WTI Crude Oil Futures Sentiment: Updated Data Through: December 01 2020

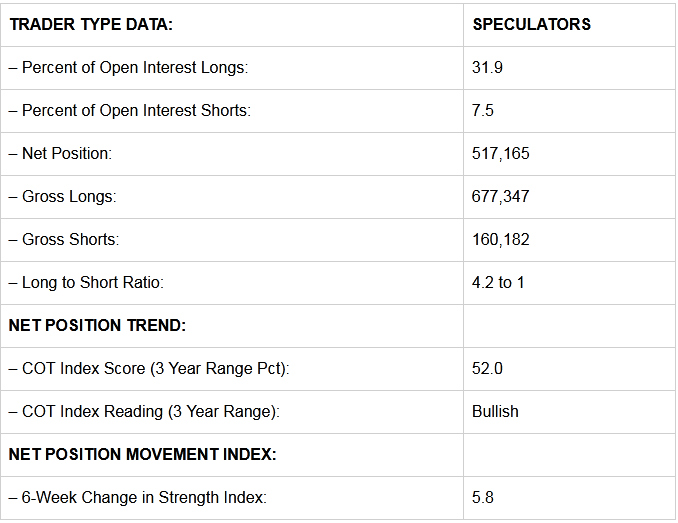

WTI Crude Oil Non-Commercial Speculator Positions:

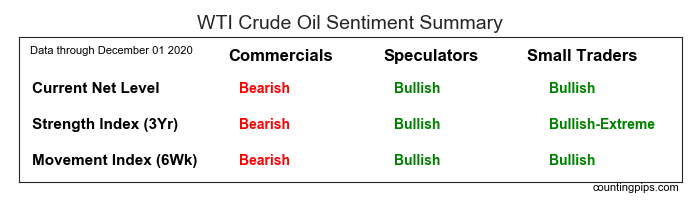

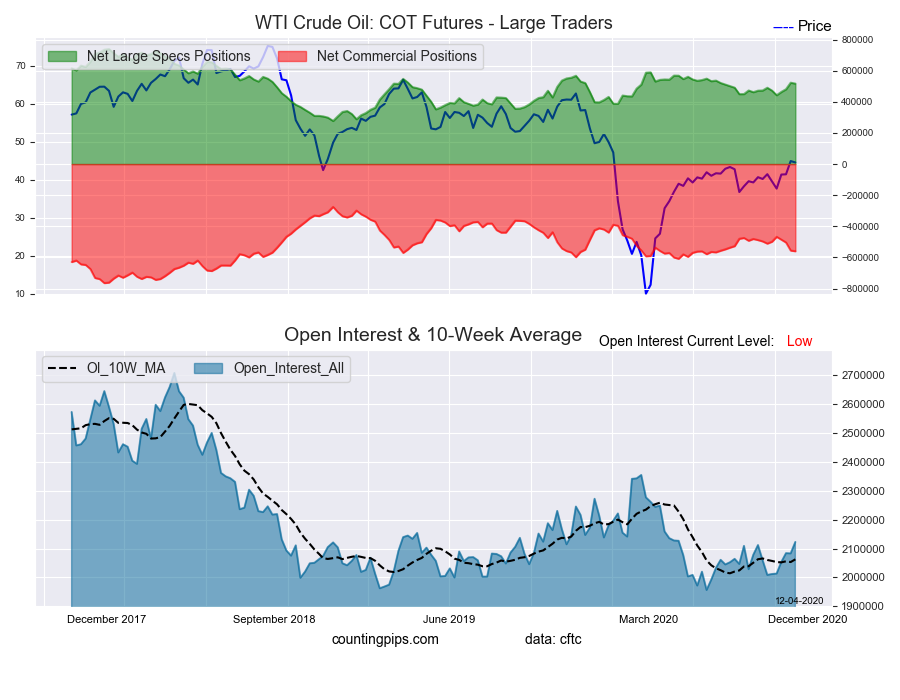

Large energy speculators cut back on their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 517,165 contracts in the data reported through December 1st. This was a weekly shortfall of -5,474 net contracts from the previous week which had a total of 522,639 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 4,190 contracts (to a weekly total of 677,347 contracts) while the gross bearish position (shorts) increased by 9,664 contracts for the week (to a total of 160,182 contracts).

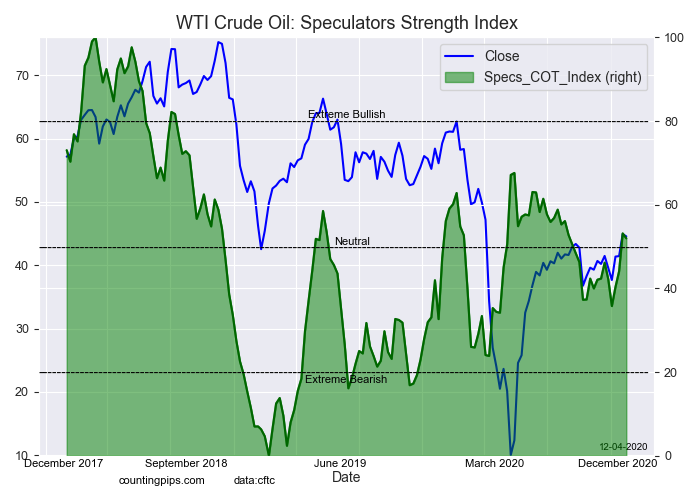

Crude oil speculators trimmed their bullish bets this week following a strong three-week run of rising bullish positions. Previously, bullish bets had jumped by a combined total of +80,179 contracts over the prior three weeks that pushed the net position back over the +500,000 contract level for the first time in twelve weeks and move the net position to the highest level in sixteen weeks. Despite this week’s slight decline, the net position remains above the +500,000 contract level for a second straight week at a total of +517,165 contracts.

The large speculators' Strength Index level, the current score for traders compared to levels of the past three years, shows that specs are currently at a Bullish level with a score of 52.0 percent.

Speculators are seen as trend followers and usually trade in tandem with the price direction (blue line in above chart). At the extreme levels, specs are very important to watch as they have a tendency to bet the wrong way (that the trend will continue to even more extreme levels).

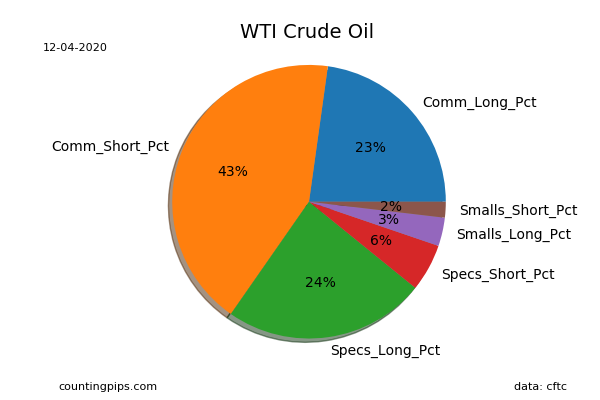

Current Trader Positions as Percent of Open Interest:

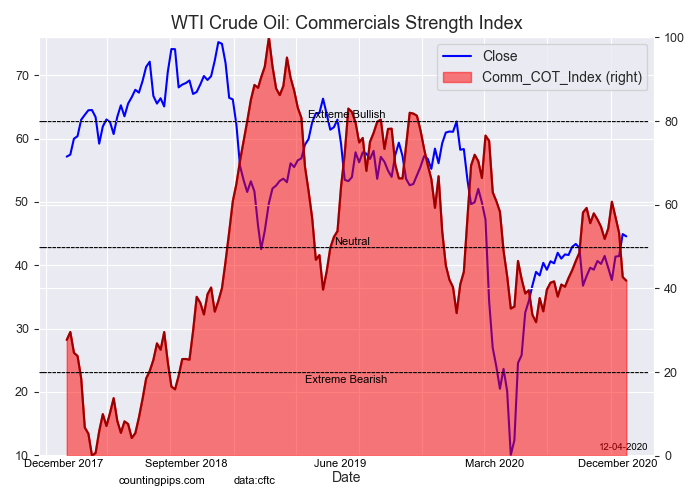

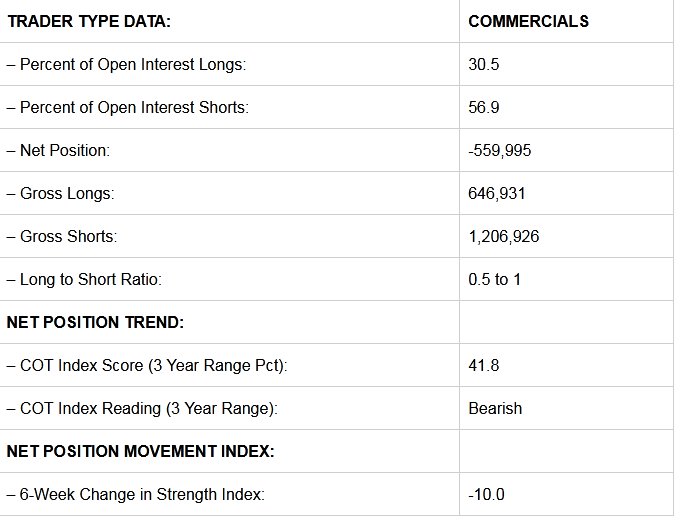

Commercial Trader Positions:

The commercial traders' position this week came in at a total net position of -559,995 contracts. This was a weekly change of -4,209 contracts from the total net of -555,786 contracts reported the previous week.

The commercials Strength Index level, a score that measures the contract levels of the past three years within a range of 0 to 100, shows that Commercials are currently at a Bearish level with a score of 41.8 percent.

At the extreme levels, commercials are very important to watch as they have a tendency to be correct at the major turning points in price trends.

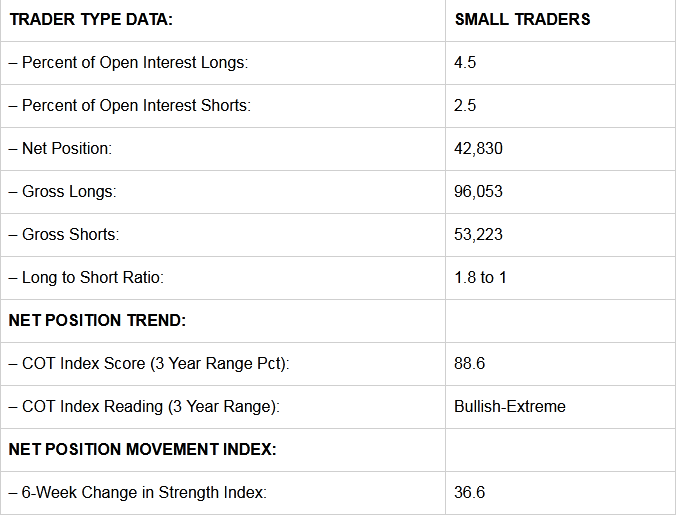

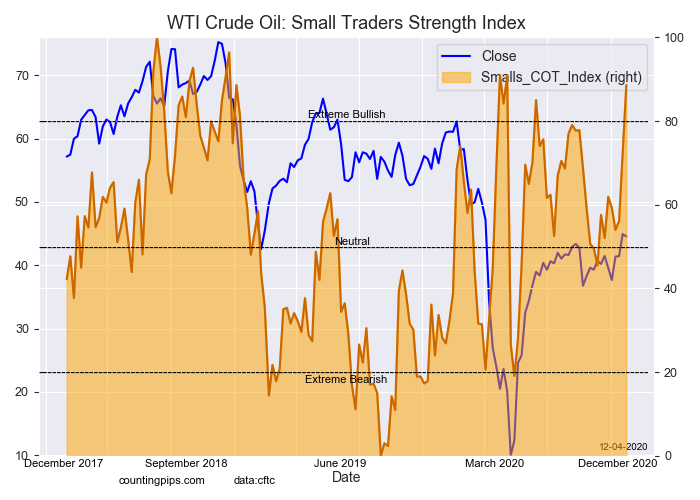

Small Trader Positions:

The small traders' position this week totaled a net position of 42,830 contracts. This was a weekly change of 9,683 contracts from the total net of 33,147 contracts reported the previous week.

The small traders' Strength Index level shows that smalls are currently at a Bullish-Extreme level with a score of 88.6 percent.

Small traders are less important to watch (in most cases) as their numbers tend to be just a small part of the total trading open interest.