Wynn Resorts ( (NASDAQ:WYNN) ) just released its second-quarter fiscal 2017 financial results, posting earnings of $1.18 per share and revenues of $1.53 billion. Currently, WYNN is a Zacks Rank #2 and is down 2.29% to $135.80 per share in trading shortly after its earnings report was released.

Wynn Resorts:

Beat earnings estimates. The company posted earnings of $1.18 (excluding $0.45 for non-recurring items), which beat the Zacks Consensus Estimate of $1.09.

Beat revenue estimates. The company saw revenue figures of $1.53 billion, which beat our consensus estimate of $1.45 billion.

The company opened Wynn Palace on August 22, 2016, with the second quarter of 2017 representing the third full quarter of operations for the resort. Net revenues and Adjusted Property EBITDA from Wynn Palace were $414.7 million and $87.4 million, respectively, for the second quarter of 2017. Casino revenues from Wynn Palace were $372.2 million for the second quarter of 2017.

Casino revenues from Wynn Macau were $654.7 million for the second quarter of 2017, a 7.4% increase from $609.8 million from the prior-year quarter. Adjusted Property EBITDA from Wynn Macau was $210.4 million for the second quarter of 2017, a 10.5% increase from $190.4 million for the same period of 2016.

Further, casino revenues from the Las Vegas Operation were $139.3 million for the second quarter of 2017, a 4.8% increase from $132.9 million from the comparable quarter last year. Adjusted Property EBITDA from our Las Vegas Operations was $132.2 million, an 8.1% year-over-year increase.

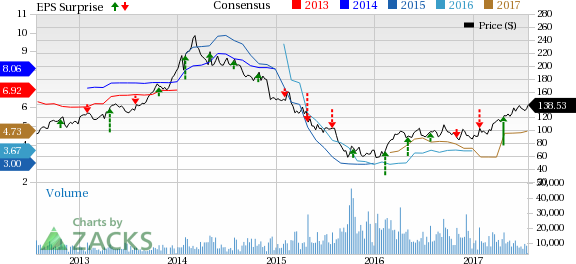

Here’s a graph that looks at WYNN’s recent earnings performance history:

Wynn Resorts Limited and its wholly-owned subsidiaries Wynn Las Vegas and Wynn Capital will own and operate Le Reve, which they've designed to be the preeminent luxury hotel and destination casino resort in Las Vegas.

Check back later for our full analysis on WYNN’s earnings report!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Wynn Resorts, Limited (WYNN): Free Stock Analysis Report

Original post

Zacks Investment Research