Worthington Industries, Inc. (NYSE:WOR) announced the addition of a new product, Type 3 Rail Mount compressed natural gas (CNG) fuel system, to its alternative fuel systems business. It is the lightest fuel system in the market comprising only five unique parts, offering parallel operating experience like diesel trucks.

According to Worthington, the product has been designed to increase payload and improve fuel economy, reducing fleet cost of ownership. Further, the system is built on the input from installers, truck OEMs and fleet owners which help to achieve both fuel economy and improve profitability.

The Type 3 cylinder provides protection to the driver in the event of any collision through superior impact durability. Truck OEM factory-installed steps along with the 27 inches width off of the rail frame helps to lower chances of clipping objects while taking turns.

The new fuel system will make its debut this month, as the company’s seven units roll out from its Salt Lake City facility to Arcadia, CA, and will join a fleet of trucks operated by Food Express, Inc., a for-hire transportation company.

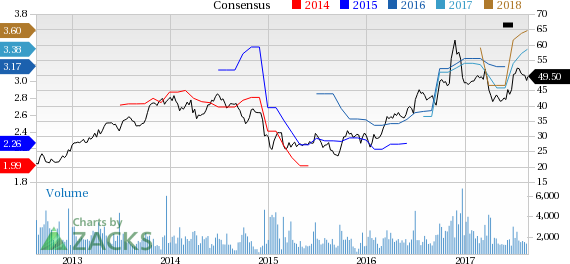

Shares of Worthington have moved up 14.2% in last three months, significantly outperforming the industry’s 3.3% growth.

Worthington reported net earnings of $56.5 million or 87 cents per share in fourth-quarter fiscal 2017 (ended May 31, 2017), lower than $58.5 million or 92 cents per share recorded a year ago. Earnings per share for the reported quarter beat the Zacks Consensus Estimate of 83 cents.

Revenues rose around 18.3% year over year to $845.3 million in the reported quarter. Sales also comfortably topped the Zacks Consensus Estimate of $786 million.

For the fiscal year ended May 31, the company logged a profit of $204.5 million or $3.15 per share, up from a profit of $143.7 million or $2.22 registered a year ago.

Sales for the full year increased roughly 7% year over year to $3 billion.

Worthington, in June 2017, acquired Amtrol, a leading producer of water system tanks and pressure cylinders for roughly $283 million. The acquisition combines the two leaders in the U.S. and European LP Gas business, adding well and water tank product lines to Worthington’s portfolio. The company expects the acquisition to provide momentum and growth in the Pressure Cylinders unit.

Worthington remains focused on improving business through its innovation, transformation in driving lean practices and strengthening competitive position in the markets which it serves.

Worthington currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Some other top-ranked stocks in the basic materials space are The Chemours Company (NYSE:CC) , POSCO (NYSE:PKX) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Chemours has expected long-term earnings growth rate of 15.5%.

POSCO has expected long-term earnings growth rate of 5%.

Kronos has expected long-term earnings growth rate of 5%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Worthington Industries, Inc. (WOR): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

Original post

Zacks Investment Research