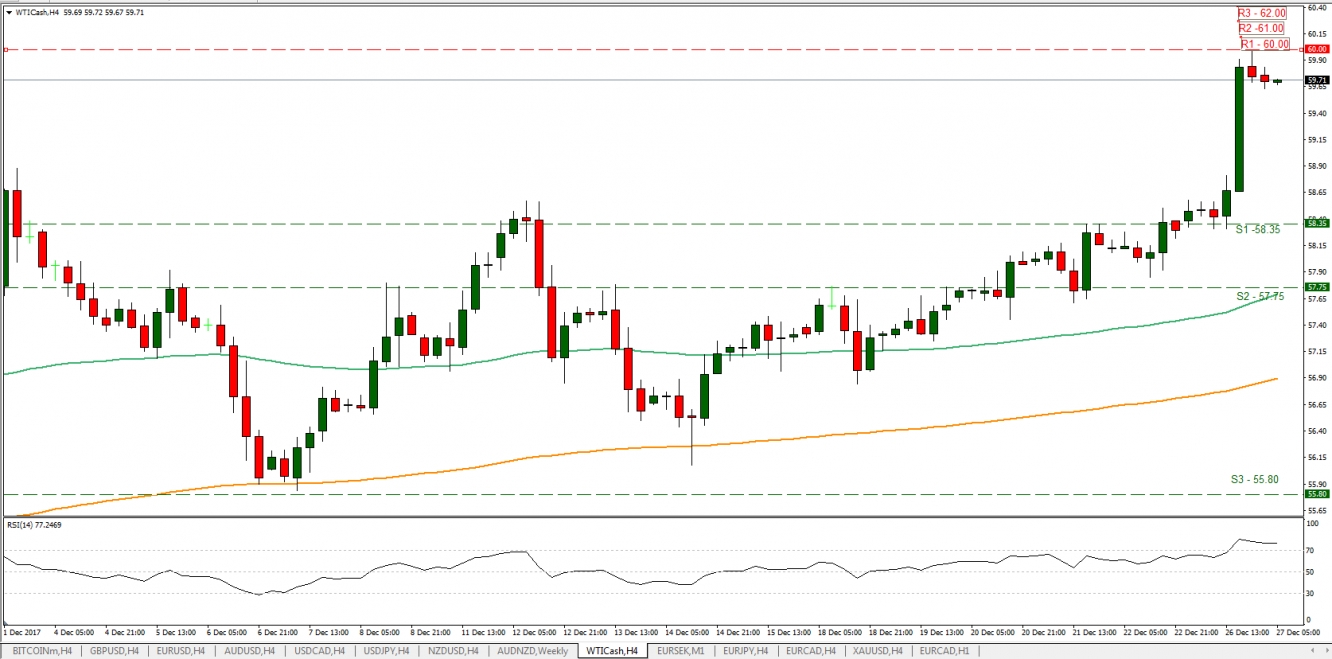

Media reported an explosion on a major oil pipeline in Libya. The overall effects on oil supply are expected to last for a longer period as the restoration of the pipeline may require a considerable amount of time. Meanwhile media reports also suggested that Saudi Arabia is expecting an 80% increase in oil revenue by 2023. This could be another factor of the oil price increase, given the recently agreed oil production cuts extension, to the end of 2018 by OPEC. It should be noted that oil related currencies such as the Canadian Dollar could benefit from the increased oil prices.

- Oil surged to the highest price for at least the past 2 years reaching the 60 Dollar level (R1) and then subdued somewhat. Given the size of the surge yesterday, should oil continue to remain under buying interest it could break the 60 (R1) dollar resistance level and test the psychological 61 (R2) dollar zone, or even the 62 (R3) dollar level. On the other hand should it come under selling interest, support could be found at the 58.35 (S1) level and should this be broken, at the 57.75 (S2) support zone.

Bitcoin still rises

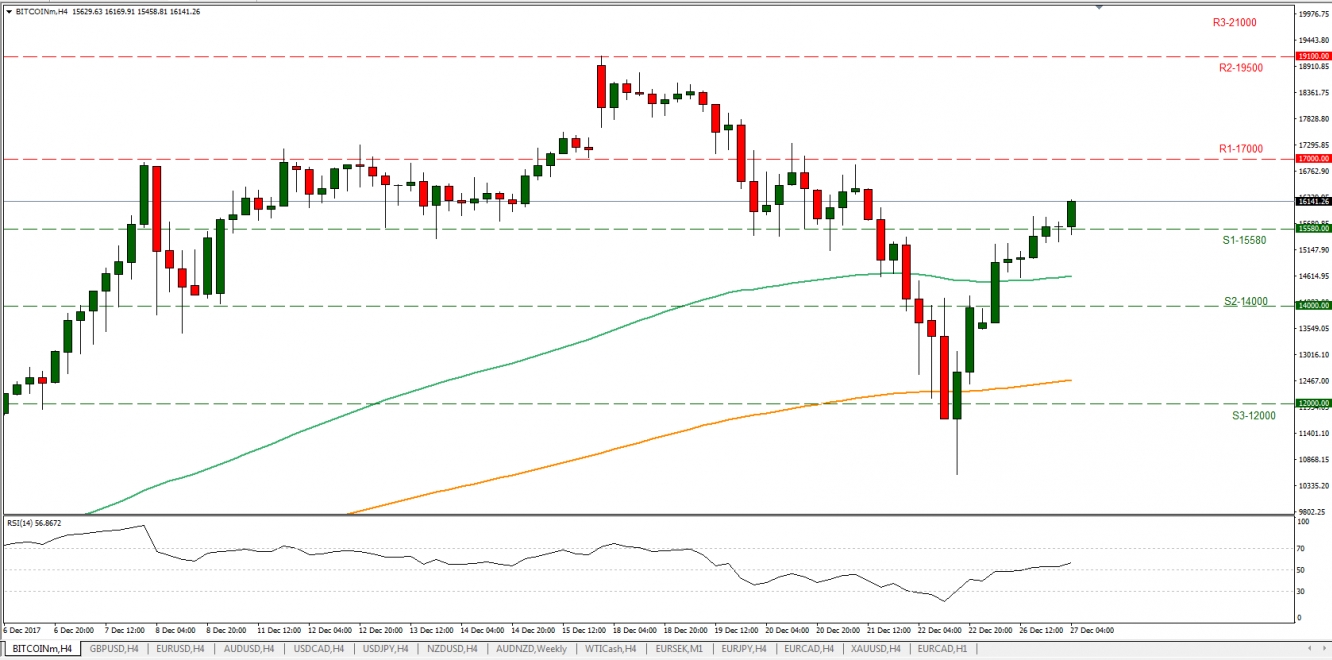

- The surge of the cryptocurrency continued yesterday and during today’s Asian morning however it was not able to reach the last week high yet. Despite the fact that the cryptocurrency covered Friday’s losses, marking possibly a temporary stabilization, fears of high volatility remain according to media reports. The high volatility, could also be a factor which prevents large businesses from accepting the cryptocurrency and hence reducing its overall acceptance as a payment method, having an unseen detrimental effect on Bitcoin and highlightening its role mostly as a speculative instrument.

- Bitcoin continued to rise yesterday and today during the Asian morning, it broke the 15580 (S1) resistance zone (now turned to support) and its price hovered slightly above it. Our opinion is that the direction of the cryptocurrency could continue currently on a sideways manner with the risks still tilted to the downside. Should the bulls take the driver’s seat, it could break the 17000 (R1) resistance level and aim for the 19500(R2) resistance zone. On the other hand should the bears take the reins, bitcoin could break 15580 (R1) resistance level and test the 14000 (R2) resistance zone.

Today’s other economic highlights

- During the late European day, from the US we get the consumer confidence index which is expected to drop and the pending homes sales change rate which is forecasted to slowdown. Both indicators are to be released simultaneously and could affect the US Dollar somewhat.

BTC

Support: 15580(S1), 14000 (S2), 12000 (S3)

Resistance: 17000 (R1),19500 (R2), 21000 (R3)

WTI

Support: 58.35(S1), 57.75 (S2), 55.80 (S3)

Resistance: 60.00(R1), 61.00(R2), 62.00(R3)