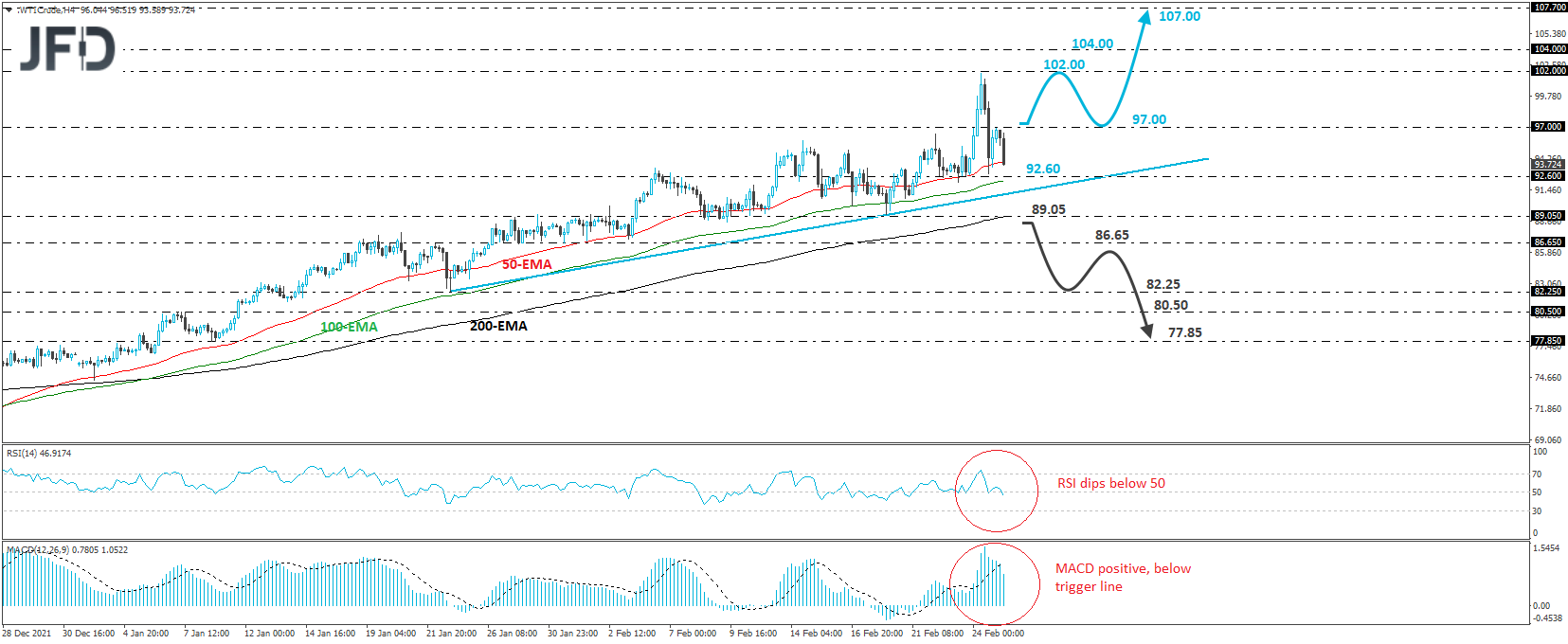

WTI crude oil traded higher yesterday but hit resistance near the 102.00 level for the first time since July 2014, and then it pulled sharply back. However, the black liquid remains above the upside support line drawn from the low of Jan. 24, and thus, we would consider the short-term outlook to be still cautiously optimistic.

We believe there is a decent chance for a rebound from near the 92.60 level or the aforementioned upside line. However, to get confident on a trend continuation, we would like to see a clear break above 97.00. This may confirm the current correction's end and encourage the bulls to aim for another test at 102.00. If they decide to break higher, they will confirm a forthcoming higher high, with the next potential resistance being at 104.00, marked by the highs of Jul. 17 and 18, 2014.

Another break above 104.00 could carry more significant extensions, perhaps towards the 107.70 zone, which provided resistance between Jun. 13 and 24, 2014. Turning our gaze to our short-term oscillators, we see that the RSI turned down and touched its toe back below its 50 line, while the MACD, although positive, lies below its trigger line. Both indicators suggest that there might be some more slide before the next leg south, and that’s another reason we prefer to wait for WTI to break above 97.00 before getting confident on a trend continuation.

To start examining the bearish case, we would like to see an apparent dip below 89.05, support marked by the low of Feb. 18. This could confirm the break below the upside line taken from the low of Jan. 24 and may initially aim for the 86.65 barrier, which supported WTI between Jan. 26 and Feb. 1.

A break lower could encourage the bears to dive towards the 82.25 or 80.50 zones, marked by the low of Jan. 24 and the inside swing high of Jan. 7, respectively, and if none of those two barriers can halt the slide, then we could see declines towards the low of Jan. 10, at 77.85.