It has been about a month since the last earnings report for Wynn Resorts, Limited (NASDAQ:WYNN) . Shares have added about 2% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Wynn Resorts Q2 Earnings & Revenues Top Estimates

Wynn Resorts posted solid results for second-quarter 2017, with earnings and revenues beating the Zacks Consensus Estimate.

Earnings and Revenues Discussion

Adjusted earnings of $1.18 per share surpassed the Zacks Consensus Estimate of $1.09 by 8.3%. Further, earnings increased 10.3% from the year-ago figure of $1.07, given a substantial rise in revenues.

Wynn Resorts’ revenues of $1.53 billion topped the Zacks Consensus Estimate of $1.45 billion by 5.3%. Moreover, revenues increased 44.5% given significant contribution from Wynn Palace along with favorable performance by the company’s Las Vegas Operations and higher revenues from Wynn Macau.

Adjusted property earnings before interests, taxes, depreciation and amortization (EBITDA) surged 37.5% to $430 million year over year on higher revenues.

Meanwhile, total operating costs and expenses increased 40.8% to around $1.28 billion, primarily owing to a rise in casino, rooms, food and beverage, entertainment, retail and other as well as general and administrative expenses.

Macau Operations

Wynn Resorts reports its Macau table games results under two segments – VIP and mass market.

Wynn Macau

Wynn Macau revenues increased 6.8% year over year to $682.7 million in the quarter owing to higher casino revenues, somewhat offset by lower non-casino revenues.

Notably, casino revenues from Macau operations jumped 7.4% to $654.7 million. Meanwhile, table games turnover in the VIP segment soared 35.3% to $16.02 billion. However, the VIP table games win rate (based on turnover) was 3.53%, down 45 basis points (bps) year over year but above the projected range of 2.7% to 3%.

Table drop in the mass market segment was $1.07 billion, down 9%. Table games win in the mass market category amounted to $221.6 million, down 5.8%. Nevertheless, mass market win rate was 20.8%, up 80 bps.

Non-casino revenues before promotional allowances tanked 10.8% to $60.8 million. Meanwhile, room revenues decreased 12.4% to $25.7 million. Revenue per available room (RevPAR) plunged 14.3% in the quarter to $252 million as average daily rate (ADR) declined 19.6%. But occupancy rate increased 600 bps to 97.5%.

In the quarter, adjusted property EBITDA was $210.4 million, up 10.5% year over year.

Wynn Palace

On Aug 22, 2016, Wynn Resorts’ chairman of the board and chief executive officer, Steve Wynn, unveiled the Wynn Palace resort in the Cotai area of Macau. Thus, the second quarter of 2017 represents the third full quarter of operations for this resort.

Wynn Resorts’ revenues from Wynn Palace were $414.7 million in the quarter, while casino revenues totaled to $372.2 million.

While table games turnover in the VIP segment was nearly $11.60 billion, VIP table games win rate (based on turnover) was 2.18%, below the expected range of 2.7–3%.

Notably, table drop in the mass market segment was $729 million. Meanwhile, table games win in mass market operations amounted to $168.7 million and mass market win rate was 23.1%.

Non-casino revenues, before promotional allowances were $79.5 million. During the quarter, room revenues were $35.4 million with an ADR of $232 million, occupancy of 96.2% and REVPAR of $224 million. In the quarter, adjusted property EBITDA stood at $87.4 million.

Though Wynn Palace is poised to witness increased visits from tourists and leisure gamblers over the long term, foot traffic has been low of late due to construction around the resort. As a result, the company failed to fully capitalize on the rebound in Macau gaming revenues, in the quarter.

Las Vegas Operations

Wynn Resorts’ revenues from Las Vegas operations were up 3.1% to $431.9 million on the back of higher casino and non-casino revenues. Notably, casino revenues from Las Vegas operations inched up 4.8% to $139.3 million. Meanwhile, table games win percentage was 24.2%, up 170 bps and above management’s guidance range of 21–25%.

Total non-casino revenues, before promotional allowances, increased 1.5% to $332.2 million year over year. Room revenues were up 1.4% to $115.1 million. During the quarter, RevPAR grew 1.9% to $268 million on the back of a 340 bps increase in occupancy rate and a 1.9% rise in ADR. While food and beverage revenues increased 4% to $160.1 million, entertainment, retail and other revenues decreased 4.9% to $57 million. Adjusted property EBITDA was up 8.1% to $132.2 million.

How Have Estimates Been Moving Since Then?

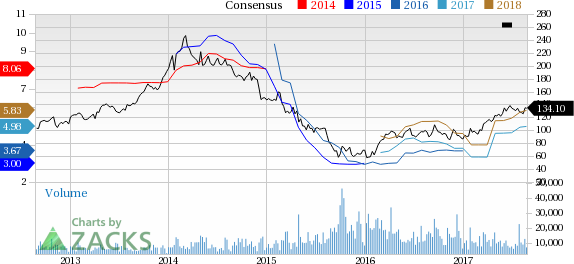

Following the release, investors have witnessed an upward trend in fresh estimates. There has been one revision higher for the current quarter, while looking back an additional 30 days, we can see even more upward momentum. There has been two moves higher compared to one lower two months ago.

VGM Scores

At this time, Wynn Resorts' stock has a great Growth Score of A, a grade with the same score on the momentum front. However, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is equally suitable for growth and momentum investors while value investors may want to look elsewhere.

Outlook

While estimates have been trending upward for the stock, the magnitude of this revision has been net zero. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Wynn Resorts, Limited (WYNN): Free Stock Analysis Report

Original post