The unfavorable conjuncture of the debt and foreign exchange market does not allow the XAU/USD bulls to launch a counterattack

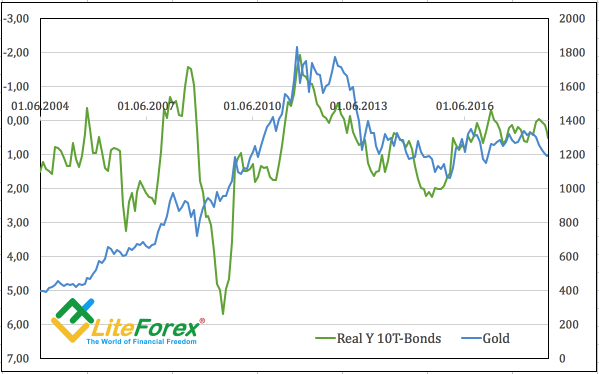

What does not kill makes us stronger. Gold has not been in such an unfavorable environment for a long time. If the main reason of the 12% decline of the precious metal from the levels of the April highs was the US dollar, then in October, the growth in the yield on 10-year US Treasury bonds caused headaches in the XAU/USD bulls. So far, according to Jerome Powell, the risks of accelerating inflation are low, the rally of real rates of the debt market will continue. And this circumstance makes gold think exclusively about protection, and investors - to withdraw money from the ETF. According to Commerzbank (DE:CBKG) estimates, since the beginning of October, stocks of specialized exchange funds have decreased by 14.5 tons.

Dynamics of gold and real yield of US Treasury bonds

Source: Reuters.

What is going on? Why neither the strong dollar, nor the unfavorable state of the American debt market leads to the recovery of the downtrend in the XAU/USD? The precious metal is stuck in consolidation in the range of $ 1,185-1215 and neither the Fed meeting nor the US labor market statistics for September could take it out of there. In my opinion, the reason is in the actions of speculators, and in the uncertainty about the impact of trade wars on the global economy.

While net shorts in gold are near historic highs, there is a high risk of avalanche-like triggering of stop orders. And some hedge funds can't wait to launch an avalanche. At the very beginning of the American Forex session, on October 2, within 10 minutes, the trading volume exceeded its average 100-day values 12 times and the price rose sharply. All this took place against the backdrop of an escalation of the political crisis in Italy, which allowed some analysts to associate this factor with the spurt of the XAU/USD. In fact, events in Rome are putting pressure on the euro, which leads to an increase in the USD index. In my opinion, speculators decided to put the cart before the horse and will now try to maintain their positions.

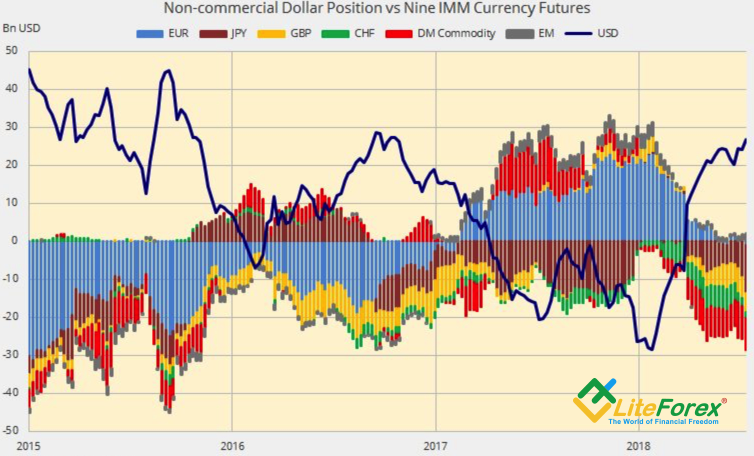

From a fundamental point of view, the main reason for the current consolidation of the precious metal is uncertainty in the fate of the global economy. On the one hand, the rapid growth of US GDP inspires optimism, on the other hand, the slowdown of China, on the contrary, heightens anxiety for developing countries as a whole. In my opinion, the States will sooner or later begin to reap the fruits of their own selfishness. The slogan “America first”, and the associated policy of protectionism will lead to a decrease in US GDP growth rates, which will force investors to return to bonds, reduce their profitability and hit the attractiveness of the dollar. Currently, speculators continue to believe in greenback, which translates into an increase in net-longs, but I personally do not share the optimism of Jerome Powell, who claims that economic expansion can last forever.

Dynamics of speculative positions in G10 currencies

Source: Bloomberg.

Thus, it makes sense for investors to look for opportunities to form long positions in gold upon the break of resistance at $ 1215 per ounce, or upon the fall of quotations with subsequent return to the upper part of the trading range $ 1185-1215.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you" :)

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.