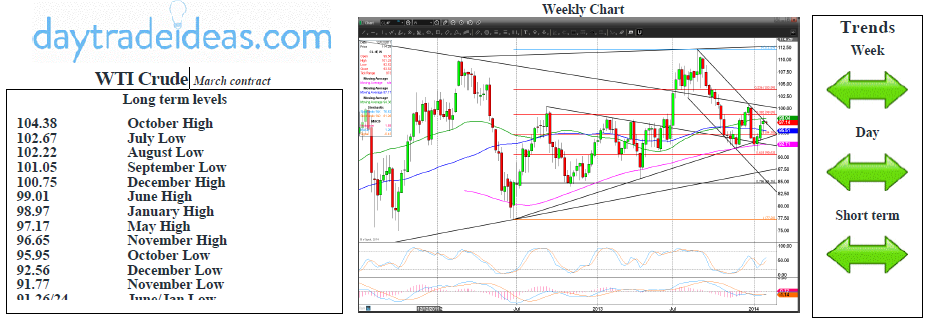

WTI Crude retested 9635/30 as expected and shot higher to our selling opportunity at 9790/9800 to top exactly here. This area could hold the topside again today as the outlook turns more negative. Look for a dip to 9745/40 then 9715. If we continue lower there is good support at 9685/80, but below here we could retest the low of the last 2 days at 9640/30.

A selling opportunity at 9790/9800 once again today which should hold a move higher but shorts need stops above 9860 highs last week.