Independent value

Management has mapped out a clear strategy to deliver a significant increase in profitability over the next three years as a standalone company. Regional results were mixed last year, but new business indicators appear to be positive in all areas now and the rising order book trend looks set to continue. Ahead of this, our estimates have increased modestly, with an improved UK mix. The rating looks undemanding on this basis, more so if management’s medium-term targets are met.

High aspirations as an independent entity

After a five-month review period, management has concluded that continuing as an independent entity is the best way to generate increased future shareholder value. The previously announced FY18 PBT target of £15m is unchanged, and gives a good indication of the scale and rate of uplift intended by management. The pipeline of identified projects has increased since the beginning of 2015, with larger ones in overseas regions forming part of this. WYG Plc (LONDON:WYGR) has a major project unit in place to address these opportunities and a new £25m flexible banking facility to accommodate increased work flows. FMW Consultancy has been acquired since the year end to add to UK capabilities and acquisitions may contribute further towards WYG’s three-year target.

UK drives year-on-year progress

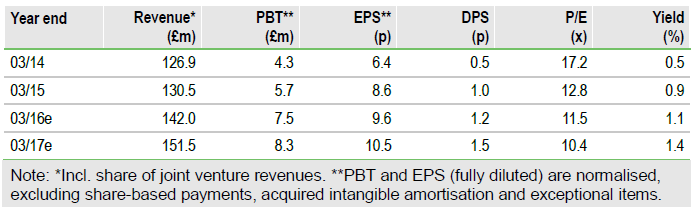

FY15 results were in line with April guidance and modestly ahead of our estimates with PBT of £5.7m. Earnings benefited from a tax credit (as in FY14) and EPS (normalised and fully diluted) was up c 35% year-on-year. Having returned to the dividend list by declaring a final payment for FY14, DPS doubled to 1.0p for FY15 as a whole. UK operations were the standout performers with overseas regions affected by a funding transition in the EU’s main aid framework mechanism. WYG had a £12.3m net cash position at the end of FY15, the majority of which is unrestricted. Hence, the company has financial flexibility to handle a higher order book and pipeline positions. Our EPS estimates for this year and next have increased by 5.6% and 7.3% respectively.

Valuation: Single digit P/E in view

WYG’s share price rose c 10% when the strategic review was announced in January, but has settled back to the post-H115 results level, performing in line with the FTSE AIM All Share. On revised estimates, an FY16 P/E of 11.5x falls to 9.3x by FY18 (EV/EBITDA of 6.9x to 5.0x on the same basis). Management’s PBT target is more than 50% above our estimate at the end of this time period and implies an FY18 P/E multiple comfortably below 10x.

To Read the Entire Report Please Click on the pdf File Below