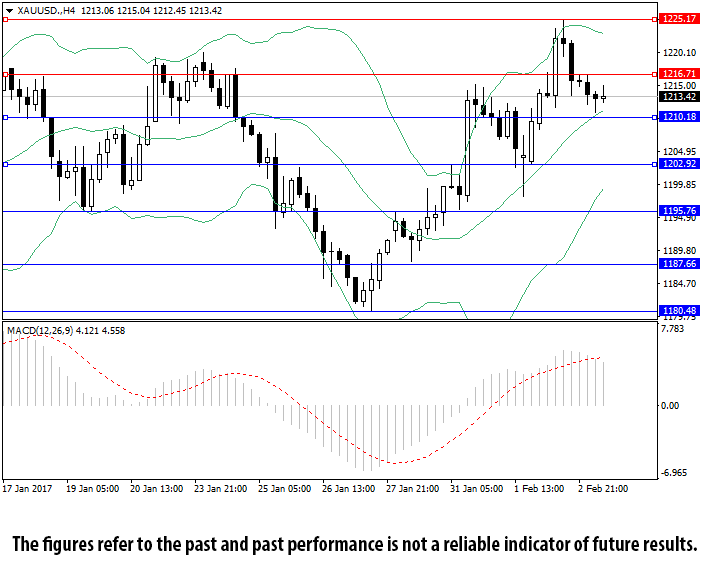

The pair has tested the maximum 1225.17 and then lowered after the positive USA macro economic statistics publication. The Initial Jobless Claims lowered to 246K WoW from 260K in the previous week. The Nonfarm Productivity grew in the fourth quarter by 1.3% against the expected growth of 1.0%. As a result the pair lowered to the level of 1215.50. Today the traders are waiting for the USA employment rate, so the gold price is consolidating near the middle line of the Bollinger® Bands indicator (1211.40). The trading activity is lowered. The Nonfarm Payrolls index is expected to grow to 175K in January from 156K in the previous month. In this case of if the index is better than expected the USD will be supported, which will result in the lowering of gold price. The index can be better than expected, as the ADP Employment Change index, published on Wednesday, showed the result of 246K in January against 151K in the previous month.

On the 4-hour chart the technical indicators reflects the lowering of the trading activity and the consolidation of the pair. The Bollinger Bands indicator is pointed sideways. The MACD histogram is in the positive zone, its volumes are decreasing, still giving no clear signal.

- Support levels: 1210.18, 1202.92, 1195.76.

- Resistance levels: 1216.71, 1225.17, 1233.12.