A second large inventory build in two weeks, reported by EIA on Wednesday, has seen the oil rally stutter just as it was getting going.

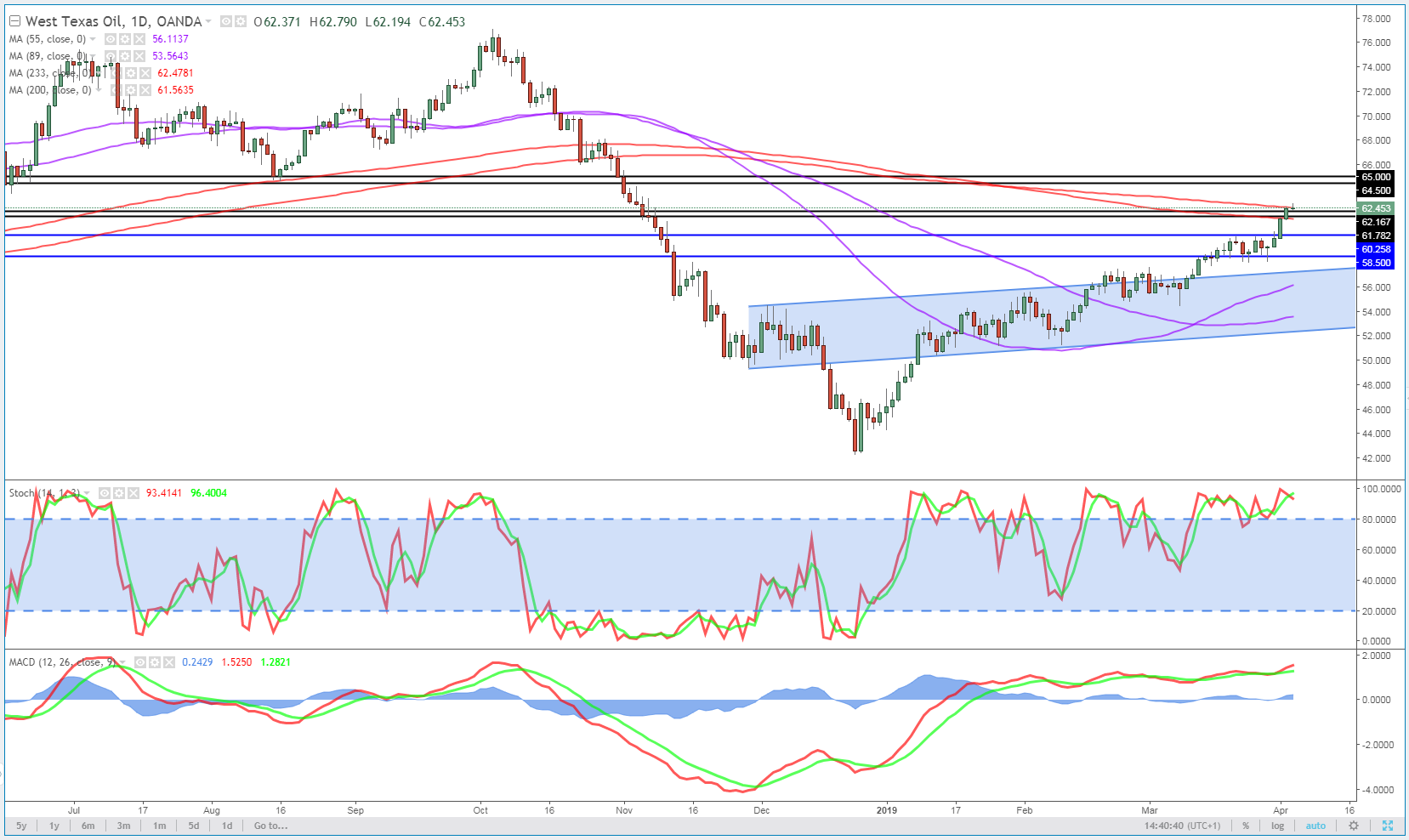

A breakthrough an important resistance zone last week appeared to be a catalyst for another pop higher in WTI. The price jumped from around $63 to $65 in just a couple of days. However, we are already seeing consolidation around these levels and momentum appears to have waned.

WTI Crude Daily Chart

OANDA fxTrade Advanced Charting Platform

The rise in inventories accompanied new economic projections by the IMF which highlighted slowing growth around the world and numerous risks to the economy. Reports that Russia may be contemplating raising production and refusing to partake in OPEC+ cuts beyond the current June deadline may also have contributed to oil quickly losing its appeal.

EIA Crude Oil Inventories

There remain numerous supportive factors for oil prices though, with clashes in Libya drawing much attention despite current production being uninterrupted. Above $65, the $67-68 has previously been a major area of support and resistance so we may not have to wait long for the rally to once again run into difficulty if of course, it finds its mojo again.