“FORECAST”

STOCKS: The European debt contagion has been “kicked down the road” a bit further as Spanish and Italian short- and long-term bond yields have moderated recently given the ECB “plan” to buy bonds of up to 3-years in maturity...but only if asked; and only if conditionality is imposed upon those asking. The Fed has also changed its game from “inflation-fighting” to “unemployment fighting;” and with any war — they will go further and farther than anyone believes in printing money to achieve their ends. This will support all asset prices ultimately.

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1226; which delineates bull/bear markets. The much followed 200-dma support level stands at 1349, and remains the bulls “Maginot Line.” We’ve noted this is perhaps one of the “weirdest rallies” we’ve ever seen, and it causes us a great deal of consternation. But the new Fed policy is directly at stocks; expect an S&P all-time high test at 1576.

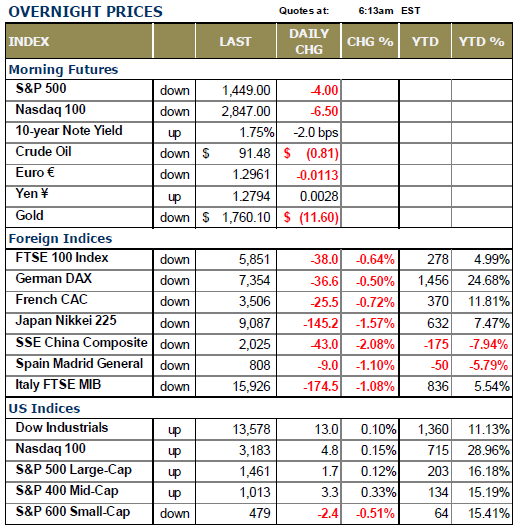

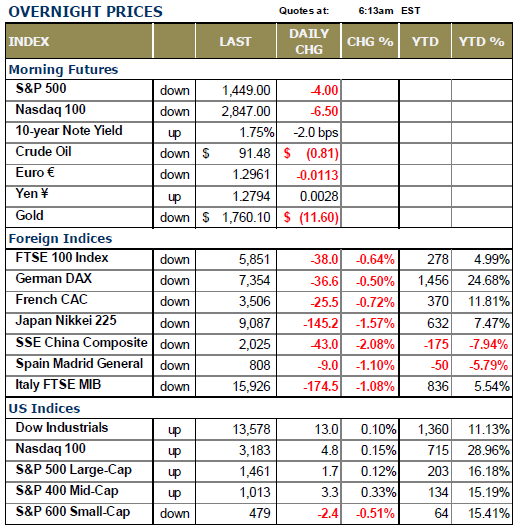

WORLD STOCK MARKETS ARE WEAKER THIS MORNING as they continue to correct after the ECB, Fed and BOJ have all eased monetary policy once again. We view this at present as nothing more than a digestion of the gains leading up the central bank announcements, and we view these corrections from the lens of “time” rather than “price,” for really prices have given up very little. In fact, the stock markets have been rather boring of late, and we will note the old axe that one shouldn’t short a boring market short.

If there is any news of consequence overnight it is that Spain was able to auction 10-year notes in a larger amount and at a smaller interest rate than first believed. This is supposed to be a positive for the euro, for it is not as it is falling rather sharply today as the USD also corrects its recent material weakness. Of note to the euro, it rose “11 large numbers” from 1.20 to 1.31 in the space of 6-weeks; so a correction is warranted.

Moving on, let’s note that the S&P futures are lower this morning, and they have corrected in sideways fashion over the past week. They very well may go a bit lower, but our hourly model for the S&P futures is now at oversold levels that in the past suggest that the risk-reward is skewed to the upside. In this vein, over the past two trading sessions, we’ve added a short bond/long yield position, and we’ve added a long POT position.

Today, we’ll continue along this road and add Navistar (NAV), which then brings the portfolio up to 50% encumbered. We’ll look to do more once it is clear that prices are headed higher; looking at adding energy, steel, copper and transport stocks, for these are the “laggards” and the ones most prone to economic sensitivity.

To Read the Entire Report Please Click on the pdf File Below.

STOCKS: The European debt contagion has been “kicked down the road” a bit further as Spanish and Italian short- and long-term bond yields have moderated recently given the ECB “plan” to buy bonds of up to 3-years in maturity...but only if asked; and only if conditionality is imposed upon those asking. The Fed has also changed its game from “inflation-fighting” to “unemployment fighting;” and with any war — they will go further and farther than anyone believes in printing money to achieve their ends. This will support all asset prices ultimately.

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1226; which delineates bull/bear markets. The much followed 200-dma support level stands at 1349, and remains the bulls “Maginot Line.” We’ve noted this is perhaps one of the “weirdest rallies” we’ve ever seen, and it causes us a great deal of consternation. But the new Fed policy is directly at stocks; expect an S&P all-time high test at 1576.

WORLD STOCK MARKETS ARE WEAKER THIS MORNING as they continue to correct after the ECB, Fed and BOJ have all eased monetary policy once again. We view this at present as nothing more than a digestion of the gains leading up the central bank announcements, and we view these corrections from the lens of “time” rather than “price,” for really prices have given up very little. In fact, the stock markets have been rather boring of late, and we will note the old axe that one shouldn’t short a boring market short.

If there is any news of consequence overnight it is that Spain was able to auction 10-year notes in a larger amount and at a smaller interest rate than first believed. This is supposed to be a positive for the euro, for it is not as it is falling rather sharply today as the USD also corrects its recent material weakness. Of note to the euro, it rose “11 large numbers” from 1.20 to 1.31 in the space of 6-weeks; so a correction is warranted.

Moving on, let’s note that the S&P futures are lower this morning, and they have corrected in sideways fashion over the past week. They very well may go a bit lower, but our hourly model for the S&P futures is now at oversold levels that in the past suggest that the risk-reward is skewed to the upside. In this vein, over the past two trading sessions, we’ve added a short bond/long yield position, and we’ve added a long POT position.

Today, we’ll continue along this road and add Navistar (NAV), which then brings the portfolio up to 50% encumbered. We’ll look to do more once it is clear that prices are headed higher; looking at adding energy, steel, copper and transport stocks, for these are the “laggards” and the ones most prone to economic sensitivity.

To Read the Entire Report Please Click on the pdf File Below.