WTI Crude Oil Non-Commercial Speculator Positions:

Large energy speculators lifted their bullish net positions in the WTI Crude Oil futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

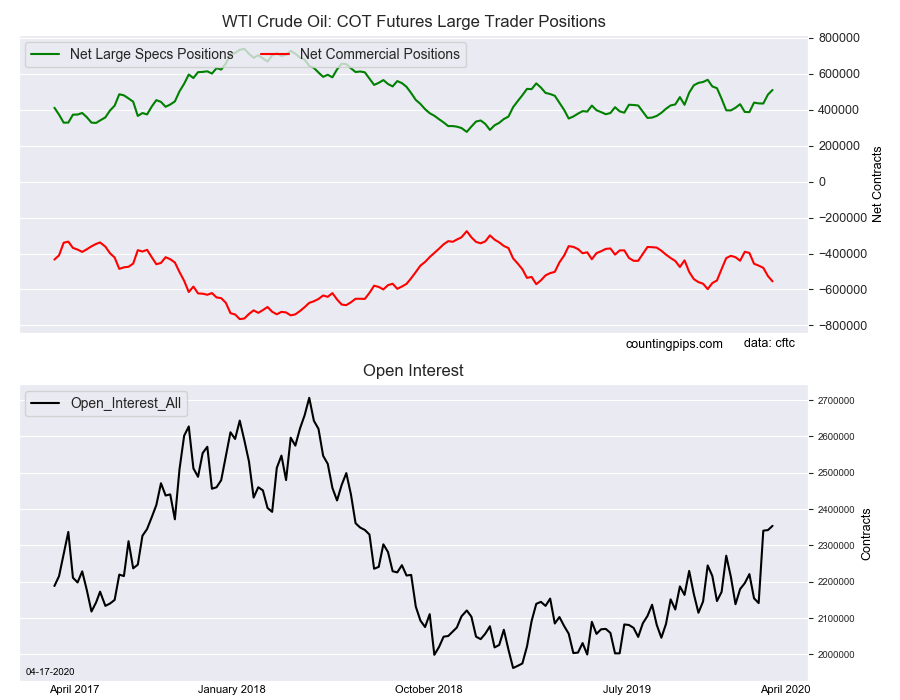

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 510,669 contracts in the data reported through Tuesday, April 14th. This was a weekly advance of 25,774 net contracts from the previous week which had a total of 484,895 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 44,703 contracts (to a weekly total of 700,474 contracts) while the gross bearish position (shorts) rose by a lesser amount of 18,929 contracts for the week (to a total of 189,805 contracts).

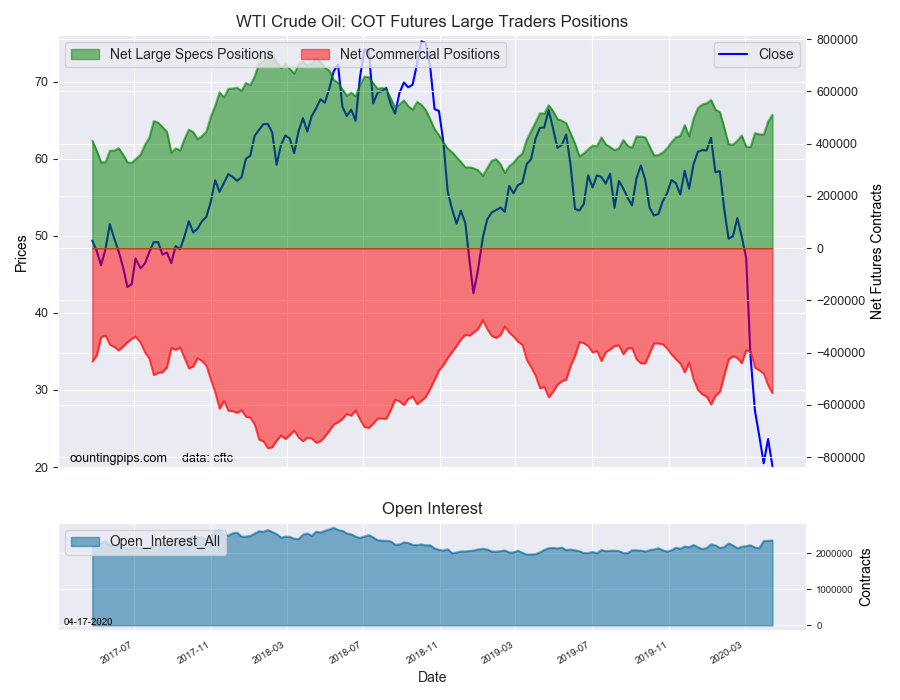

Oil speculative positions once again saw a strong gain this week by over +25,000 contracts following a jump by +49,787 contracts last week. These rises in bullish bets have pushed the overall standing to the highest level in twelve weeks at a total of +510,669 contracts. Despite this positive spec sentiment, the oil price dropped this week to the lowest level in 18 years at under $18 per barrel as concerns of oversupply and lack of demand overshadowed a historic oil production cut by OPEC and other countries.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -554,829 contracts on the week. This was a weekly fall of -29,782 contracts from the total net of -525,047 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $20.11 which was a fall of $-3.52 from the previous close of $23.63, according to unofficial market data.