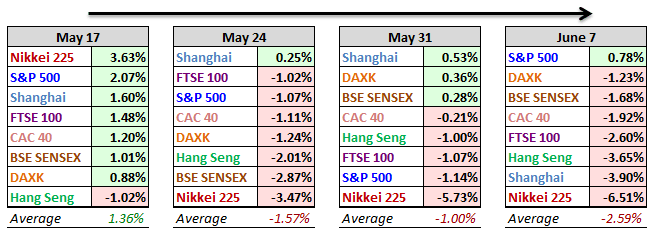

The eight indexes on my world watchlist ended the week last week with the worst collective performance of the year with an average decline of 2.59%. The S&P 500 was the sole index to post a gain, up 0.78%. Japan's Nikkei fell 6.51%, the worst weekly performance in 2013 of a watchlist index.

The Shanghai remains the only index on the watch list in bear territory -- the traditional designation for a 20% decline from an interim high. See the table inset (lower right) in the chart below. The index is down 36.31% from its interim high of August 2009. But the Nikkei is certainly heading in that direction. It closed the week at 12,877.53. If it drops to the 12,500 level, it will be in a cyclical bear market. The S&P 500 remains closest to its interim high (which is its all-time high) with a gap of only 1.55%. The DAXK is second closest at 3.61% off its interim high.

Here is a closer look at the YTD performance, which illustrates the power of Abenomics to levitate the Land of the Rising Sun to its interim high on May 22, followed by a sudden and dramatic selloff. Will central banks see this is a warning that massive QE can have unintended consequences?

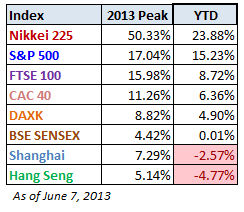

Here is a table highlighting the 2013 year-to-date gains, sorted in that order, along with the 2013 interim highs for the eight indexes. The strong performance of Japan's Nikkei over the past few months, despite its correction, puts it solidly in the top spot with a 23.88% YTD gain (but a whopping 17.60% off its 2013 high). The China duet, the Hang Seng and Shanghai indexes, share the dubious distinction of negative YTD performances, but India's SENSEX is a mere 2 bps from making it a trio.

A Closer Look at the Last Four Weeks

The tables below provide a concise overview of performance comparisons over the past four weeks for these eight major indexes. I've also included the average for each week so that we can evaluate the performance of a specific index relative to the overall mean and better understand weekly volatility. The colors for each index name help us visualize the comparative performance over time.

The chart below illustrates the comparative performance of World Markets since March 9, 2009. The start date is arbitrary: The S&P 500, CAC 40 and BSE SENSEX hit their lows on March 9th, the Nikkei 225 on March 10th, the DAX on March 6th, the FTSE on March 3rd, the Shanghai Composite on November 4, 2008, and the Hang Seng even earlier on October 27, 2008. However, by aligning on the same day and measuring the percent change, we get a better sense of the relative performance than if we align the lows.

A Longer Look Back

Here is the same chart starting from the turn of 21st century. The relative over-performance of the emerging markets (Shanghai, Mumbai SENSEX, Hang Seng) is readily apparent, especially the SENSEX, but the trend over the past two years has not been their friend (make that three years for the Shanghai).

Check back next week for a new update.

Note from dshort: I track Germany's DAXK a price-only index, instead of the more familiar DAX index (which includes dividends), for constency with the other indexes, which do not include dividends.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

World Markets Update: Worst Week Of 2013

Published 06/09/2013, 12:10 AM

Updated 07/09/2023, 06:31 AM

World Markets Update: Worst Week Of 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.