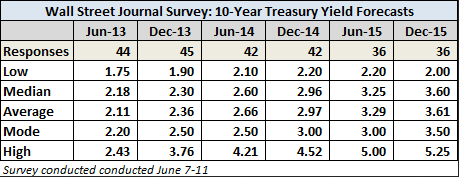

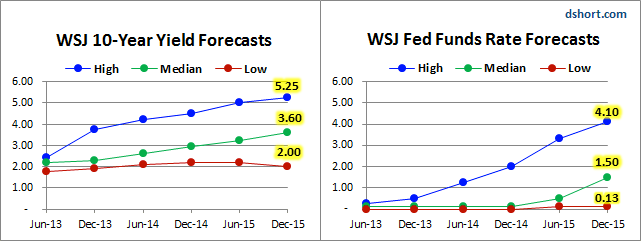

In advance of today's FOMC meeting outcome and Chairman Bernanke's press conference, let's take a quick look at a couple of items in the latest Wall Street Journal survey of economists -- this one conducted June 7-11. With the recent controversy over the direction of Treasury yields, a key issue addressed in the survey is where economists expect the 10-year yield to be across six timeframes: mid-year and year end 2013 through 2015.

The survey was sent to 52 economists, 46 of whom responded and of the 46, some skipped individual survey questions. Here is a table showing the major response statistics: Low, Median (middle), Average (aka Mean), Mode (most frequent) and High.

As we readily see from the table, the responses for mid-year 2013 fit a rather narrow range, with the median and mode about where the yield has been hovering over the past few days.

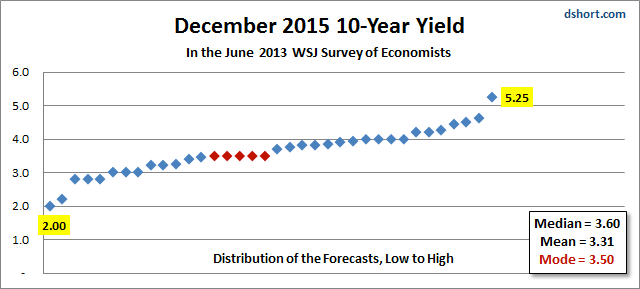

But more interesting is where the economists see 10-year yields at the end of 2015. The spread is substantial, ranging from about where we are today to a high of 5.25%. Note, however, that the median, mean and mode are fall into a narrow range from 3.5% to 3.61%.

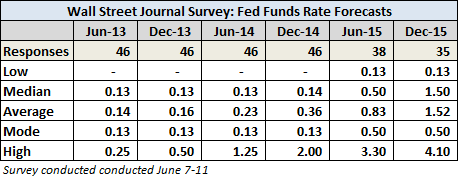

Of course, a key driver for yield expectations is what the Fed is doing with the Fed Funds Rate. The current set rate is 0-0.25 percent with the latest effective rate of late hovering around 0.09.

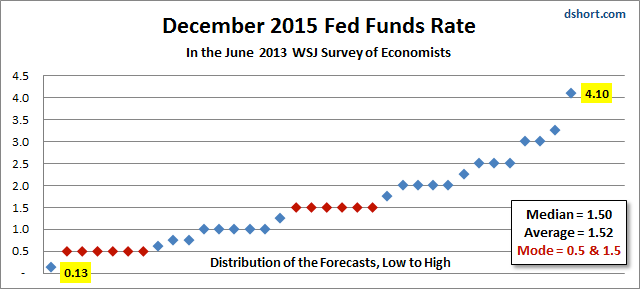

Here's a closer look at the array of opinions for the end of 2015. Note the full percentage point spread between the two modes.

Here is a side-by-side showing the high, low and median for the 10-year yield and FFR (Note that I've kept the same vertical 0%-to-6% vertical axis).

Market volatility has increased of late on conflicting signals from FOMC voting members and other Federal Reserve Bank presidents. Will today's news from the FOMC and Bernanke's press conference clear up confusion? Stay tuned!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

WSJ's Survey On 10-Year Yields And FFR

Published 06/19/2013, 01:15 PM

Updated 07/09/2023, 06:31 AM

WSJ's Survey On 10-Year Yields And FFR

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.