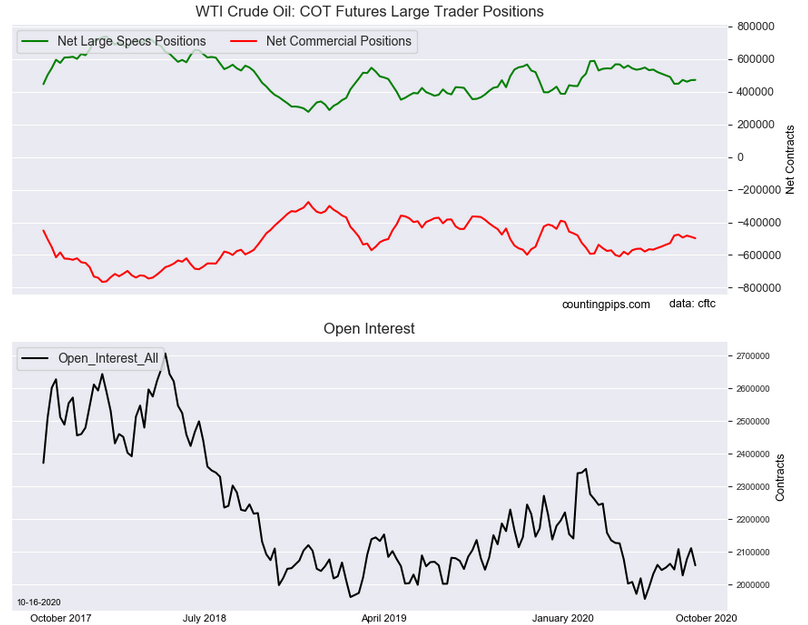

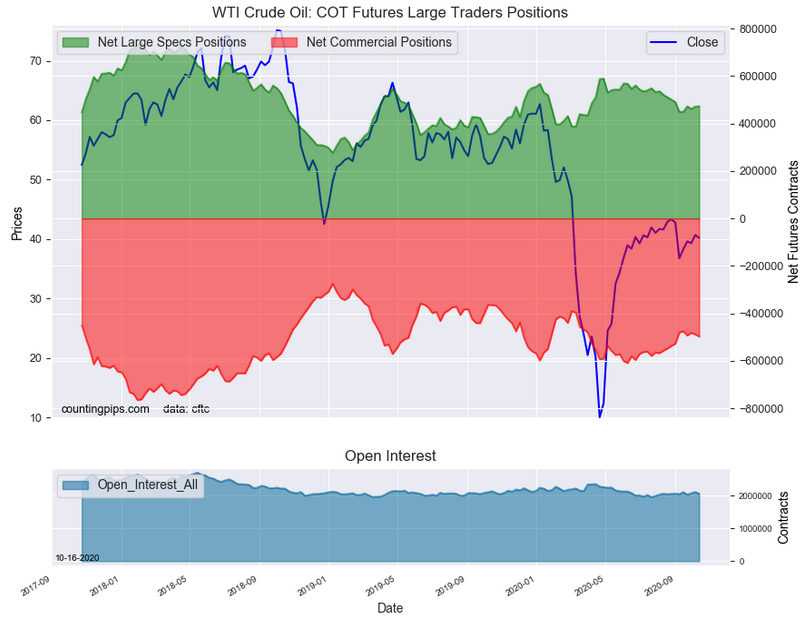

WTI Crude Oil Non-Commercial Speculator Positions:

Large energy speculators advanced their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 472,797 contracts in the data reported through Tuesday, October 13th. This was a weekly gain of 1,261 net contracts from the previous week which had a total of 471,536 net contracts.

The week’s net position was the result of the gross bullish position (longs) falling by -7,854 contracts (to a weekly total of 649,933 contracts) while the gross bearish position (shorts) dropped by a larger amount of -9,115 contracts for the week (to a total of 177,136 contracts).

The crude oil speculators edged their net positions higher this week for a second straight week and for the fourth time in the past five weeks. This week’s gain brings the overall bullish standing to the highest level of the past six weeks. Speculators are slowing building their bullish position back after a sharp decline for five straight weeks (Aug. 11th to Sept. 8th) took off a total of -86,900 net contracts from the bullish standing.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -496,915 contracts on the week. This was a weekly shortfall of -8,551 contracts from the total net of -488,364 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $40.2 which was a decline of $-0.47 from the previous close of $40.67, according to unofficial market data.