WTI Crude Oil Non-Commercial Speculator Positions:

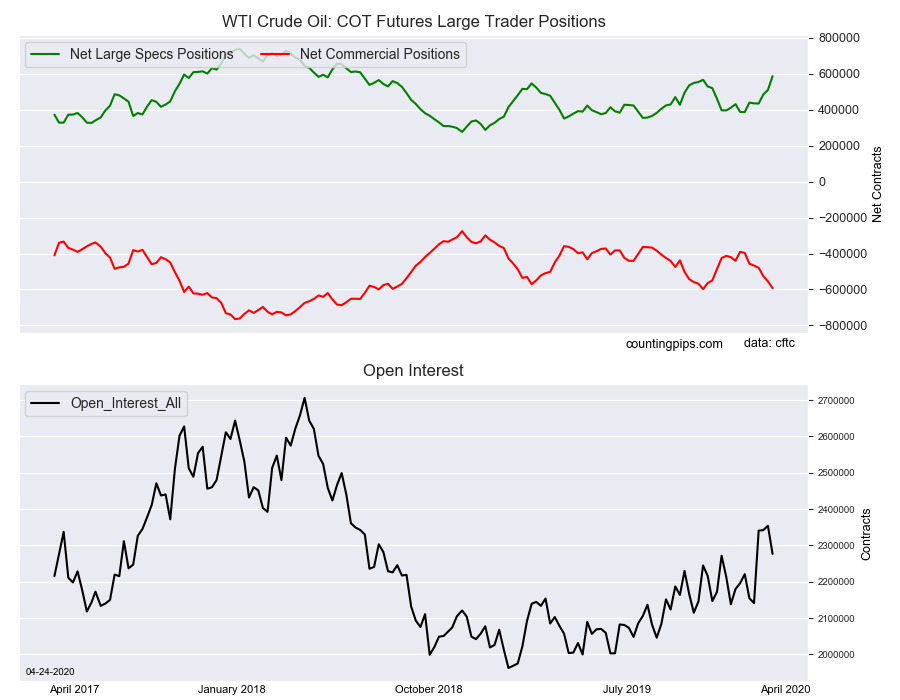

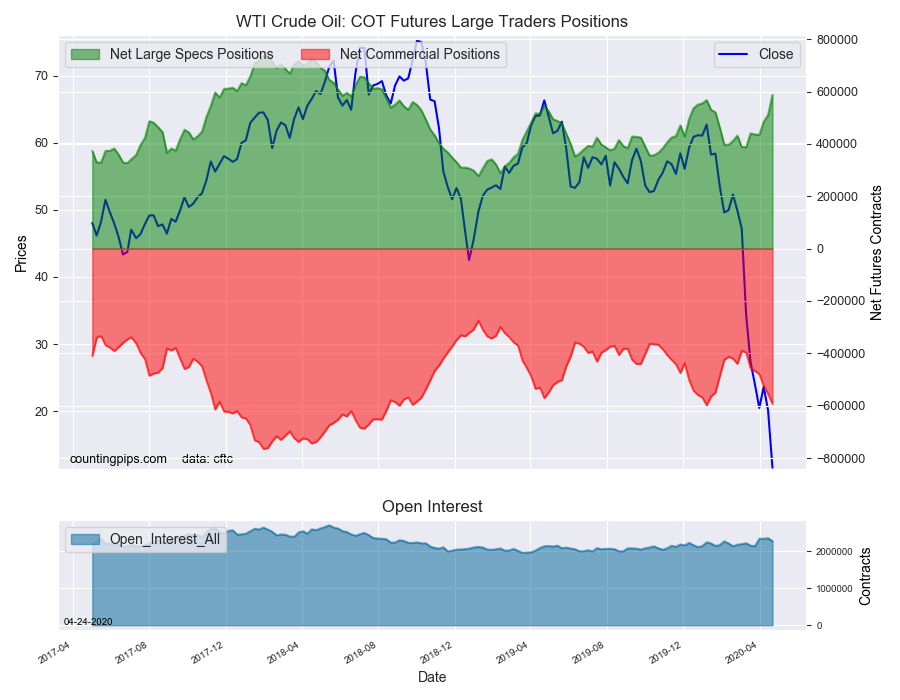

Large energy speculators strongly raised their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 587,180 contracts in the data reported through Tuesday, April 21st. This was a weekly jump of 76,511 net contracts from the previous week which had a total of 510,669 net contracts.

The week’s net position was the result of the gross bullish position (longs) increasing by 35,774 contracts (to a weekly total of 736,248 contracts) while the gross bearish position (shorts) dropped by -40,737 contracts for the week (to a total of 149,068 contracts).

Crude oil speculators piled into bullish bets on Tuesday following a historic day on Monday where the May crude contract went into negative territory. The drop into a negative futures price was the first time on record for that to happen and came as a multitude of events have been effecting crude oil prices. This week marked the third straight week speculator bullish positions rose and they have now gained by a total of +152,072 contracts in just these past three weeks. The speculator position rises bring the overall net level to the most bullish position since August 7th of 2018 when the net position was a total of +608,927 contracts.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -592,582 contracts on the week. This was a weekly drop of -37,753 contracts from the total net of -554,829 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $11.57 which was a loss of $-8.54 from the previous close of $20.11, according to unofficial market data.