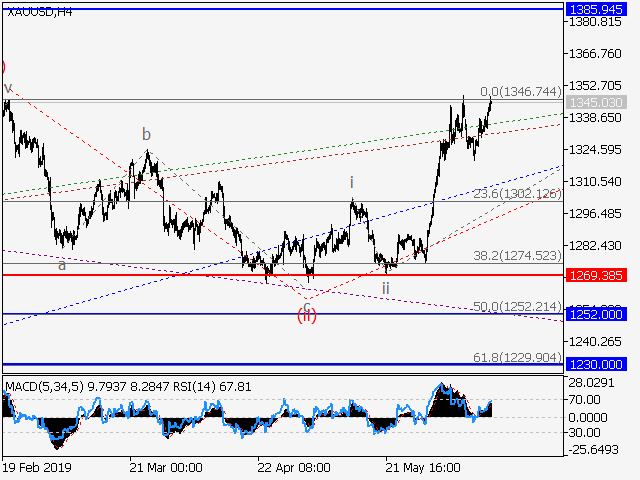

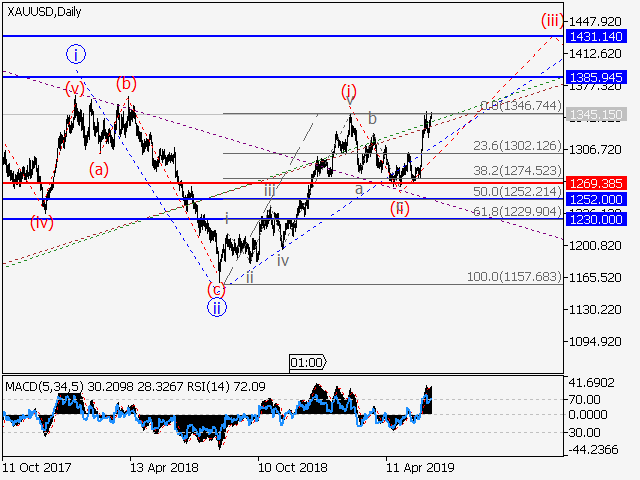

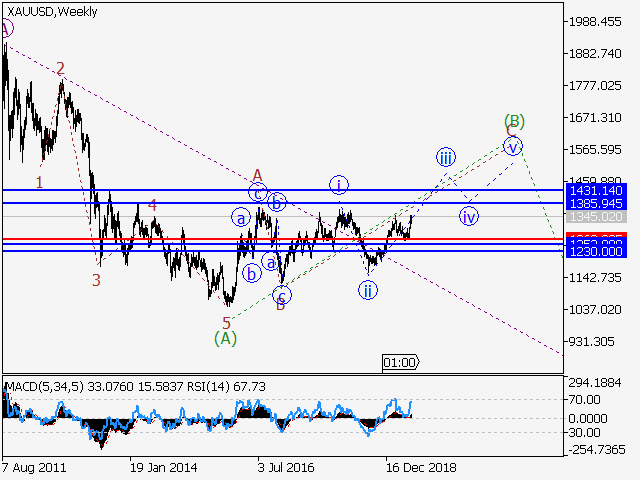

The pair XAU/USD is still likely to grow. Estimated pivot point is at a level of 1269.38.

Main scenario: long positions will be relevant above the level of 1269.38 with a target of 1385.94 – 1431.14.

Alternative scenario: Breakout and consolidation below the level of 1269.38 will allow the pair to continue declining to the levels of 1252.00 – 1230.00.

Analysis: Supposedly, a correction wave of senior level (B) continues forming on the weekly time frame, with the wave C of (B) developing within. On the D1 time frame, presumably the third wave iii of C is developing , with the wave of junior level (i) of iii formed and the local correction (ii) of iii completed inside. Presumably the wave (iii) of iii started developing on the H4 time frame. If this assumption is correct, the pair will continue to rise to 1385.94 – 1431.14. The level 1269.38 is critical in this scenario.