Many of you probably recall the situation we had on November 8th of 2016 that had billions of people in a panic and genuinely worried about the future. No, I'm not talking about the election of Donald Trump. I'm talking about something that actually affected people's lives, the demonetization of India.

In the span of 50 days, citizens were asked to deposit all of their largest bank notes. Virtually overnight all 500 and 1000 Rs notes were made illegal. At the time, it was estimated by Prime Ministere Modi's team that about one third of all cash in the country would disappear.

They hypothesized that rich people with ill gotten gains who were hoarding massive amounts of undeclared cash would not dare to digitalize their fortunes and instead would be left with "worthless pieces of paper."

Well, that didn't exactly happen.

Of course the rich found ways to deposit their wealth. Many gave it to family members or brokers to deposit on their behalf, or they paid their workers for several months in advance. People with this type of money are much better at hiding it than the government is at finding it.

On the other hand, people who have little or no money were much more inconvenienced than the rich. Many of whom had to get by on much less for a long period of time, wait in ridiculously long lines at the bank, and some have even died due to the suddenness of the change.

In a report that came out yesterday the Reserve Bank of India estimated that 99% of all the newly illegal notes were indeed deposited into the Indian banking system.

Though this may be a big blow to Modi in the short term, this story is not yet over. Now that all the money is in digital form the government is working hard to process the data and find a few likely culprits. We can probably expect some arrests to be made in the coming weeks.

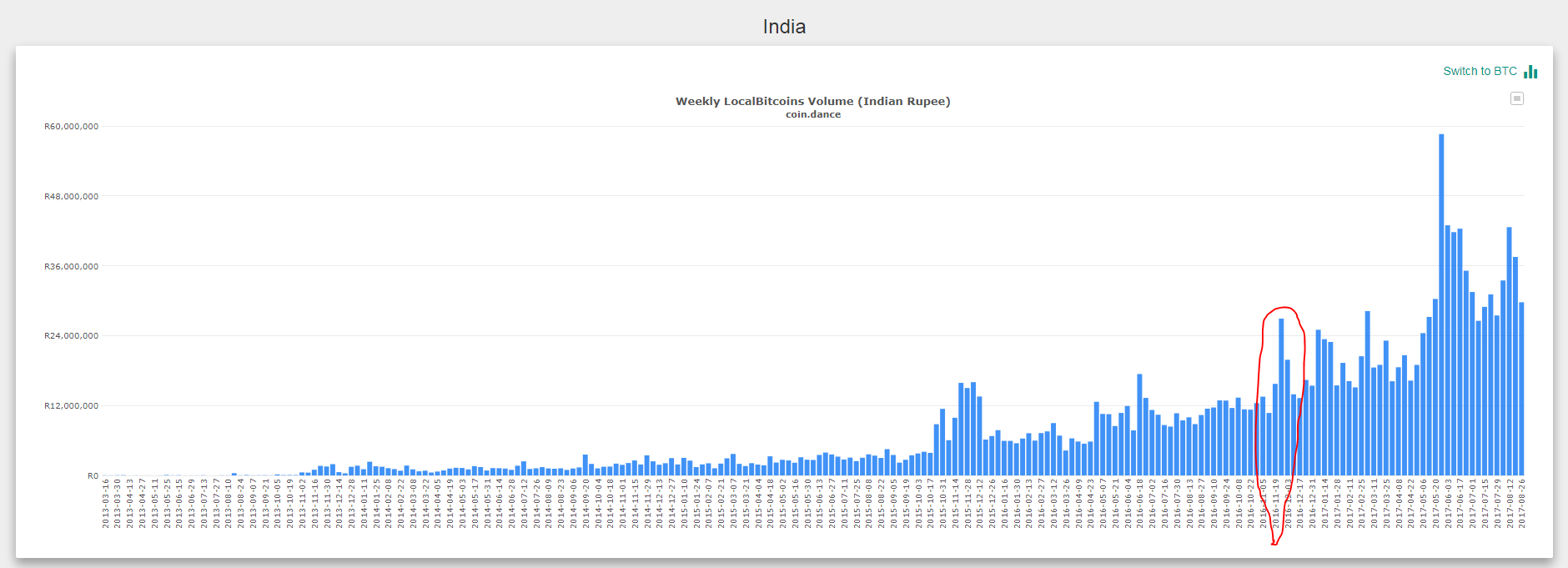

Meanwhile, this story has had a noticeable effect on Bitcoin trends. In November of last year (red circle) we can see a large spike in Indian Bitcoin volumes, which seems to have sparked a trend of higher transaction amounts there.

Today's Highlights

3% Growth in USA?

Macron to the Rescue

Market Moving Data

Please note: All data, figures & graphs are valid as of August 31st. All trading carries risk. Only risk capital you're prepared to lose.

Market Overview

Yesterday it was reported that the United States had grown a remarkable 3% in the second quarter of 2017.

Billionaire investor Warren Buffet has already commented on these figures saying that "this doesn't feel like a 3% economy.

In this interview with CNBC Uncle Warren pointed out some flaws in the way that they calculate the numbers and shared his intuition which says that we're probably growing at about 2% per year, which is still pretty good.

Stocks rose sharply in the United States and in Europe with the tech sector leading the way. Asian stocks do not seem to be enjoying the enthusiasm though and are down a bit on the day.

Party at the White House

This better than expected growth is in large part due to the confidence of investors and small business owners who feel that profits will rise sharply in the next few years once Trump is able to reduce the corporate taxes.

Speaking of which, the Tax Reform agenda that was released yesterday was a bit light on details. Still, the new plan is a step up from the last release that contained only a single piece of paper with several bullet points.

Indeed, this was more of a "rally the troops" speech than a detailed plan of action. At the end of the day, if the president really wants to paint a picture he will only be able to draw the broad strokes and leave the detailed work to Congress.

Redrawing Gold Lines

The price of gold dipped briefly to $1300 this morning before making a recovery. The precious yellow metal has been one of the best performing assets (with the exception of cryptocurrencies) since the beginning of the year.

Though we might be in for a slight pullback, the technicals are looking really strong after the recent surge in price.

In this graph, we can see the spike (blue circle) from the night of the US election. A sudden rise and subsequent fall as investors rushed to price in more aggressive monetary measures of the Trumpean era.

If we look at January 1st until today, we can see a very apparent ascending channel (yellow lines). The chanel was broken once to the upside and once to the down side but overall seems very consistent.

@euanmaca seems to agree and is predicting that we retest $1325 shortly. He's currently buying gold with 7.29% of his portfolio and has a Take Profit level of $1844.

What Else

Some fair numbers out of China this morning with the PMI inflation reading a bit better than expected. Later today we'll get some CPI numbers from Europe as well as bunch of other potentially market moving data from the economic calendar.

Tomorrow is the Non-farm Payrolls in the USA, which is always much anticipated, and usually has a fair amount of influence on market movements.

The Crypto market is also chugging along nicely. Over the last 24 hours, the value of all cryptos has gone up by more than $2 Billion despite a massive yet temporary pullback.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.