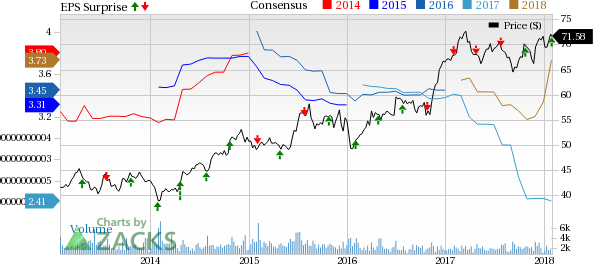

W.R. Berkley Corporation’s (NYSE:WRB) fourth-quarter 2017 operating income of 76 cents per share beat the Zacks Consensus Estimate of 73 cents by 4.1%. However, the bottom line deteriorated 7.3% year over year.

The company witnessed lower revenues attributable to lower premiums as well as net investment income. However, expenses slightly declined in the reported quarter.

Including realized pretax gains of 45 cents per share, net income inched up 0.8% from the year-ago quarter to $1.21.

Full-Year Highlights

For 2017, W.R. Berkley reported operating income per share of $4.26, having declined 8.9% year over year.

Total operating revenues of $6.9 billion nudged up 0.4% year over year.

Behind the Headlines

W.R. Berkley’s net premiums written for the quarter were $1.5 billion, down 2.1% year over year. Lower premiums written at both the Insurance and Reinsurance segments resulted in the downside.

Operating revenues came in at $1.8 billion, down 1.9% year over year, mainly due to lower net premiums earned and a fall in net investment income. However, the top line beat the Zacks Consensus Estimate by 1.4%.

Investment income declined 6.4% year over year to $149.2 million.

Total expenses dipped 0.3% to $1.7 billion, primarily on lower losses and loss expenses plus other operating costs and expenses.

Catastrophe loss totaled $18 million in the quarter, including $8 million related to the California wildfires. Consolidated combined ratio (a measure of underwriting profitability) came in at 94.9%, which remained flat year over year.

Segment Details

Net premiums written in the Insurance segment slid 0.4% year over year to $1.4 billion in the quarter. This decrease was attributable to lower premiums written under other liability, short-tail lines and professional liability. Combined ratio in this segment deteriorated 60 bps year over year to 94.4%.

Net premiums written in the Reinsurance segment decreased 17.3% year over year to $127.0 million due to substantially lower premiums written under property and casualty reinsurance. Combined ratio improved 330 bps to 100.2%.

Financial Update

W.R. Berkley exited the fourth quarter with total assets worth $24.3 billion, up 4.1% from the year-end 2016.

Book value per share rose 6.9% from the year-end 2016 to $44.53 as of Dec 31, 2017.

Cash flow from operations soared 55.1% year over year to $189.0 million.

The company’s return on equity deteriorated 100 bps to 12.3%.

Share Repurchase Update

The company bought back 0.3 million shares in the quarter for $19.4 million.

Zacks Rank

W.R. Berkley holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry having reported fourth-quarter earnings, the bottom line of Brown & Brown, Inc. (NYSE:BRO) , MGIC Investment Corporation (NYSE:MTG) and The Progressive Corporation (NYSE:PGR) beat the respective Zacks Consensus Estimate.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

MGIC Investment Corporation (MTG): Free Stock Analysis Report

W.R. Berkley Corporation (WRB): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research