What are the macroeconomic, geopolitical and technical factors driving oil prices this week?

Despite Saudi-led OPEC+ output cuts, black gold has walked down the stairs to re-explore the lower floor after progressing in their July-August range between $85 and $100.

Macroeconomics

On the macroeconomic view, the greenback explored a new roof as the US Dollar Index marched just above $110 at the beginning of the week—still regularly progressing within its yearly regression channel with a Pearson’s R (correlation coefficient) of 97 %.

Fundamental Analysis

On Monday, Saudi-leaded OPEC+ members agreed to a small production cut of 100,000 barrels per day from October onwards to bolster prices. The key to this decision is also the possible return of Iran to the market if the economic sanctions are lifted. Indeed, Iran could add up to 1 million bpd to the market even though President Joe Biden told Israeli Prime Minister Yair Lapid during their meeting a week ago that an Iranian nuclear deal was out of the question in the short-term.

It seems that the risk of losing Russian energy supplies is no longer enough to support prices, as traders are focused on demand. In addition, poor Chinese trade figures have recently been published, with a sharp slowdown in export growth, to 7.1% year on year in August (compared to 18% in July). On oil more specifically, Chinese crude imports are down 4.7% since the start of the year compared to the same period in 2021, and imports of refined products have shrunk by 15.9%. Added to this is the new wave of health restrictions, which now affect several hundred million Chinese, to stem a new wave of COVID-19 cases with very strict policies.

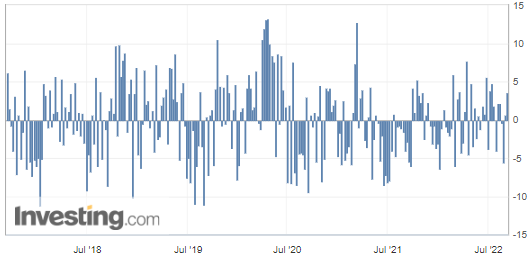

U.S. API Weekly Crude Oil Stock

On Wednesday, the American Petroleum Institute (API) released the weekly change in crude oil stock. During the week ended September 4, oil inventory levels were build to an excess of 3.645M barrels, while analysts were anticipating a very light decline.

![]()

(Source: Investing.com)

Geopolitics

Russian President Vladimir Putin uses oil and gas as an economic weapon, but the market, rather than worrying about its effect on supply, has turned its attention to the effect on weakening demand at high energy prices. Moreover, on Wednesday, the Russian head of state warned that Russia would no longer deliver oil or gas to countries that would cap the prices of hydrocarbons exported by Moscow since the G7-group and the European Union have prepared projects ranging in this direction.

Russian Energy Minister Nikolai Shulginov said on Tuesday morning at the Eastern Economic Forum in Vladivostok:

“Russia will respond to price caps on Russian oil by shipping more oil to Asia. Russia and partners are considering setting up their own insurer to facilitate oil trade.

Nothing has been decided on Nord Stream 1 gas pipeline resumption.”

These comments expressed by Nikolai Shulginov came just a few days after members of the G7-group agreed last Friday to impose a price cap on Russian oil in a bid to hit Moscow's ability to finance the war in Ukraine.

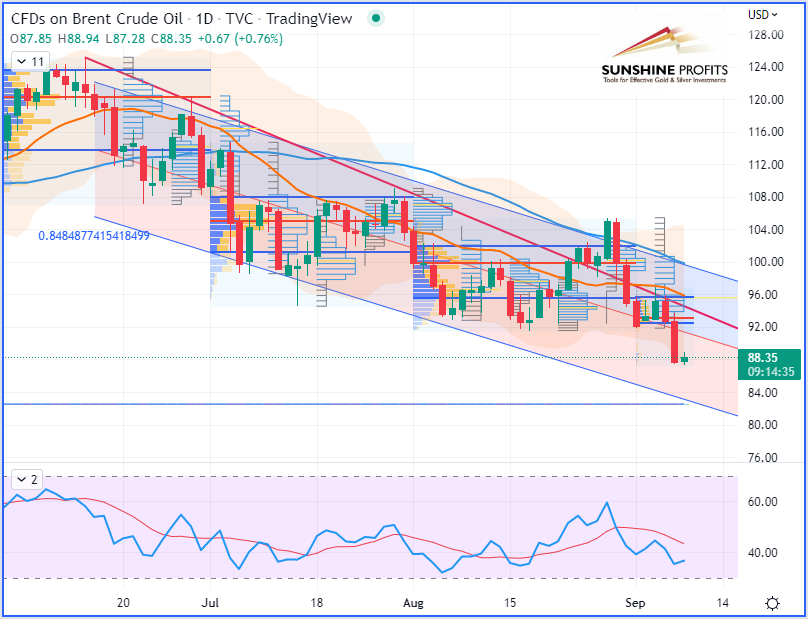

Technical Analysis

On the daily chart, WTI crude oil (October contract) has just broken below its 10-week support and is moving towards the lower band of the regression channel (which was set with two standard deviations from the mean regression line).

* * * * *

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.