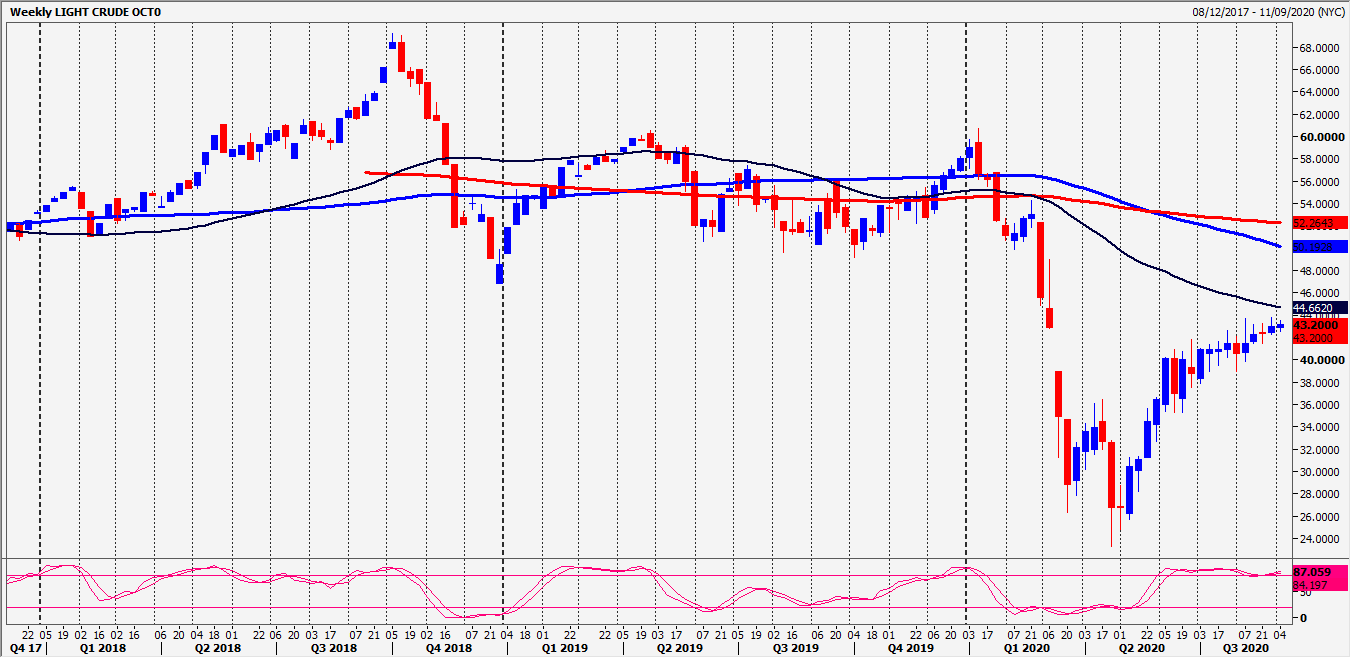

WTI Crude November Future recovered all of the previous week’s losses last week. Yesterday we recovered all of Monday’s losses. I cannot see a pattern or trend to follow—other than a clear volatile sideways trend, which makes swing trading almost impossible of course.

For 5 weeks we have been bouncing around in a 5 point range of 3660–4140/70. Down 1 week & up the next. Shorts at 3950/70 were stopped above 3990 but we topped exactly at the next target & minor resistance at 4020/40.

Today’s Analysis

WTI Crude levels are still relevant but if you find yourself with a profitable position I suggest you take it quickly! We held minor resistance at 4020/40 as expected yesterday but with little opportunity for much profit as we only drifted lower to 4000/3990. A break higher today meets strong resistance at 4100/20. Obviously bulls need a break above last week’s high at 4147 for a breakout buy signal.

First support at 3970/50. A break lower targets minor support at 3910/00 which held the downside so far this week. A break lower this time targets 3860/40. On further losses look for 3770/60.

Trends

- Weekly Outlook Neutral

- Daily Outlook Neutral

- Short Term Outlook Neutral