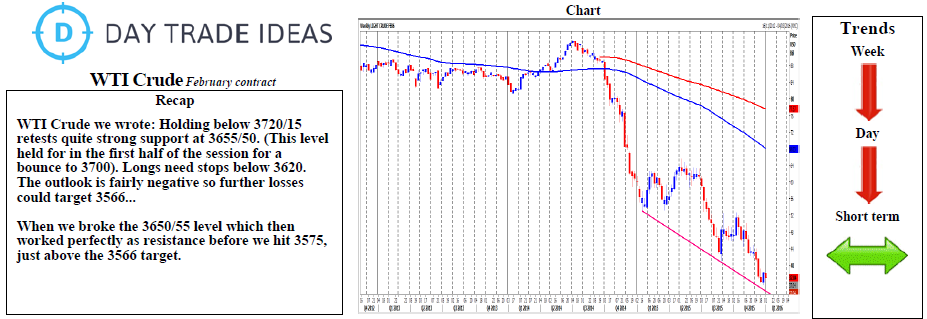

WTI Crude now oversold short term with first resistance at 3635/39 but above here targets resistance at 3675/80. We should struggle here today but if we continue higher look for a selling opportunity at 3700/05. Shorts need stops above 3740. Just be aware that a break higher could target 3780/85.

We are travelling mostly sideways to lower over the past 2 weeks. Failure to beat first resistance at 3635/39 targets 3605 then 3575. If we continue lower today look for 3566 before the February contract low for the bear trend at 3535. This is obviously important, especially in oversold conditions but longs are still risky in the bear trend. A break lower however is obviously negative and targets 3510/05. If we continue lower look for 3465/60 then important trend line support at 3405/00.