WTI Crude Oil Non-Commercial Speculator Positions:

Large energy speculators boosted their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

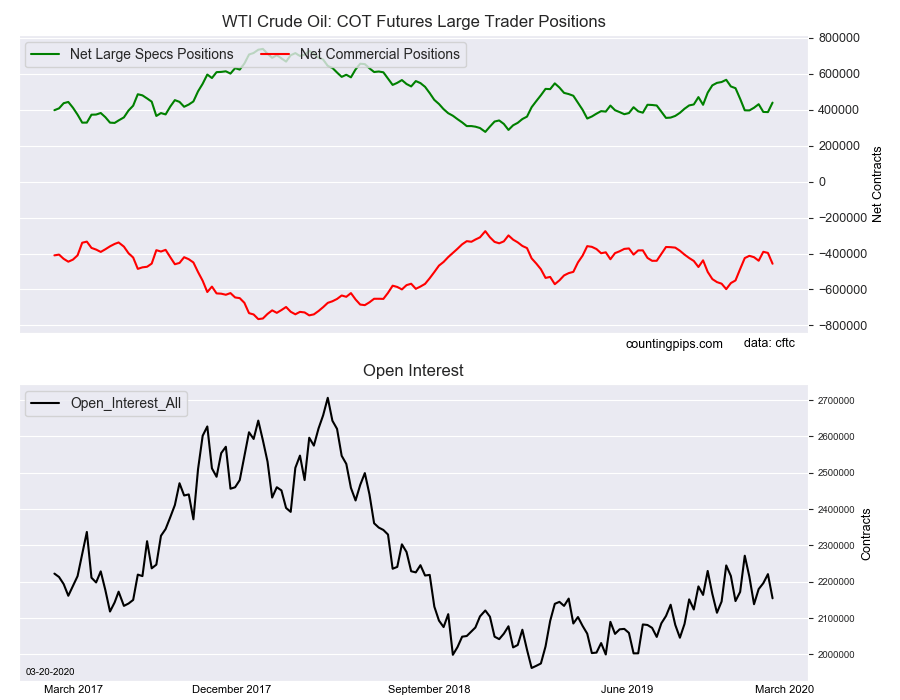

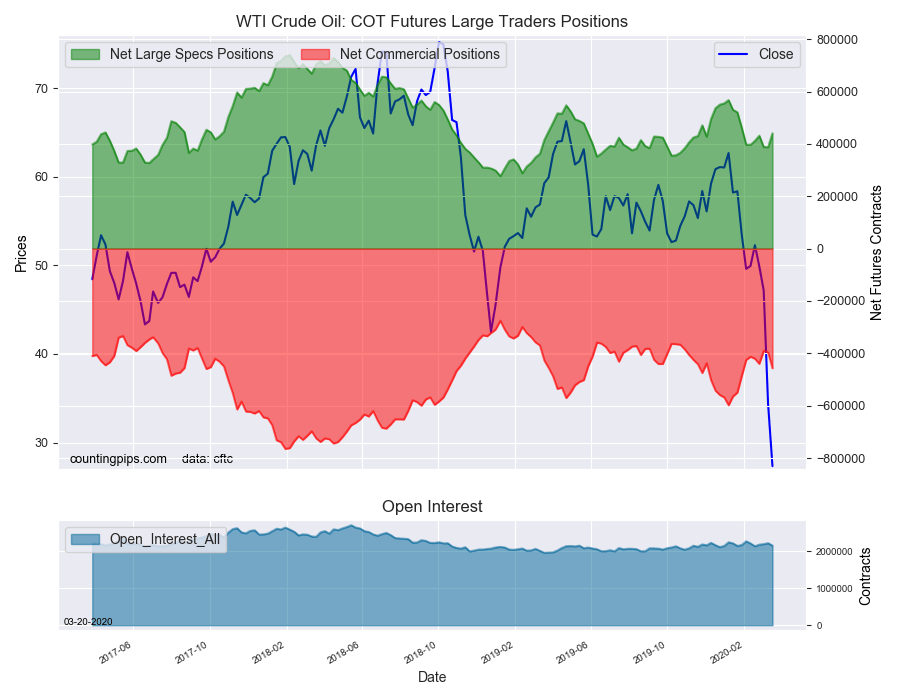

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 440,237 contracts in the data reported through Tuesday, March 17th. This was a weekly change of 52,840 net contracts from the previous week which had a total of 387,397 net contracts.

The week’s net position was the result of the gross bullish position (longs) lowering by -14,748 contracts (to a weekly total of 572,819 contracts) while the gross bearish position (shorts) decreased by -67,588 contracts for the week (to a total of 132,582 contracts).

Crude speculators sharply raised their bets this week following two straight down weeks. Speculative positions have overall been on the decline in recent months as bullish bets have fallen from a total of +567,272 contracts on January 7th to as low as +387,397 contracts on March 10th. The Saudi-Russian oil price war as well as the COVID-19 outbreak has pushed the price of WTI crude to its lowest standing since 2001 and closed out the week just above the $22 price level.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -456,598 contracts on the week. This was a weekly decline of -60,216 contracts from the total net of -396,382 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $27.33 which was a shortfall of $-7.03 from the previous close of $34.36, according to unofficial market data.