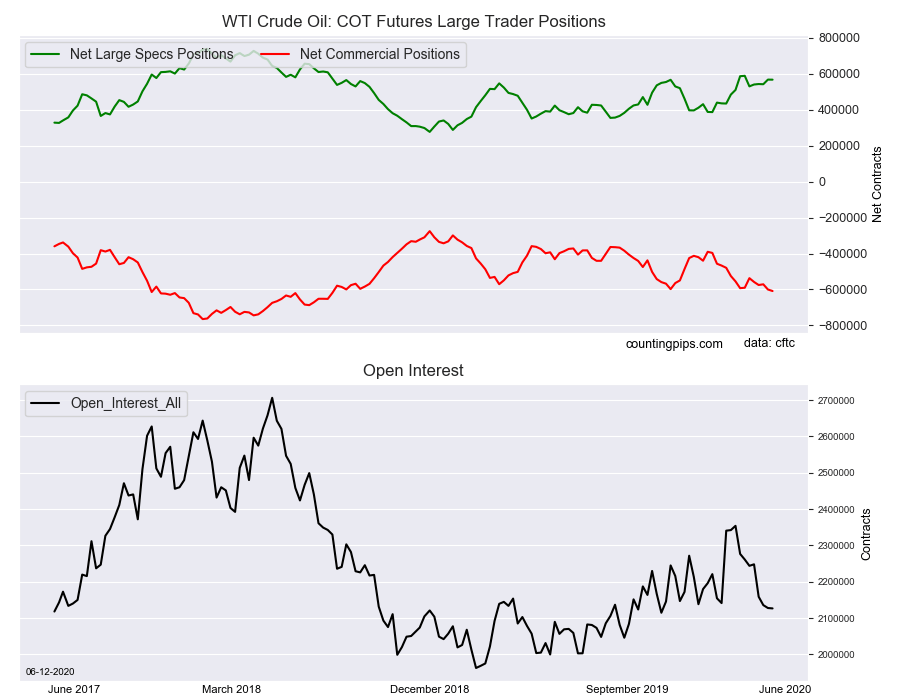

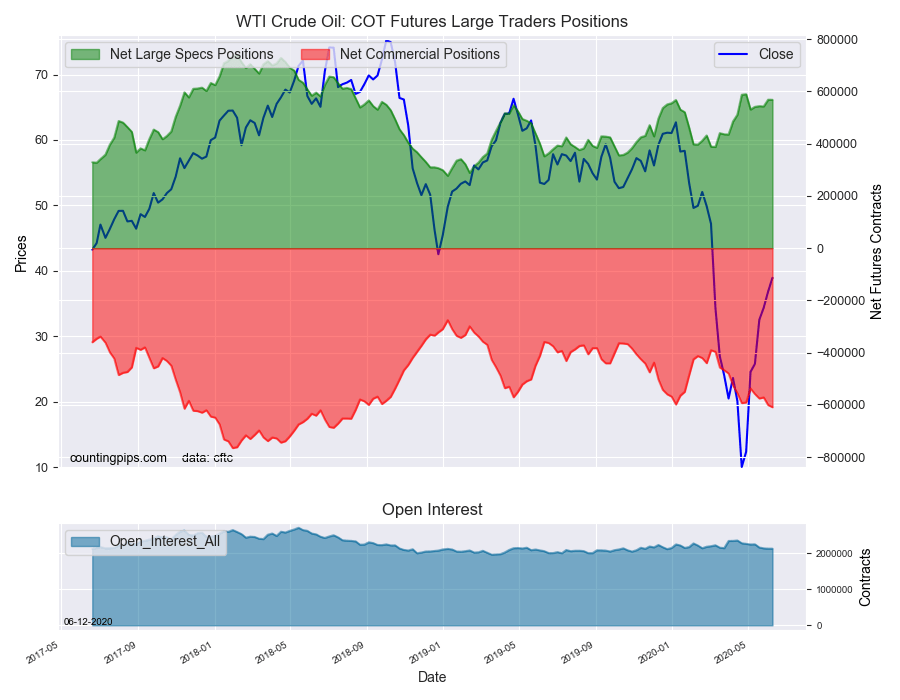

WTI Crude Oil Non-Commercial Speculator Positions:

Large energy speculators slightly decreased their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 567,909 contracts in the data reported through Tuesday, June 9th. This was a weekly dip of just -421 net contracts from the previous week which had a total of 568,330 net contracts.

The week’s net position was the result of the gross bullish position (longs) ascending by 3,762 contracts (to a weekly total of 732,934 contracts) while the gross bearish position (shorts) advanced by 4,183 contracts for the week (to a total of 165,025 contracts).

Crude speculators edged their bullish bets lower this week following a strong gain last week. Speculators have been raising their bets consistently over the past three months as the bullish position has increased by a total of +180,512 contracts since March 17th. These gains have pushed the overall bullish standing above the +500,000 net contract level for nine consecutive weeks which marks the longest streak since 2018.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -608,563 contracts on the week. This was a weekly shortfall of -8,549 contracts from the total net of -600,014 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $38.94 which was an uptick of $2.13 from the previous close of $36.81, according to unofficial market data.