Market Brief

The Japanese current account balance deteriorated less than expected in November, from 833.4 billion to 433.0 billion yen (vs. 139.5bn exp.), as trade deficit decreased faster than expected. JPY-crosses traded sluggish early in Japan, the trend reversed upwards later. USD/JPY rebounded from 117.74 as Japan adjusted post-NFP after the long week-end. USD/JPY steps deeper in the Ichimoku cloud (113.54/118.53), the conversion line trends lower. Offers are seen pre-119.00, while option bets are supportive above 119.50 for today expiry. EUR/JPY clears support at 200-dma (140.29) and retreated to 139.46. Deeper downside is eyed in the absence of significant JPY-negative news.

In China, the trade data surprised on the upside. Exports accelerated to 9.7% in year to December (vs. 4.7% a month ago), imports contracted at the slower pace of 2.4% (vs. -6.7% prev.). While USD/CNY find buyers in 6.1821/6.20 area (200-dma / psychological level), expectations for growth supportive government and PBoC keep the CNY purchases limited. AUD/USD tested 0.8200 offers post-China news. The short-term technicals hint for further upside correction, upside remains fragile before Australian employment data (due Thu). Important resistance eyed at 0.8360/80 (50-dma / Oct’14-Jan’15 downtrend top).

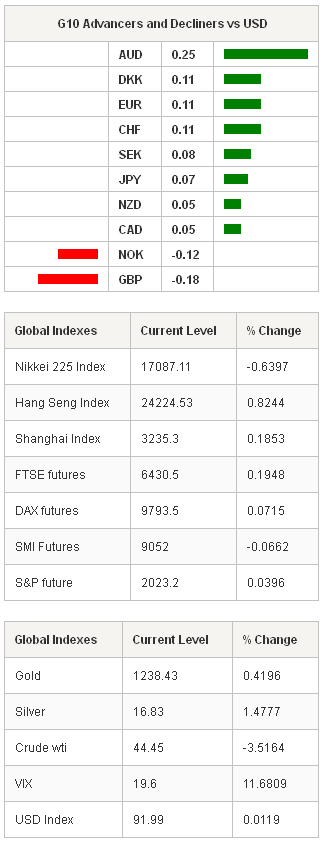

USD/CAD tests offers pre-1.20 as WTI crude slides below $45 (-3.5% on session so far). The sentiment remains negative on oil producers as CAD, NOK and RUB. The Russian central bank intervenes by purchasing FX, USD 1.3 billion equivalent of foreign exchange is reported with Jan 12th settlement.

The sentiment in GBP/USD remains bearish before the December CPI read. As elsewhere, the headline CPI in UK should have further deteriorated in December due to Oil prices, the consensus is 0.7% y/y vs. 1.0% a month ago. The Cable consolidates weakness below 1.52 as the negative pressures curb as USD loses strength across the board. The key support stands at 1.50, stops are seen below.

EUR/USD did little overnight. The sentiment remains negative, with short-term fresh positions are skeptical before EZ final CPI due later this week and the ECB meeting next week (Jan 22nd). EUR/GBP technicals are flat. A daily close below 0.7795 (MACD pivot) will keep the bias negative. Large vanilla expiries sit at 0.7800/50 for today expiry and should limit the upside attempts.

The economic calendar : German December Wholesale Price Index m/m & y/y, Swedish December Unemployment Rate and CPI m/m & y/y, Italian November Industrial Production m/m & y/y, UK CPI, RPI and PPI m/m & y/y, US December NFIB Small Business Optimism, US January IBD/TIPP Economic Optimism, US December Monthly Budget Statement.

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| GE Dec Wholesale Price Index MoM | - | -0.70% | EUR / 07:00 |

| GE Dec Wholesale Price Index YoY | - | -1.10% | EUR / 07:00 |

| SW Dec PES Unemployment Rate | 4.30% | 4.10% | SEK / 07:00 |

| SW Dec CPI MoM | -0.10% | -0.10% | SEK / 08:30 |

| SW Dec CPI YoY | -0.50% | -0.20% | SEK / 08:30 |

| SW Dec CPI CPIF MoM | 0.00% | 0.00% | SEK / 08:30 |

| SW Dec CPI CPIF YoY | 0.20% | 0.60% | SEK / 08:30 |

| SW Dec CPI Level | 313.35 | 313.56 | SEK / 08:30 |

| SW Nov Household Consumption (MoM) | - | 0.10% | SEK / 08:30 |

| SW Nov Household Consumption (YoY) | - | 1.80% | SEK / 08:30 |

| IT Nov Industrial Production MoM | 0.10% | -0.10% | EUR / 09:00 |

| IT Nov Industrial Production WDA YoY | -2.70% | -3.00% | EUR / 09:00 |

| IT Nov Industrial Production NSA YoY | - | -3.00% | EUR / 09:00 |

| UK Dec CPI MoM | 0.10% | -0.30% | GBP / 09:30 |

| UK Dec CPI YoY | 0.70% | 1.00% | GBP / 09:30 |

| UK Dec CPI Core YoY | 1.30% | 1.20% | GBP / 09:30 |

| UK Dec Retail Price Index | 257.4 | 257.1 | GBP / 09:30 |

| UK Dec RPI MoM | 0.10% | -0.20% | GBP / 09:30 |

| UK Dec RPI YoY | 1.60% | 2.00% | GBP / 09:30 |

| UK Dec RPI Ex Mort Int.Payments (YoY) | 1.60% | 2.00% | GBP / 09:30 |

| UK Dec PPI Input NSA MoM | -2.60% | -1.00% | GBP / 09:30 |

| UK Dec PPI Input NSA YoY | -11.50% | -8.80% | GBP / 09:30 |

| UK Dec PPI Output NSA MoM | -0.30% | 0.20% | GBP / 09:30 |

| UK Dec PPI Output NSA YoY | -0.40% | -0.10% | GBP / 09:30 |

| UK Dec PPI Output Core NSA MoM | -0.10% | 0.50% | GBP / 09:30 |

| UK Dec PPI Output Core NSA YoY | 1.20% | 1.40% | GBP / 09:30 |

| UK Nov ONS House Price YoY | 9.80% | 10.40% | GBP / 09:30 |

| US Dec NFIB Small Business Optimism | 98.5 | 98.1 | USD / 14:00 |

| US Jan IBD/TIPP Economic Optimism | 48.7 | 48.4 | USD / 15:00 |

| US Nov JOLTS Job Openings | 4850 | 4834 | USD / 15:00 |

| US Dec Monthly Budget Statement | $3.0B | - | USD / 19:00 |

Currency Tech

EUR/USD

R 2: 1.2118

R 1: 1.2000

CURRENT: 1.1844

S 1: 1.1743

S 2: 1.1640

GBP/USD

R 2: 1.5485

R 1: 1.5320

CURRENT: 1.5144

S 1: 1.5000

S 2: 1.4814

USD/JPY

R 2: 121.85

R 1: 120.83

CURRENT: 118.33

S 1: 117.74

S 2: 117.24

USD/CHF

R 2: 1.0435

R 1: 1.0278

CURRENT: 1.0138

S 1: 1.0033

S 2: 0.9990