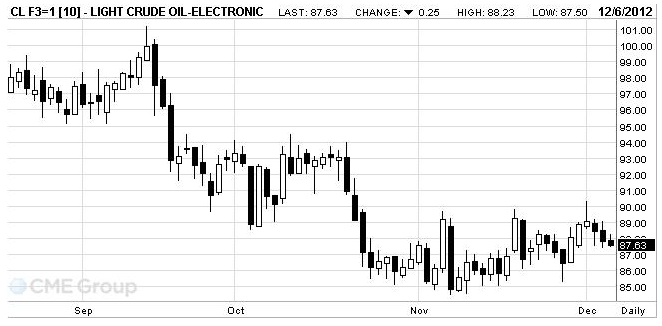

The day is early, but the week is strong. For Crude Oil, we are seeing no material change to the neutral status of the RSI, but the feel of the market is leaning to bullish. Of course we also believe that this is a last push to get the bulls back into the market. The rally to-day will need a full day to get the charts to flip into a new sense of higher. We’ll target resistance at 8930, 9038 and 9112. That last number is going to have to get a look to maintain the moves higher. Support has room to fall back to 8757, 8655 and 8542. The front spread remains tight between the –59 and –56 area and will need confirma-tion outside either. Flat price can go higher, but past 11am EST will convince us.

For the most part we held the 10min chart in a sideways pattern. It wasn’t until early this morning that we have a mall push to an uptrend. This mini move will hold the support line in the 8800 are for now. It leave us with a steep rise and our upside isn’t ready to be charted. The 60min chart has an overall feel for a rising trend and we’ll maintain the support line down to the 8760 area. The upside will look higher to push on the 8980 resistance.

Techies, some Trekkies

- 200-Day MA 9344

- 100-Day MA 9094

- 13-Day MA 879

- 8-Day MA 8803

- 14-Day RSI 51.34

- New year, new spread

- Key support: -67, -73, -77

- Key Rests: -59, -52, -48