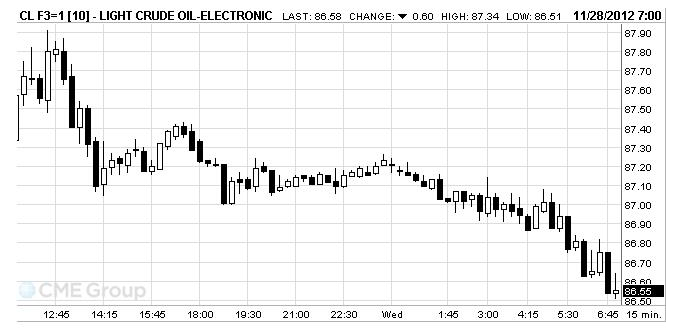

We are seeing a little more weakness this morning, but with the light volumes, it’s easy to push the market in a trending direction for a few minutes. We aren’t getting a lot of other signals to see this chart commit. So again, we turn to the numbers we already know.

We are already in a found range and we can return to resistance at 8742, 8853, and 8913. The support numbers come along at 8650, 8541 and 8436. The front spread is wallowing here in near the –70 area and we think that ahead of roll we might see more pressure to the –77 level before we see a bounce back to the –60 area. Flat price will continue its former climb today and could break 9000.

Techies, some Trekkies

- 200 Day MA 9404

- 100 Day MA 9084

- 13 Day MA 8675

- 8 Day MA 8742

- 14 Day RSI 50.84

We started lower on the 10-minute chart yesterday afternoon and the trend has been solid overnight. This will give us room to hit the support line in the 8640 area. We have room to rally up to the pivot in the 8700 area and then run up to channel resistance near the 8740 level. A rally past the 8820 number will help break the move and get us concentrating on trade above 9000. That gets us to the 60-minute chart which will break the first range support number at 8620 and look then to 8500-8480.

By Carl Larry

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

WTI Crude Oil Showing Weakness, Support 86.50, 85.41

Published 11/29/2012, 12:46 AM

WTI Crude Oil Showing Weakness, Support 86.50, 85.41

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.