WTI stands near a 5-month high and, whilst there are near-term signs of exhaustion, market positioning, technicals and seasonality suggest further gains could eventually unfold.

Ultimately, large speculators are loading up on longs and reducing short exposure, heading into what is typically WTI’s best month of the year. That said, my colleague, Fawad outlined that there could be fundamental reasons for limited upside and this is certainly something to consider if price action turns suddenly against the tide. But, for now, we’ll look at some supporting features of this otherwise unblemished bullish trend.

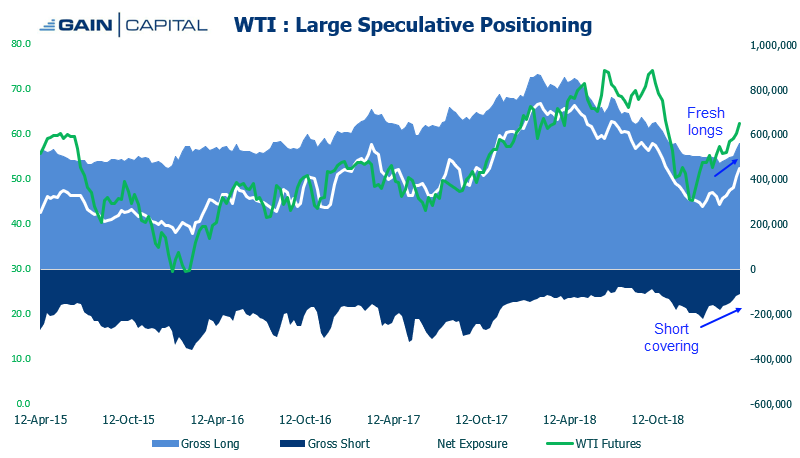

Net-long exposure for WTI has hit a 5-month high. Short-covering began around the middle of January and steadily decreased to place gross shorts at their lowest level since October. Furthermore, long positions began to pick up at the end of February and are also at their highest level since October. Overall, this is exactly what we want to see with a healthy trend as it progresses.

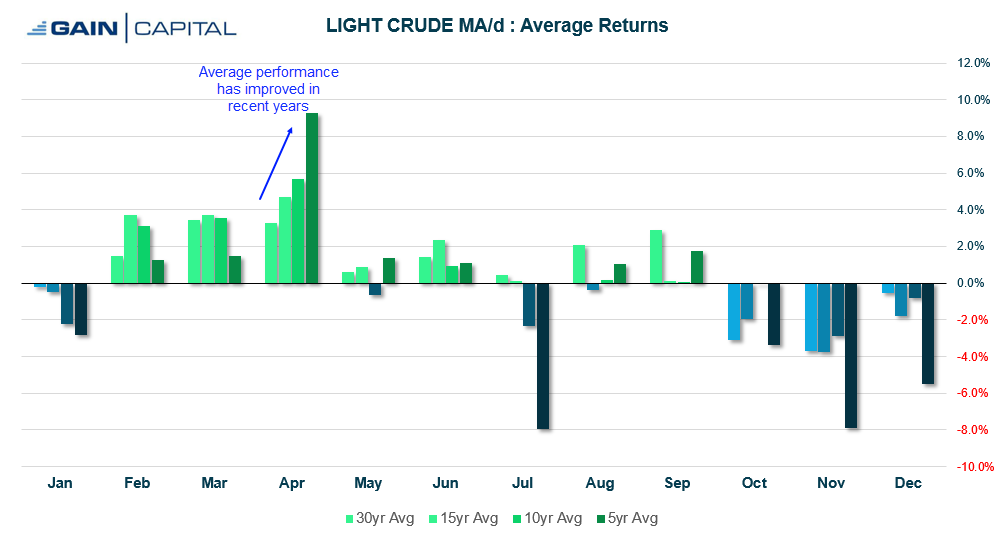

Seasonality could also favor WTI in April. April as typically seen stronger returns throughout April. Of course, whilst average returns or seasonal tendencies do not predict the future, they do show a pattern which we hope to be repeated in the future. Placed alongside favorable positioning from large speculators, we hope to gain further confidence in the underlying technical patterns.

WTI performance in April (30-Year Average)

- April tends to be WTI’s best month of the year

- Closed positive 67.3% of the time

- Averaged a positive return of 8.2%

- Averaged a negative return of -4.7%

- Average returns have increased in recent years (according to 30, 15, 10 and 5 year averages)

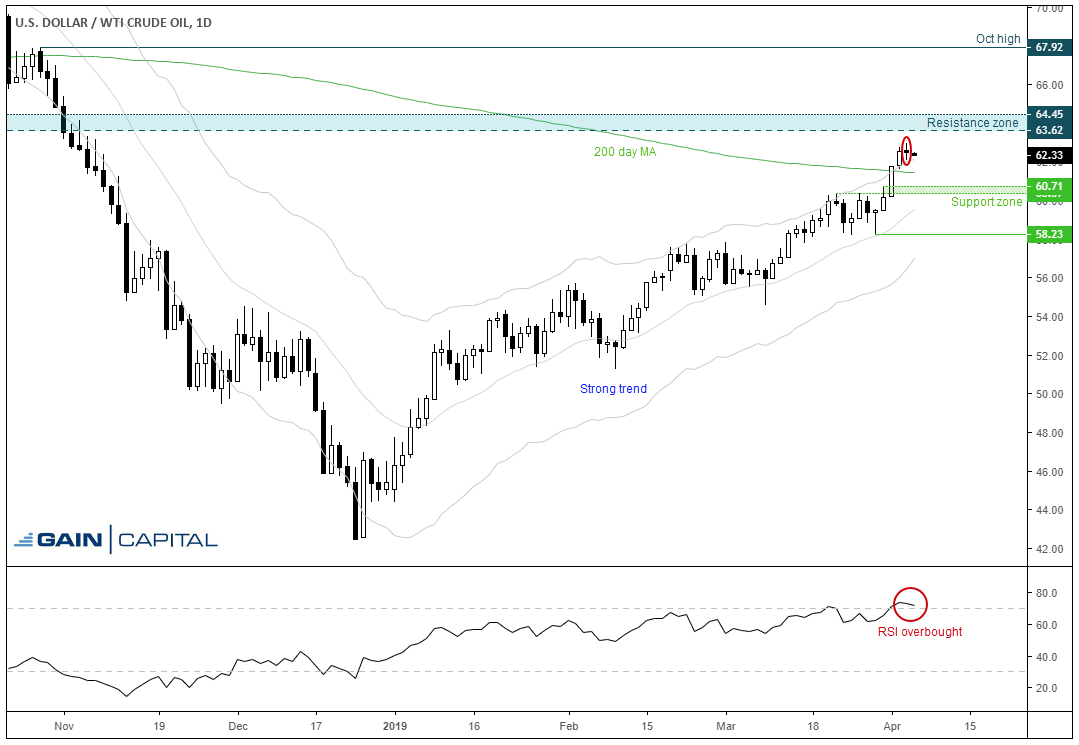

Technically, the trend remains strong although perhaps a little stretched over the near-term. The series of higher highs and lows, interconnected with shallow pull-backs underscores the strength of the trend structure. Prices have broken above the 200-day average on its first attempt (which is no mean feat) although there are signs of exhaustion around current levels. Yesterday’s spinning top reversal traded outside of the upper Keltner band and RSI is overbought. We don’t consider these as detrimental to the trend, but they do raise the odds of a pause, or retracement.

Look for support above the 60.37/71 zone. A retracement towards these levels improves the potential reward to risk ratio. We may even find the 200-day average provide support, although it isn’t uncommon to see prices oscillate around the 200-day average before the next significant move.

A break above 63.62-64.45 opens-up the October high at 67.92. However, we’d expect an initial price reaction around the June high/August lows, making them an interim target.

The trend remains bullish above 58.23. However, if the deeper retracement occurs, the closer we come to retesting these levels the less appealing the trend structure becomes. Ideally, we want to see shallow pullbacks to show bulls remain dominant, and for it to spend a better chance of breaking above the near-by resistance zone. Therefore, a pullback towards 60.37/71 would be preferable before its next leg higher.