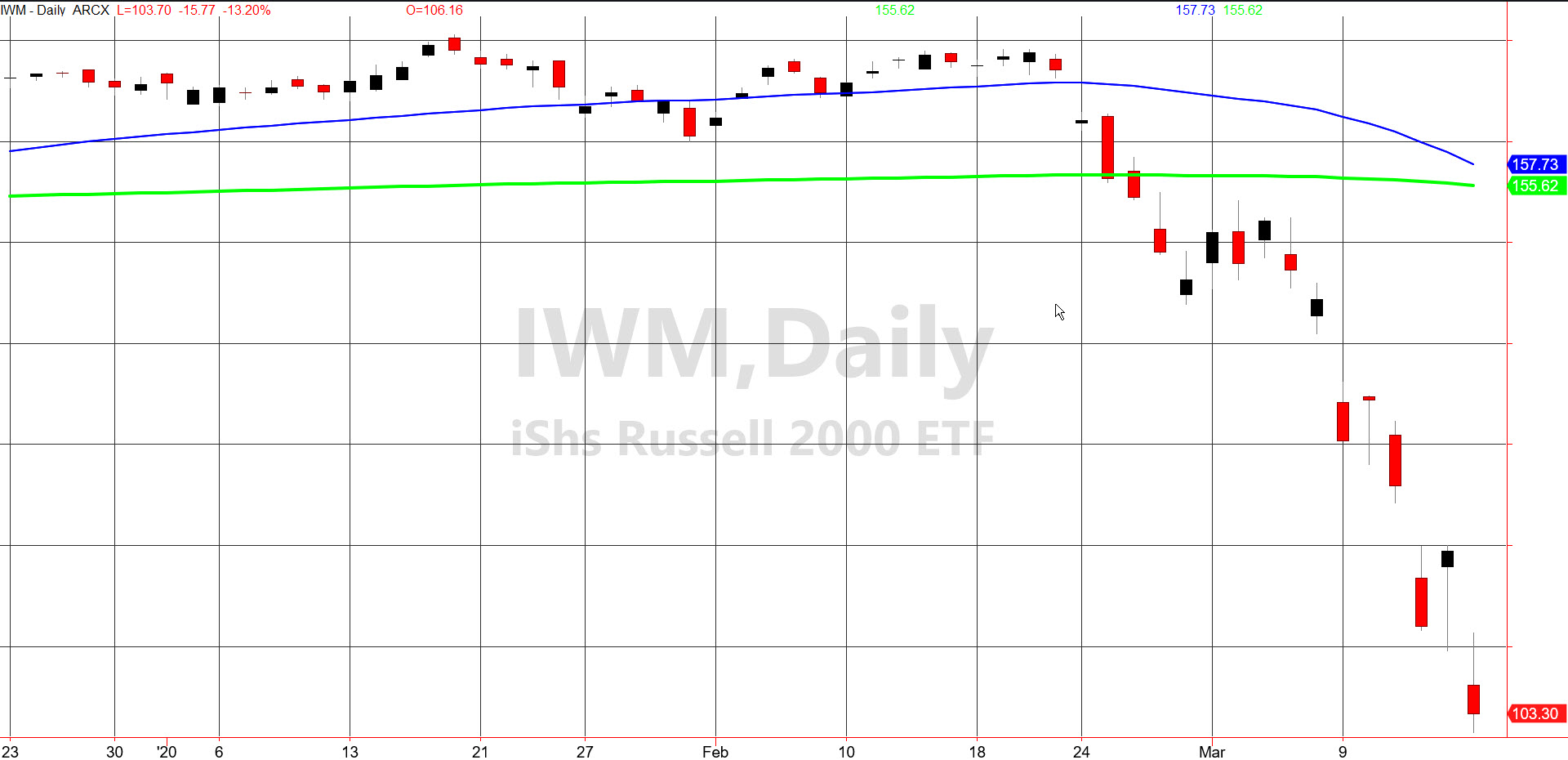

The Russell 2000 IWM saw its worst sell-off ever.

I was on the floor of the NY Commodities Exchanges on October 19th, 1987.

At the time, high rates were partly to blame for the crash.

The stock market took a year to recover.

Commodities were better, but like what we saw today, hardly immune to a large liquidity event.

With the government and the central banks pulling out all the stops to try to ameliorate both business and consumer bloodshed, the market could not sustain a rally.

However, some instruments at least, held the morning lows, while others closed above last week’s lows.

The Banks are more focused on businesses, whereas Kudlow said that there will be $400 Billion more available to offset the consumer economic shock of the virus.

Some scientists believe the virus will peak out and then begin to wane in a month.

Others believe it could take 3 months before we see a peak.

Not only is that a huge difference healthwise, but it will also impact how significant and for how long any stimulus might help both the economy and the public.

So far, the reaction to the stimulus is underwhelming, to say the least.

Besides holding mostly cash and a defensive position in equities, here are a few instruments worth watching:

In the area of Biotechnology, certain companies are worth watching like Biogen (NASDAQ:BIIB), Regeneron Pharmaceuticals (NASDAQ:REGN) and Mylan (NASDAQ:MYL) (not as pretty and after early gains, closed red.)

In the food stocks, both Kroger (NYSE:KR) and Sprouts Farmers Market (NASDAQ:SFM) had good moves with KR in striking distance of new 2020 highs.

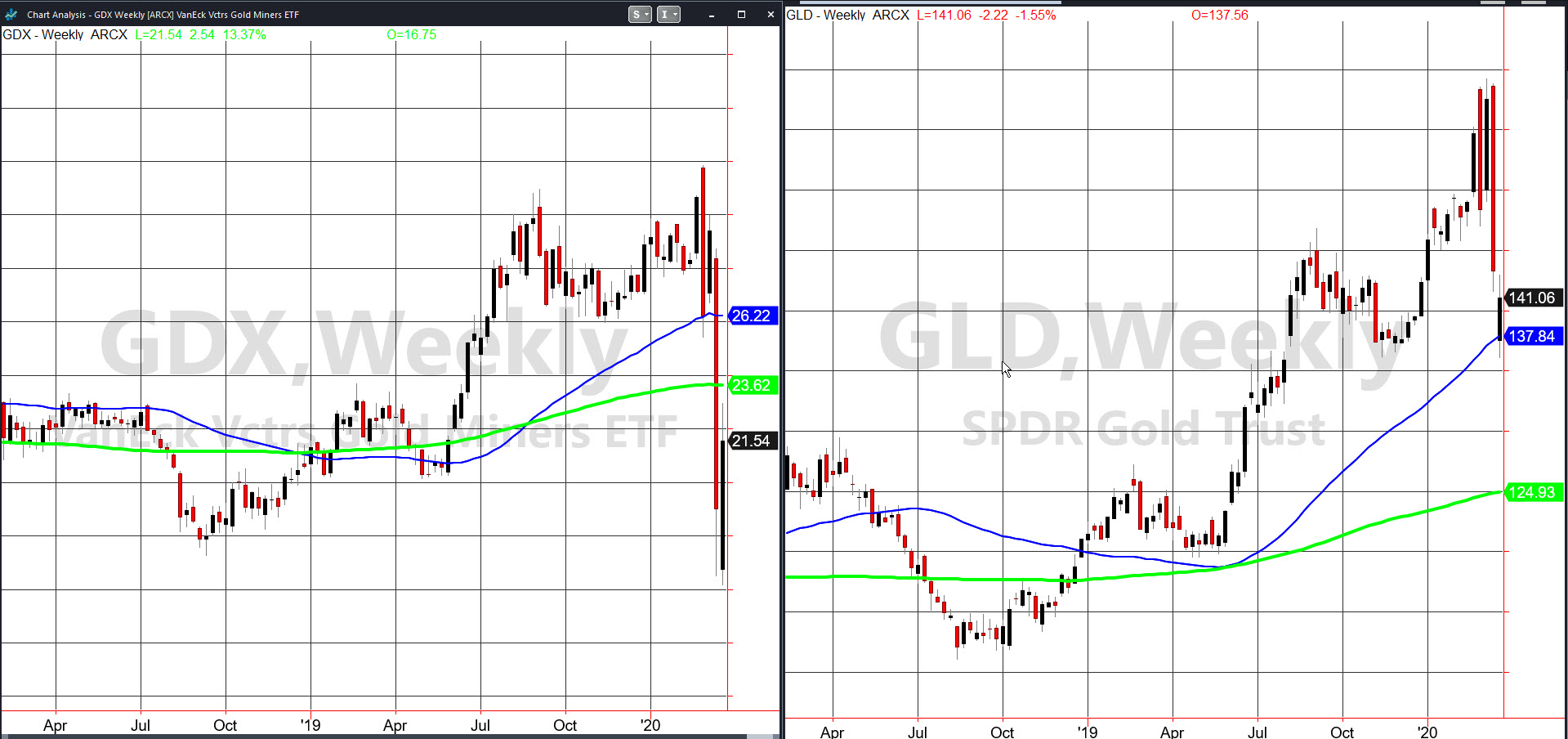

Yet, in keeping with my stagflation theory, which only looks more likely given the Fed’s actions and the impact of the virus concerning supply chain, let’s dig into gold and gold miners.

Looking at both weekly charts, GLD (NYSE:GLD) needs to hold 137.80 or the blue 50-week moving average.

GDX (NYSE:GDX) is not as pretty. But, the 2019 low at 20.14 is a good area to keep in mind for support.

S&P 500 (NYSE:SPY) 2018 low 233.76.

Russell 2000 (IWM) 2016 low 93.64

Dow (DIA) 2016 low 154.38-as crazy as that sounds-and 207.69 the 80-month MA

Nasdaq (QQQ) 143.46 the 2018 low

KRE (Regional Banks) Broke the 2016 low at 32.63 but good number to watch

SMH (Semiconductors) Still in best shape-112 resistance and support 97.60

IYT (Transportation) 114.91 the 2016 low

IBB (Biotechnology) 100.51 the 80-month MA. 89.01 the 2018 low

XRT (Retail) 25.50 support goes back to 2012 levels

Volatility Index (VXX) Up 37% today

Junk Bonds (JNK) 93.81 the 2016 low

LQD (iShs iBoxx High yield Bonds) 120 pivotal area