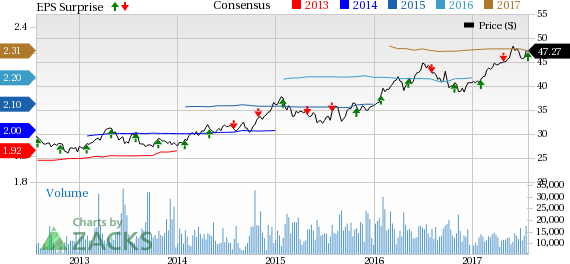

Minneapolis-based Xcel Energy Inc. (NYSE:XEL) recorded second-quarter 2017 operating earnings of 45 cents per share, beating the Zacks Consensus Estimate of 43 cents by 4.6%. Earnings were 15.4% higher than the year-ago quarter.

The improvement in earnings was due to higher electric and natural gas margins and lower operating and maintenance expenses.

Total Revenue

Xcel Energy’s second-quarter revenues of $2,644.9 million lagged the Zacks Consensus Estimate of $2,652 million by 0.3%. However, revenues were higher than the prior-year quarter level of $2,499.9 million by 5.8%.

Segment Results

Electric: Segment revenues increased to $2,338.1 million from $2,244.1 million in the reported quarter.

Natural Gas: Quarterly revenues grew 11.9% to $289.8 million.

Other: The segment recorded revenues of $17.1 million in the quarter, up 1.8%.

Quarterly Highlights

Xcel Energy is expanding its renewable portfolio and has received approval from the Minnesota Public Utilities Commission to build seven new wind firms. This initiative will help the company to lower emission levels and maintain low energy costs for its customers.

Total operating expenses increased 5.7% year over year to $2,185.3 million. Costs increased primarily due to higher electric fuel and purchased power.

Operating income in the reported quarter was up 6.5% year over year to $459.7 million.

Looking Ahead

Xcel Energy has reiterated its 2017 operating earnings guidance in the range of $2.25–$2.35 per share.

The company projects long-term annual earnings growth rate of 4–6% and aims to increase its dividend by 5-6% annually.

Zacks Rank

Xcel Energy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

NextEra Energy, Inc. (NYSE:NEE) reported second-quarter 2017 adjusted earnings of $1.86 per share, beating the Zacks Consensus Estimate of $1.76 by 5.7%.

DTE Energy (NYSE:DTE) reported second-quarter 2017 earnings of $1.07 per share, beating the Zacks Consensus Estimate of 97 cents by 10.3%.

WEC Energy Group (NYSE:WEC) reported second-quarter 2017 operational earnings of 63 cents per share, lagging the Zacks Consensus Estimate of 59 cents by 6.8%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

Xcel Energy Inc. (XEL): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Original post

Zacks Investment Research