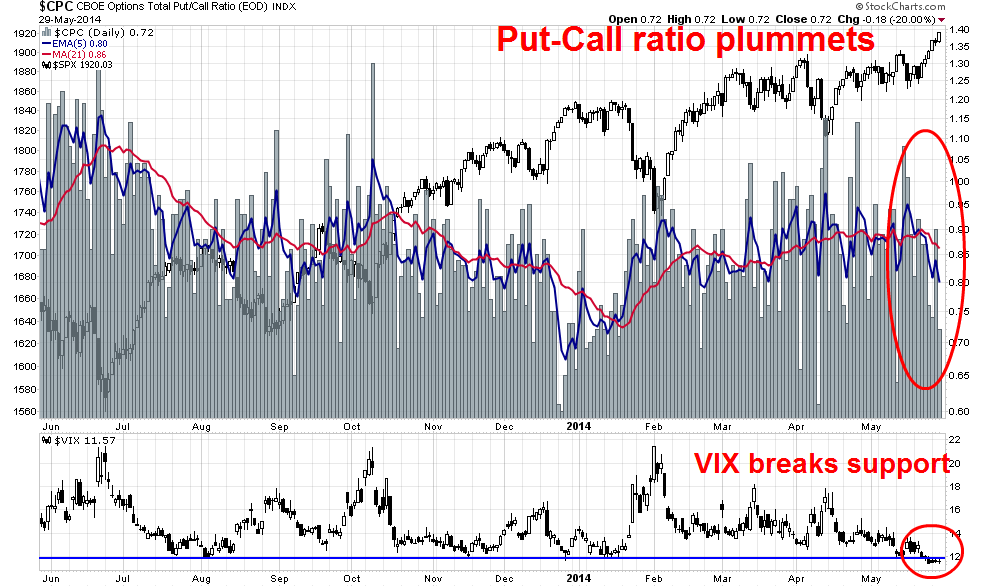

Recently there has been a lot of hand wringing about the low level of the VIX Index. Volatility has crashed and the VIX Index has broken critical technical support at the 12 level. Indeed, The Economist's Buttonwood Blog voiced concerns about the low level of volatility in the markets:

The low volatility environment is very interesting; it is rather reminiscent of those moments in westerns when the cavalry captain says "I don't like it. It's too quiet." and immediately gets an arrow through the chest. It is possible that the first rate rise from a central bank (some people at the Bank of England are getting twitchy) may be the new displacement. Euphoria stages come to an end when insiders take profits. Deutsche cites this happening in farmland and Hong Kong property but one also has to wonder about tech stocks.

Are the low volatility and level of the VIX a warning of complacency and risky assets are ready to dive?

Another way of looking at the signals from the option market is to analyze the VIX/VXV ratio. The VVX ratio is the three-month forward VIX Index. The VIX/VXV ratio is therefore a measure of the term structure of volatility, or the market's expectation of how volatility will evolve over time. A ratio over 1, or inverted term structure, indicates that near term volatility is higher than future volatility and a sign of a high level of angst in the market. By contrast, a low ratio is a sign of market complacency.

What is the VIX/VXV ratio telling us now?

At first glance, the ratio, which is shown in the top panel, is worrying for the bulls. The decline in the ratio mirrors the decline in the VIX Index (bottom panel). Moreover, the VIX/VXV ratio recently breached the 0.84 level, which is at the very bottom end of its one-year historical range. These are all signs of excessive complacency.

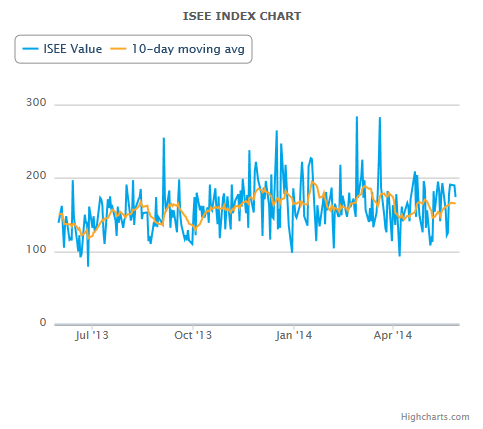

While I am not necessarily endorsing a bullish view, bullish traders may want to wait for a short-term pullback as sentiment indicators like the put-call ratio is showing excessive bullishness. One possibly bullish trigger might be for the VIX to rally test the 12 resistance-turned-support level to get long.

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

Disclaimer: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.