On the whole, global economic indicators continue to,disappoint. Industrial production retreated in April and,leading indicators point to no more than modest,growth in May. The world economy is dogged by the,uncertainties of the European crisis, but is likely to,pull through. Credit markets remain functional, a,necessary condition for offset of European weakness,by the U.S. and emerging economies over the rest of,the year.

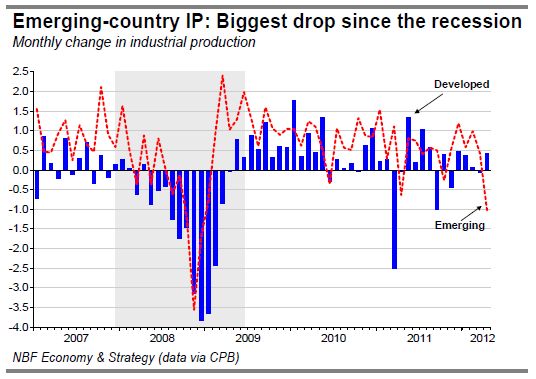

The most recent CPB data show a sluggish global,economy. World trade volume declined 0.8% in April, a,contraction that is concerning given that it comes after a,0.2% drop in March. Industrial production was also,down in April, a 0.4% pullback led by a 1.0% drop in,emerging countries. The latter decline, the first in six,months and the biggest since the last recession, was,concentrated in Asian countries.

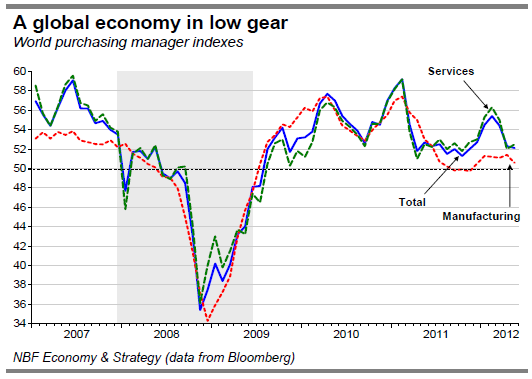

The global purchasing manager index for May shows a,slow but on the whole still-growing world economy. The,composite PMI was essentially flat at 52.1 in May versus,52.3 in April. The services index was also roughly flat in,May after a significant drop in April. The manufacturing,index slipped to a five-month low. For almost a year now,it has been barely above the growth threshold.

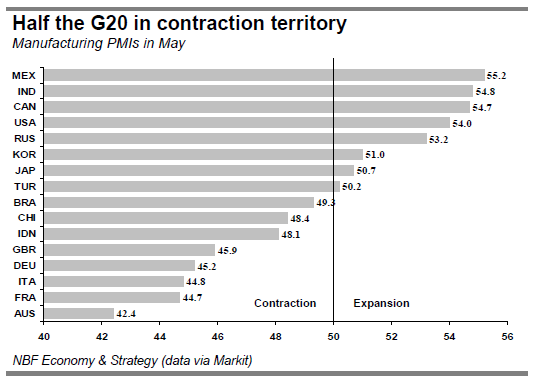

Among the G20 countries, manufacturing indicators vary,widely. At this writing North America seems in much,better shape than the rest. PMIs for the U.S., Canada,and Mexico were all above 54 in May. In contrast, the,indices for the four Western European members of the,G20 – Italy, France, Germany, the U.K. – were well into,contraction territory in the month. Also noteworthy is that,two BRIC countries, China and Brazil, are now below,the growth threshold. Brazil’s April GDP was down from,a year earlier, a first since 2009. But India’s,manufacturing PMI was 54.8 in May, well into growth,territory. The deceleration of its economy in Q1 – the,weakest quarterly growth since 2003 – had recently,been a matter of concern.

Given these challenges, it is hardly surprising that the,G20 countries committed themselves at their recent,summit to bolstering global growth and restoring,confidence. But only the euro countries committed,themselves to taking all measures necessary to ensure,the integrity and stability of their zone. The U.S., like,Canada, was reluctant to recapitalize the IMF. Amounts,contributed by the BRIC countries are yet to be,confirmed. In other words, the future of the monetary,union is in the hands of the euro-zone governments.,The European Union meeting at the end of June will,thus be much more important than the G20 summit for the future of the zone.

Can we expect major reforms, capable of reestablishing,confidence after two years of crisis? The latest report on,country competitiveness leaves ample room for doubt. It,shows the key countries involved in the current turmoil,having limited ability to adapt their policies to new,economic realities. Of 59 countries ranked, Italy (40th),,Spain (44th) and France (47th) are all closer to the,bottom of the list than the top.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

World: Economic Picture Darkens

Published 07/02/2012, 02:00 AM

Updated 05/14/2017, 06:45 AM

World: Economic Picture Darkens

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.