Investing.com’s stocks of the week

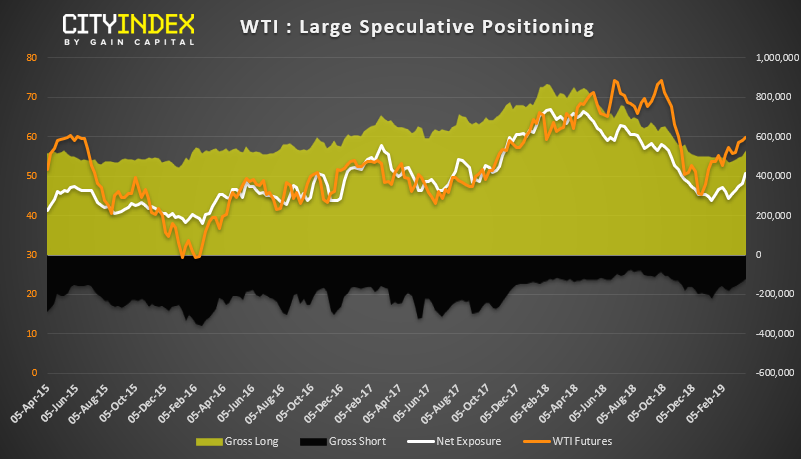

Stalling at our $60 target, we suspect there could be further for upside potential for WTI judging from its bullish trend structure and encouraging signs from the weekly COT report.

Prices are bouncing along the 8 and 21 eMA’s and Monday’s Doji held about the $58 area to suggest a shallow pullback may have completed. With it sniffing near its highs after yesterday’s minor rebound, we’re now looking for a break to new highs and head towards the $6180 and $63.60 lows. We remain bullish over the near-term above the prior swing low but sentiment among large speculators could be supportive over the medium-longer term too.

The latest COT report show some positive developments for the bull-camp. Net-log exposure had been falling throughout most of 2018, but it is now moving higher again after prices troughed late December. Short-covering among large speculators took hold around February, and this has now been coupled with an increase of bullish interest, and suggesting the decline for net-long exposure has troughed along with prices.