The daily chart for oil is a textbook example of Wyckoff’s second law as the commodity continues to trade in congestion and is exactly where I have been forecasting it would be for several weeks. And in case you are a little hazy on this law, it is that of cause and effect.

The greater the cause then the greater will be the resulting effect. In other words, the longer a market remains in congestion, then the more developed will be the trend once the price action breaks away from such an area.

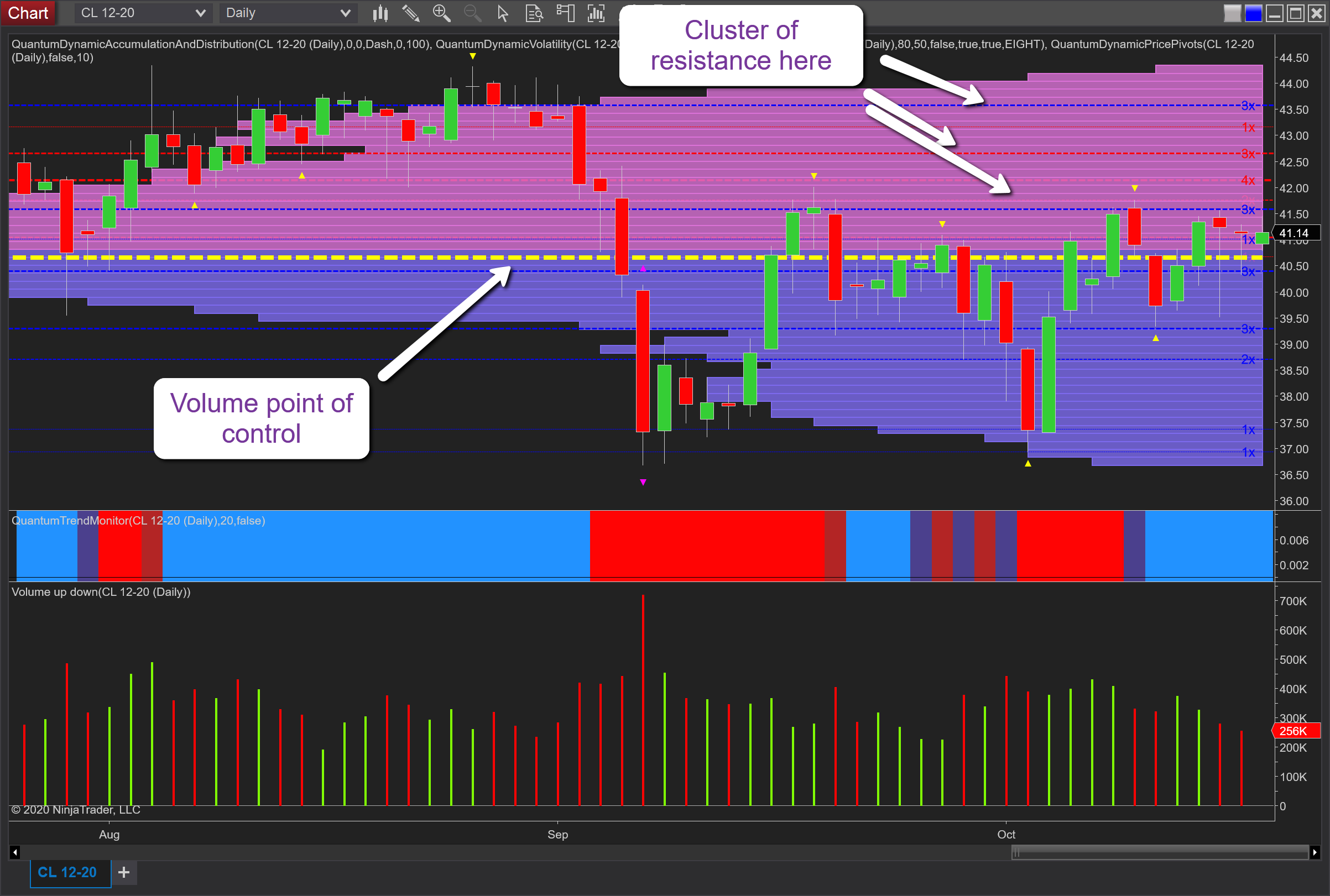

And for oil, the congestion looks set to continue for some time to come, given it is the supply and demand equation which is governing prices and suppressing them as a result. The volume histogram on the y-axis is now extremely well developed and increasing each week around the volume point of control at $40.60 per barrel and denoted with the yellow dashed line. This is now the fulcrum of the market where the price is in agreement and showing no bullish or bearish bias. This histogram of volume extends through to $44.50 per barrel to the upside and $36.50 to the downside, and as such, any attempt to rally to and beyond the current region will require a considerable increase in the volume driving the price action, not something we are seeing at present. Indeed last week’s two candle rally saw the volume fall on the second of these candles, despite the fact it was a wider spread candle than its predecessor and once more indicates the lack of demand by big operators and buyers in general.

From a price-based perspective there are several levels above the vpoc which are now forming into clusters, and whilst weak on their own, when clustered in this way present a significant barrier to progress higher. These are denoted with the red and blue dashed lines of the accumulation and distribution indicator from $41.50 per barrel through to $43.50 per barrel adding yet another resistance area to any recovery for crude oil.