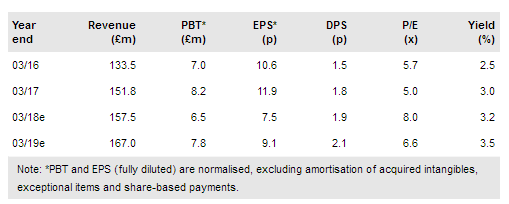

In recent weeks, trading performance has been softer than anticipated, leading to revised expectations. There is no suggestion that funding programmes will be pared back, but we have taken a more conservative position on the rate at which this workflow builds across the business. We have lowered EBIT estimates by around one-third and now project a dip in earnings this year and, for now, a more gradual increase thereafter.

Funding transition slows H1 trading

WYG Plc (LON:WYGR) trading has been affected by funding transition delays, underperformance in UK planning and contract adjustments in other areas. International development work in Turkey has slowed due to a run-down of current pre-accession projects and deferred start to new ones. Slower starts have also been experienced under new climate change in Africa and Western Balkans infrastructure programmes where WYG has strong positions. In the UK, WYG started the year with a reasonably good order book position and has announced some sizeable framework appointments although workflow has been slow to build. Lastly, in the UK, a review of engineering contracts has highlighted the likelihood of some less favourable outcomes than previously anticipated.

To read the entire report Please click on the pdf File Below: