After rallying over 4% across the previous session and with the OPEC+ meeting kicking off today, it’s fair to say that oil will be under the spotlight on Thursday. WTI is extending gains in early trade on Thursday.

Oil prices surged in the previous session on expectations of deeper OPEC output cuts and following data showing a large drop in oil inventories last week. Yet despite Wednesday’s 4.1% rally, oil prices are only back to where they were a week ago, before they tanked on the lack of progress towards a US – China phase one trade deal.

What OPEC Will Discuss

Attention is now firmly on the OPEC+ meeting where members are seeking to extend the current production cuts beyond March 2020, with some members supporting deeper cuts of 400,000 bpd taking total cuts to 1.6 million bpd.

Why extend cuts?

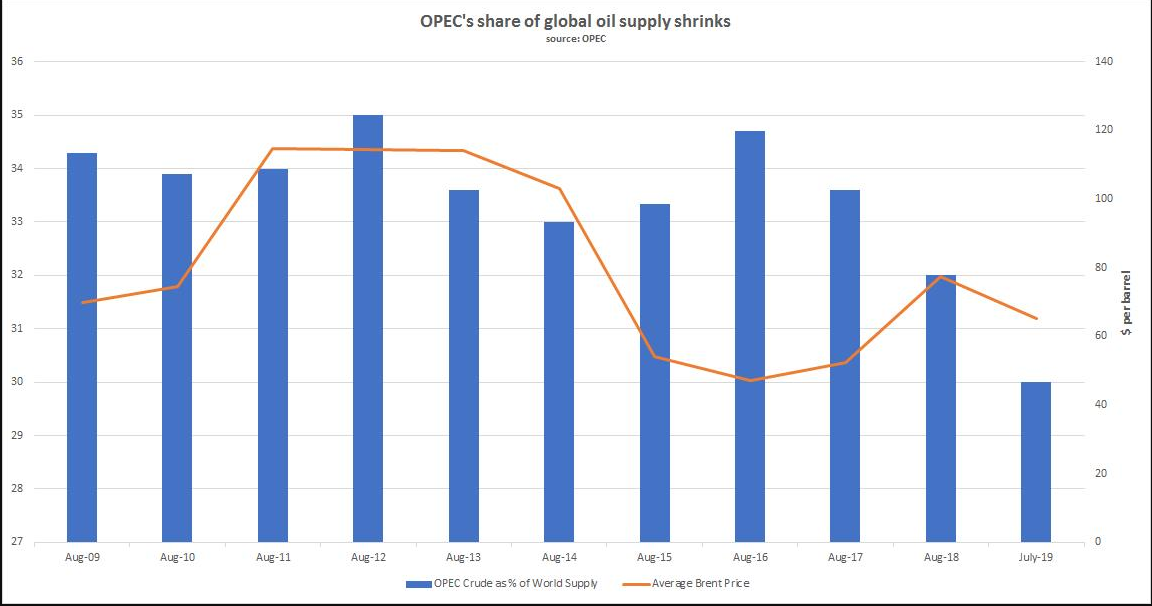

OPEC is looking to slash oil output further to prevent an oil glut in the coming year amid surging production from the US, now the world’s largest oil supplier, plus increased output from non-OPEC countries such as Brazil and Norway is expected to flood the market. And let’s not forget that a deeper supply cut could support the stock offering price of Aramco

Problems will further cuts

The problem however, it that production cuts by the OPEC + group are no longer a reliable method of influencing global oil process. Given that the group including Russia only control under 50% of the worlds oil supply, this isn’t sufficient to force prices higher through supply restrictions. This could prevent the group from taking cuts further.

On the demand side, with no US – China trade deal in place, doubts over the strength of the global economy in the coming year could also dent demand. However, this could quickly change should the US and China agree to a deal.

The broad expectation is that oil production cuts will be prolonged. However, a further cut is not fully priced in and the market remains skeptical as to whether OPEC+ will agree to that.

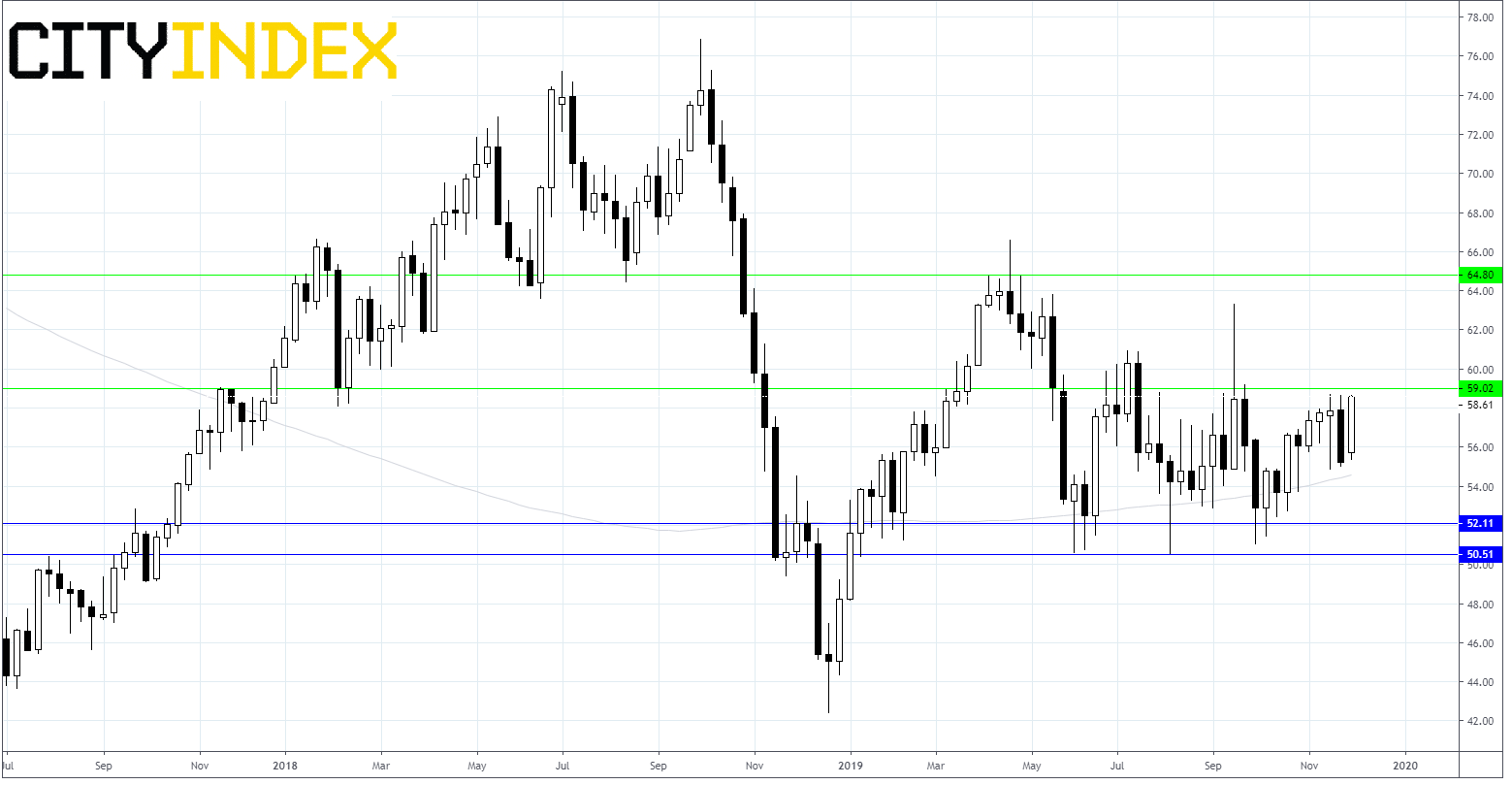

Levels to watch:

WTI has been trading within a familiar range of $52 - $61 since May and between $52 - $59 since August. We would be looking for a meaningful move above $59 to confirm an uptrend. The price then could target $64. On the downside support can be seen at $52, prior to $50.50.