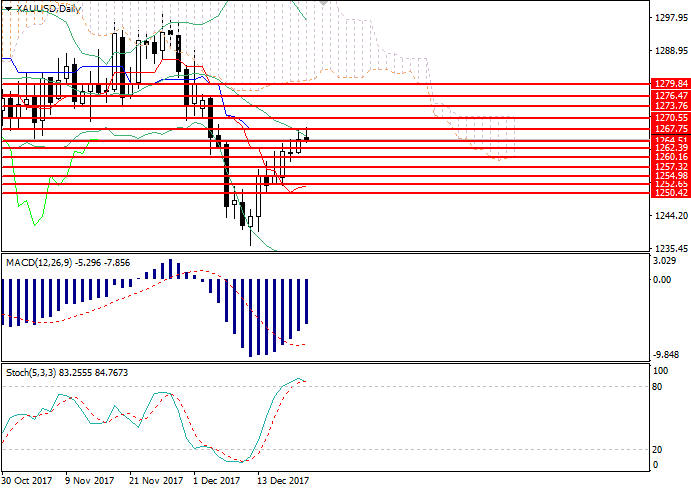

XAU/USD, D1

In the D1 chart the instrument is trying to consolidate above the middle line of Bollinger Bands. The key resistance level is 1267.70. Breaking through it will be a strong signal for the opening of long positions. The indicator has reversed downwards, while the price range has considerably widened which is a basis for the preservation of the current trend. MACD is in the negative zone, and the sell signal is still valid. Stochastic is about to leave the overbought area, and a strong signal for the opening of sell positions will be formed in the near future.

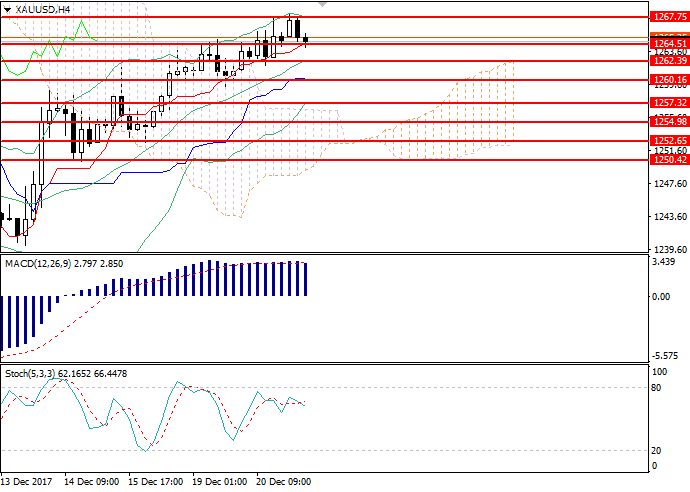

XAU/USD, H4

In the H4 chart the instrument is trying to consolidate below the level of 1264.45. The key support level is 1262.40. Breaking through it will cause the fall of gold to the levels of 1257.30, 1252.60. Bollinger Bands are directed upwards, while the price range is narrowing which serves as a reason for the change of the current trend. MACD histogram is in the positive zone preserving a strong buy signal. Stochastic does not give a clear signal for entering the market.

Key levels

Support levels: 1250.42, 1252.65, 1255.00, 1260.15, 1262.40, 1264.50.

Resistance levels: 1267.75, 1270.55, 1273.75, 1276.50, 1279.85.

Trading tips

Short positions should be opened below the level of 1262.35 with targets at 1257.35, 1252.65 and stop-loss at 1265.10. The period of implementation is 1-3 days.

Long positions may be opened from he level of 1268.00 with target at 1274.00 and stop-loss at 1262.60. The period of implementation is 2-4 days.