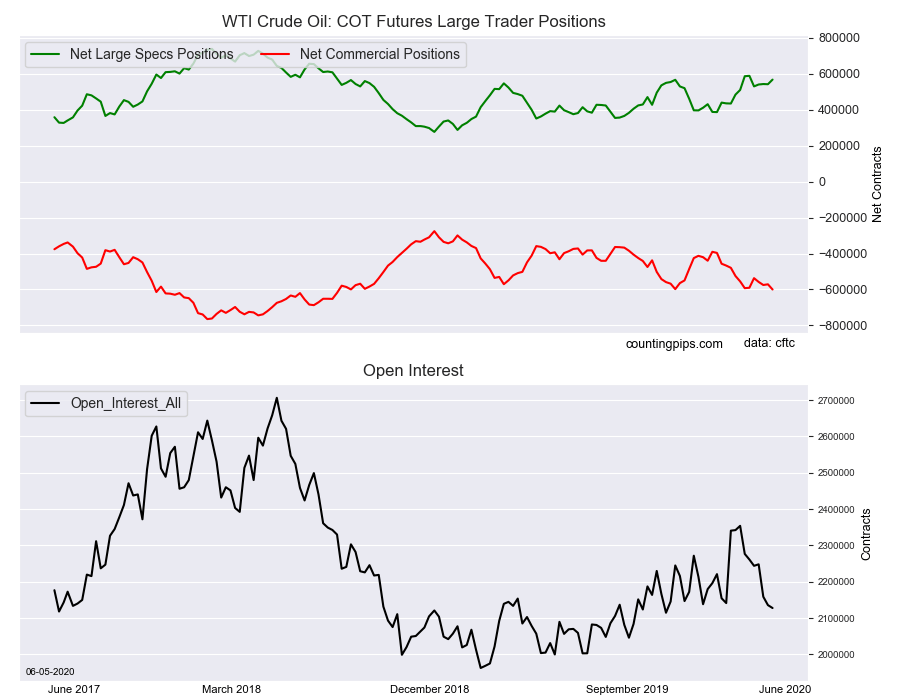

WTI Crude Oil Non-Commercial Speculator Positions:

Large energy speculators lifted their bullish net positions in the WTI Crude Oil futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 568,330 contracts in the data reported through Tuesday June 2nd. This was a weekly gain of 25,756 net contracts from the previous week which had a total of 542,574 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 27,938 contracts (to a weekly total of 729,172 contracts) while the gross bearish position (shorts) gain by 2,182 contracts for the week (to a total of 160,842 contracts).

Crude oil speculators boosted their bullish bets by the most in six weeks (+25,756 contracts) this week and pushed the net position higher for the seventh time in the past nine weeks. The current position (+568,330 contracts) is puts the net position at a five-week high. The overall speculator standing has remained above the +500,000 net contract level for an eighth consecutive week, marking the longest +500,000 contract streak since the last streak ended in October 2018.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -600,014 contracts on the week. This was a weekly fall of -28,874 contracts from the total net of -571,140 contracts reported the previous week.

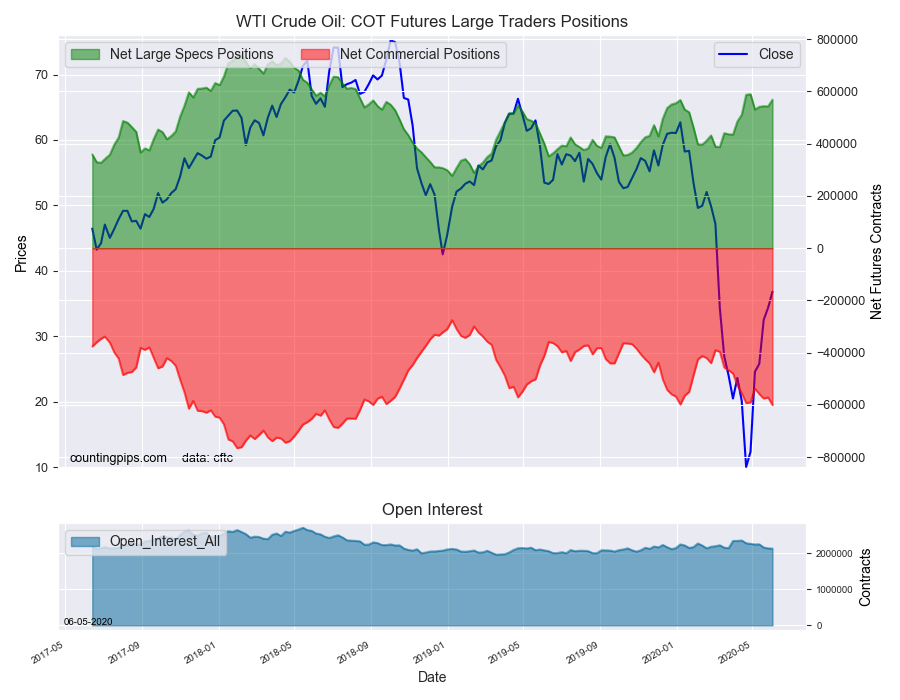

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $36.81 which was an increase of $2.46 from the previous close of $34.35, according to unofficial market data.