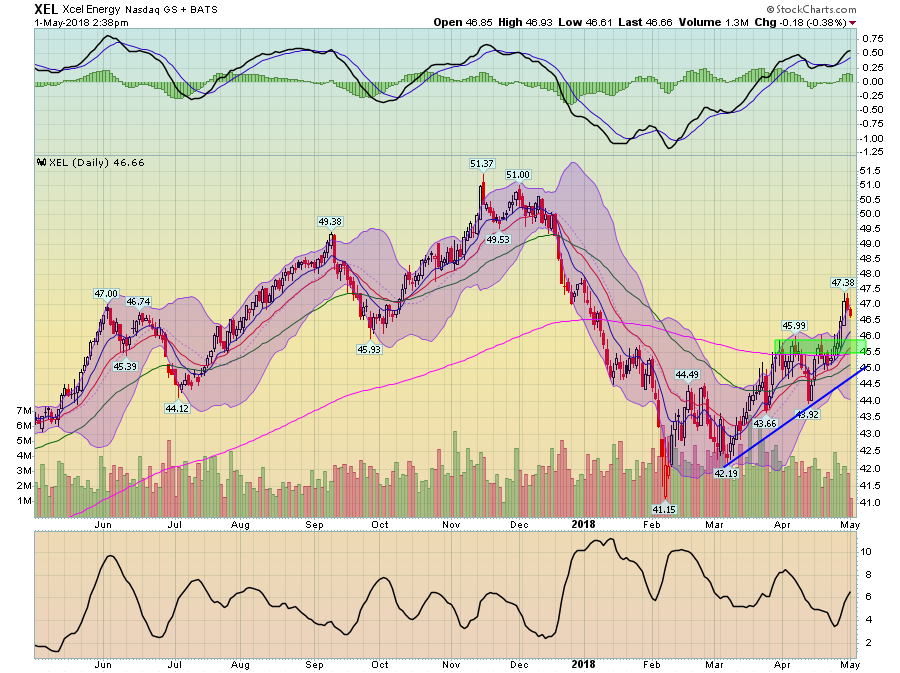

XEL's chart is in a solid uptrend:

Prices sold off with the broader market starting in mid-December. Prices hit a hard bottom in early February and have been moving higher since. Prices are now above the 200-day EMA. The shorter EMAs are rising; prices are using them for technical support. The MACD (top panel) shows rising momentum, which supports a bullish case for the stock.

Here are XEL's main developments over the last quarter (data from their latest 10-Q):

- Total revenue was up modestly, as was net income.

- The company applied for a $245 million base rate increase in Colorado. That is on hold for now as the company has to recompute its demand by taking the TCJA into consideration. Colorado PUC has told the company the request must come down by $101 million.

- The company applied for a rate increase of $43 million in New Mexico which the NMPUC lowered by $11 million.

- XEL asked for a rate increase of $55 million in Texas, which the Texas PUC lowered by $32 million while also asking for an addendum that explains the TCJA effect on the company's request.

- The Minnesota PUC has asked the company to lower its recent request by $136 million due to the TCJA changes.

Let's turn to the numbers from the 10-Q (please see this link for the source for all data going forward).

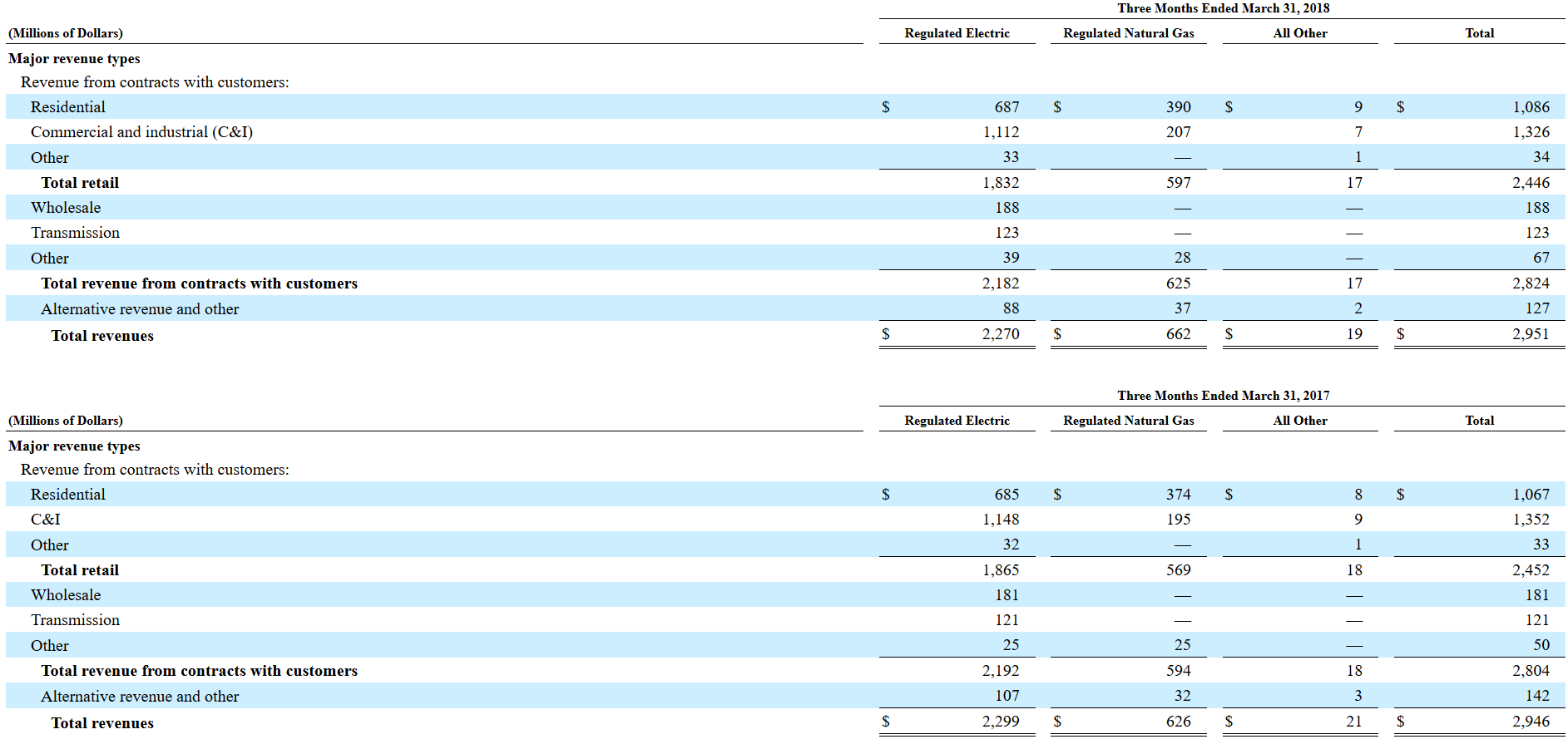

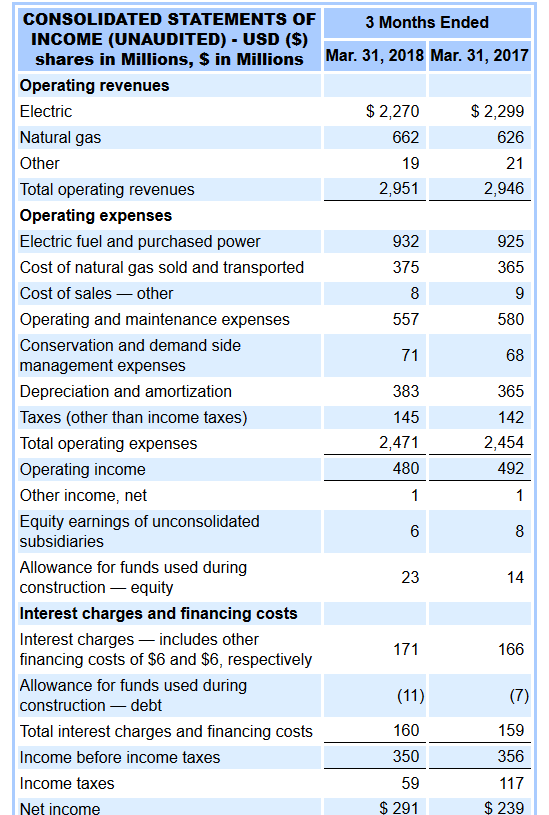

First up, is the simple quarter on quarter comparison:

Total revenue and operating income were up marginally. But the increase could just as well be classified as statistical noise. Net income increased due to a lower tax bill.

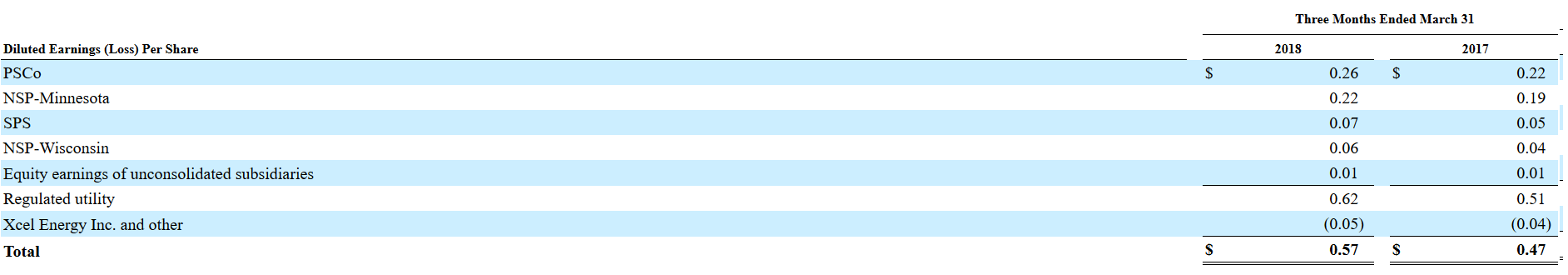

The following table breaks the data down into operating segments:

For all practical purposes, the numbers barely moved; any increase or decrease is analytically meaningless.

We see the exact same result in the per-share earnings results for the various operating segments:

Across the board, we see modest increases and decreases. There was no significant movement in either direction.

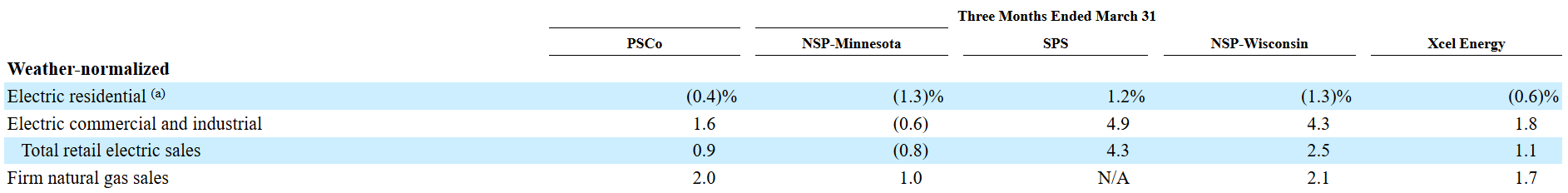

The reason for earnings standing still is weak weather-normalized sales growth:

The above table shows "weather-normalized" sales, where the company attempts to remove the weather impact from the numbers. It's very similar to an economist performing a seasonal adjustment.

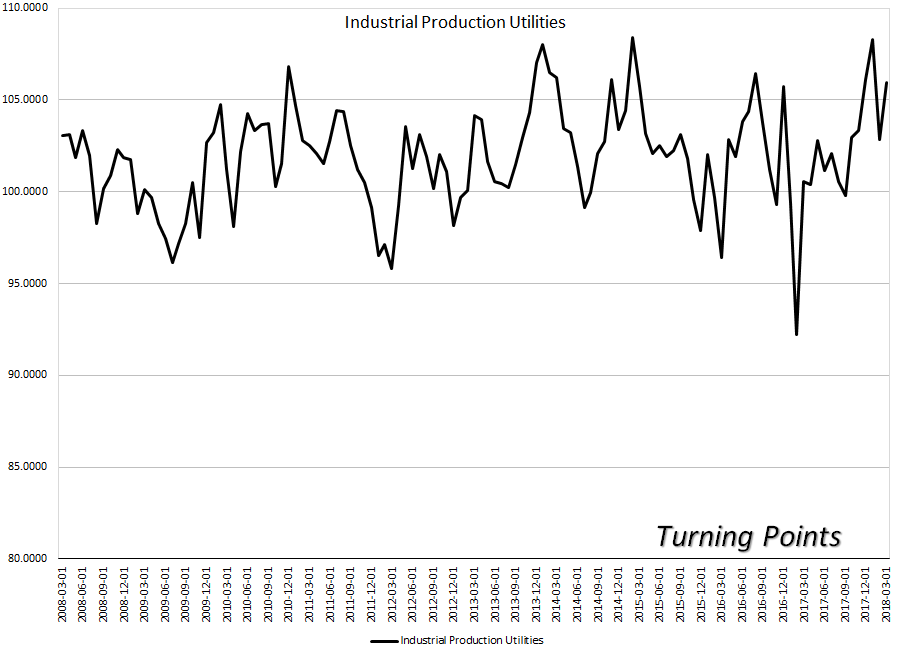

The numbers really aren't that surprising; large utilities have been coping with lower overall demand for the duration of this expansion. As a result, industrial production for utilities has been flat:

(data from the Federal Reserve)

What can we expect in the next quarterly report? As I recently noted, probably more of the same with a potential for modestly higher earnings:

- Overall utility output continues to move sideways.

- Although natural gas prices increased last year, they're still contained within a longer historical trend that most utilities have probably hedged against.

- Pricing is increasing, which should lead to higher gross revenue in second-quarter earnings.

How does this fit with the rest of the utility industry? Overall, Eastern utilities (those that are east of the Mississippi River) have had a more difficult time growing revenue, instead relying on increasing margins to send more money to net income. In contrast, utilities in the NW have seen better top-line revenue growth and, in some cases, improved margins. The current quarter's earnings place XEL squarely in the middle of standard, east-of-the-Mississippi River utilities: it is difficult for them to grow revenue.

Conclusion

Xcel is facing the same problem as many utilities: increased energy efficiencies are lowering or stagnating overall demand. That makes the selection process for utility candidates that much more important. While Xcel's size (it is the 7th largest electric utility by market capitalization) and 3.25% dividend might be attractive, there are other utilities that have either higher dividend yields or better revenue growth for investors to consider.

It pays to look at the whole picture: not just where markets are headed, but what the economic data tells us about that, and how that can inform our investment decisions.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.