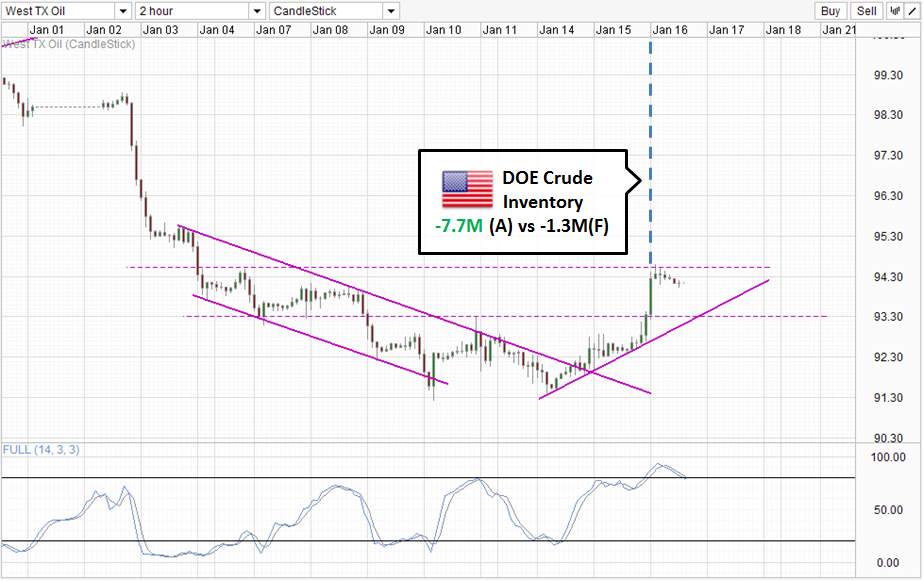

Crude Oil prices traded higher yesterday on stronger than expected data from DOE. Crude Inventory for the week of 10th Jan decreased by 7.66 million barrels, almost 6 times as much as analysts' consensus estimate which was at 1.3 million. This is also much higher than the numbers compiled by American Petroleum Institute, which estimated a fall of 4.14 million barrels. Perhaps even more significant was the fact that last week's decline in inventory is higher than that of the preceding week, suggesting that the pace of rising implied demand isn't going to end soon.

2 Hourly Chart

Prices rose to a high of 94.6 following the news release, with prices starting to pullback when it's clear that the resistance level is not going to go away. This decline continued well into the Asian session, dragged lower by the bearish sentiment evident from Asian stocks this morning. Currently, price is heading back towards 93.3 support and confluence with rising trendline. Stochastic readings concurs with this bearish outlook as Stoch curve is currently pointing lower with a fresh bearish cycle signal looking likely to be formed in the upcoming candle or the next. However, price should ideally break below 94.0 - 94.1 (the ceiling back between 7th to 8th Jan) in order to demonstrate strong bearish conviction which will match with the emergence of a proper bearish cycle signal.

It should also be noted that Crude prices are also inherently bullish with prices actually accelerating higher and breaking the 93.3 resistance even before the DOE numbers were released. This can be attributed to the overall bullish risk appetite during the European/early US session pushing risk correlated assets higher. With this in mind, S&P 500 Futures currently is pushing lower and may even break the 1,845 support level. Should risk appetite remain bearish, the likelihood of a 93.3 test increases.

Daily Chart

Daily Chart is less bearish than before with prices entering the 93.0 - 95.0 consolidation zone. However, overall bearish pressure remain, and even if price manage to recover and push higher from here, it is unlikely that 95.0 resistance will be broken and even should the unlikely happen, 96.0 and 97.0 will stand ready to keep rallies in check. Stochastic readings have given us a bullish cycle signal now, but even that may not take us far as Stoch curve has its own "resistances" to take care of, and a full bullish cycle from here out will be a difficult task to say the least.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

WTI Crude: Risk Aversion Weighing Price Down

ByMarketPulse

AuthorMingze Wu

Published 01/16/2014, 05:13 AM

Updated 03/05/2019, 07:15 AM

WTI Crude: Risk Aversion Weighing Price Down

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.