WTI has broken above $58 resistance with its most bullish session in two weeks. With two distinct hammer lows improving its trend structure, its recent correction found support around its bed of moving averages, and price action is beginning to look clearer as bears get shaken out of their trade.

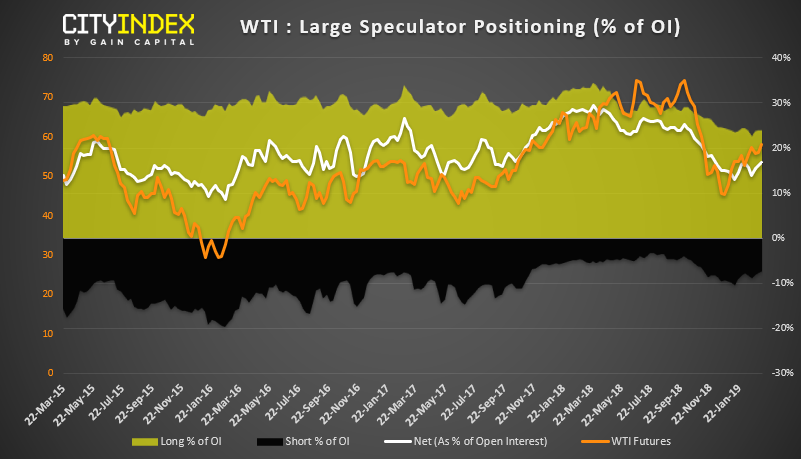

Adjusted for open interest, net-long exposure on WTI is beginning to rise from historically low levels. What began with short-covering back in January, slowly we’re seeing a pick-up of bullish interest to make the gradual rise of net-long exposure more convincing for the rise in prices.

$60 is within plain sight and makes the next obvious target. Keep in mind the 50% retracement from the 2018 low to highs resides just below here, so perhaps this is not a trade to outstay your welcome on upon its first attempt to break above $60. Currently treading water near its multi-month highs, we could wait to see if it find support above its 8-day eMA before hopping on board.