WTI Crude Oil Non-Commercial Speculator Positions:

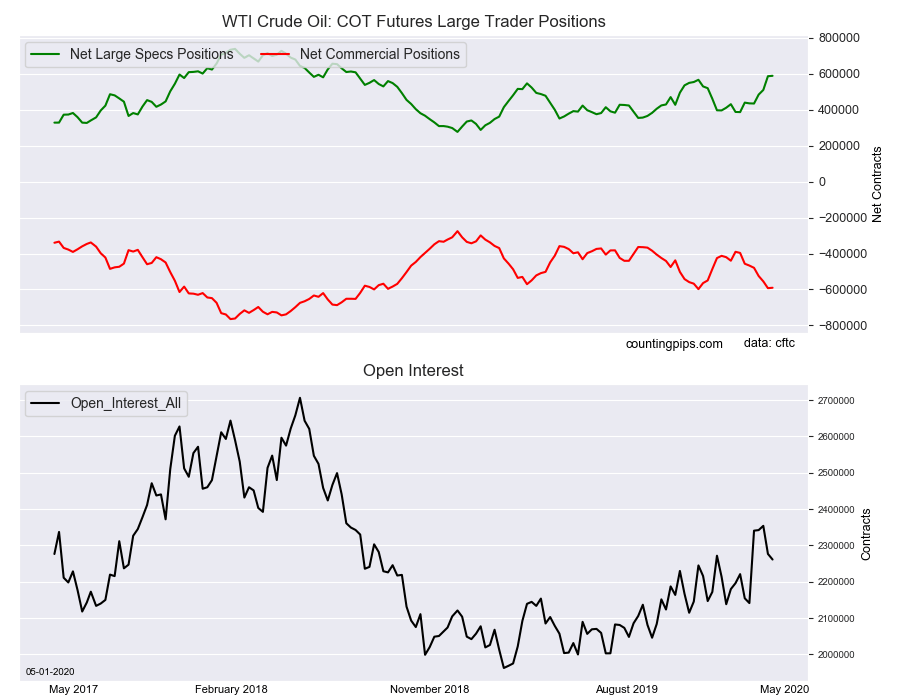

Large energy speculators lifted their bullish net positions in the WTI Crude Oil futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 589,388 contracts in the data reported through Tuesday April 28th. This was a weekly increase of 2,208 net contracts from the previous week which had a total of 587,180 net contracts.

The week’s net position was the result of the gross bullish position (longs) ascending by 1,530 contracts (to a weekly total of 737,778 contracts) while the gross bearish position (shorts) fell by -678 contracts for the week (to a total of 148,390 contracts).

WTI crude speculative net positions rose slightly this week following a large jump by over +75,000 contracts last week. The total number of bullish bets added in the past four weeks now totals +154,280 contracts. These gains have pushed the current bullish standing of +589,388 contracts to the highest level in ninety weeks, dating back to August 7th of 2018.

WTI Crude Oil Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -590,285 contracts on the week. This was a weekly boost of 2,297 contracts from the total net of -592,582 contracts reported the previous week.

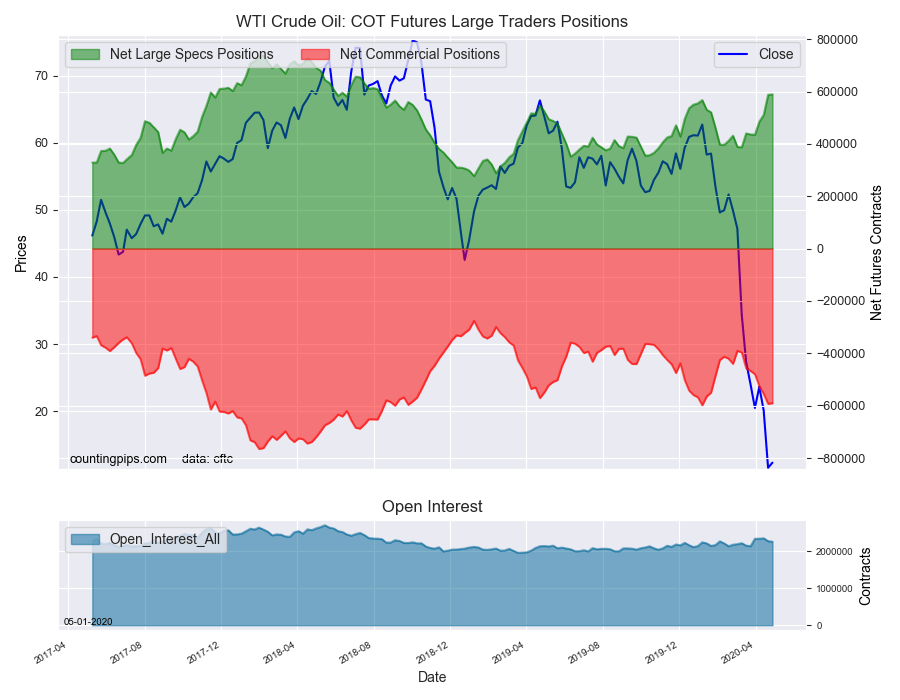

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $12.34 which was a boost of $0.77 from the previous close of $11.57, according to unofficial market data.