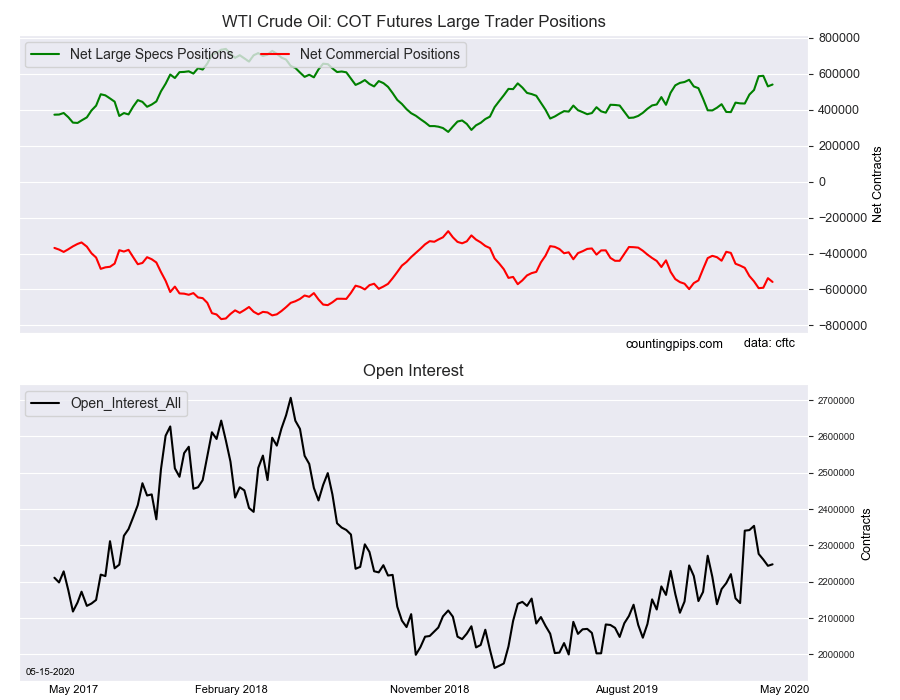

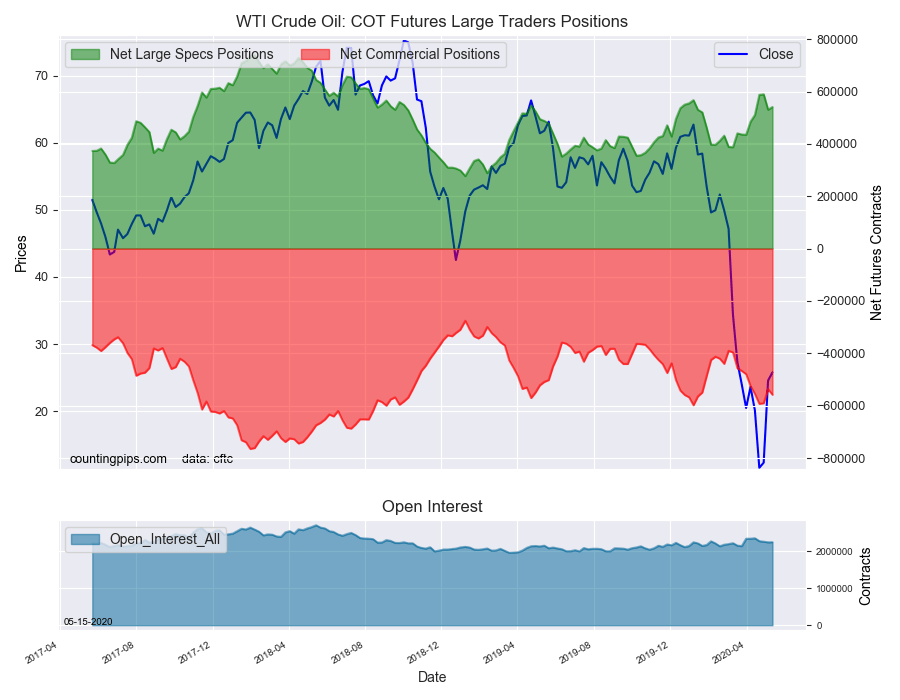

WTI Crude Oil Non-Commercial Speculator Positions:

Large energy speculators boosted their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 541,019 contracts in the data reported through Tuesday, May 12th. This was a weekly gain of 10,407 net contracts from the previous week which had a total of 530,612 net contracts.

The week’s net position was the result of the gross bullish position (longs) falling by -13,355 contracts (to a weekly total of 709,557 contracts) but were overcome by the gross bearish position (shorts) which fell by -23,762 contracts for the week (to a total of 168,538 contracts).

Crude oil speculative net positions bounced back this week following last week’s sharp decline of -58,778 contracts. The crude net position has risen in five out of the past six weeks and has added a total of +105,911 contracts to the bullish position in that time-frame. Overall, the current bullish standing is now over the +500,000 net contract level for the fifth consecutive week.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -557,971 contracts on the week. This was a weekly loss of -21,073 contracts from the total net of -536,898 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $25.78 which was an increase of $1.22 from the previous close of $24.56, according to unofficial market data.