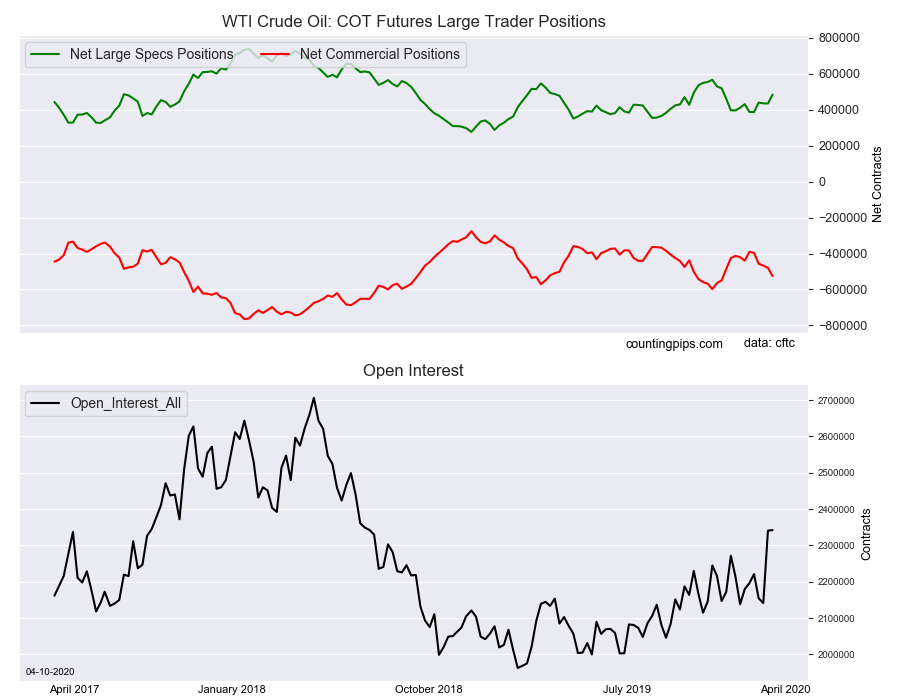

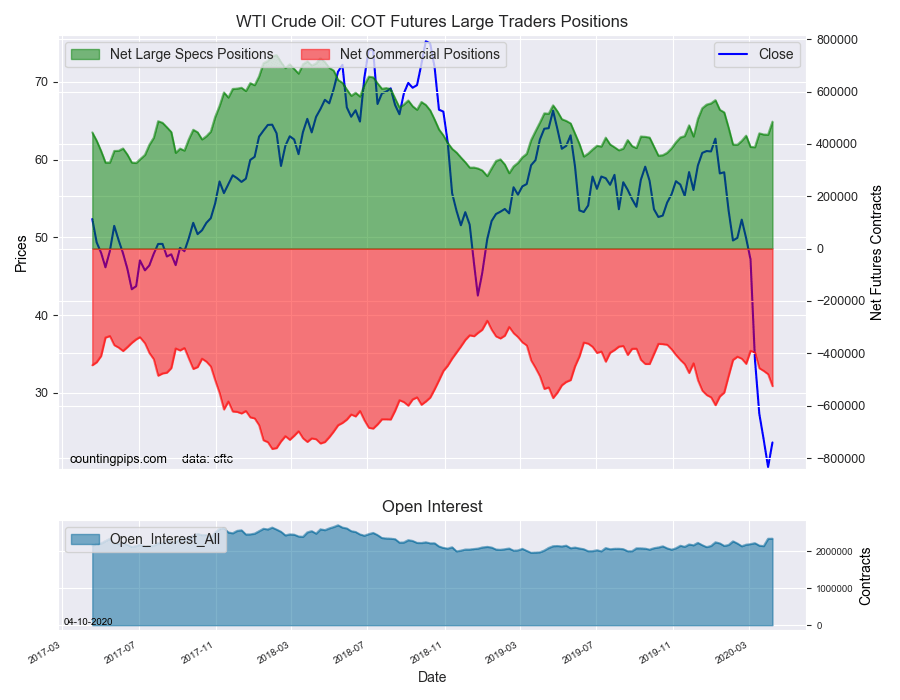

WTI Crude Oil Non-Commercial Speculator Positions:

Large energy speculators sharply increased their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 484,895 contracts in the data reported through Tuesday, April 7th. This was a weekly jump of 49,787 net contracts from the previous week which had a total of 435,108 net contracts.

The week’s net position was the result of the gross bullish position (longs) growing by 31,374 contracts (to a weekly total of 655,771 contracts) while the gross bearish position (shorts) fell by -18,413 contracts for the week (to a total of 170,876 contracts).

Crude oil speculators sharply raised their bullish bets to the highest level in eleven weeks this week. This week’s gain follows two weeks of declining bullish bets and pushed the overall bullish to the highest level since January 21st. The speculators have remained strongly bullish despite the setbacks in the oil price. The oil market has been sharply hit by a Saudi Arabia-Russian oil price war and by the lack of demand from an economic shutdown due the COVID-19 outbreak. The oil price may get some relief in the coming days as OPEC and other nations have been in talks for an oil production cut that would boost the price.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -525,047 contracts on the week. This was a weekly shortfall of -45,653 contracts from the total net of -479,394 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $23.63 which was an advance of $3.15 from the previous close of $20.48, according to unofficial market data.